Bitcoin fell due to the impact of U.S. tariffs on Asian markets, while Ethereum rose on the back of institutional demand; global indices declined amid macroeconomic risks. Bitcoin (BTC) is trading at $114,800.77.

The new global tariffs announced by the White House have increased selling pressure in Asian stock markets. The Nikkei 225 and Seoul's KOSPI indices are declining, and Bitcoin has also been affected by this wave. Historically, digital assets tend to move in tandem with stocks in response to tariff announcements.

Bitcoin (BTC) is facing profit-taking and global economic pressures following its historic rise to all-time highs.

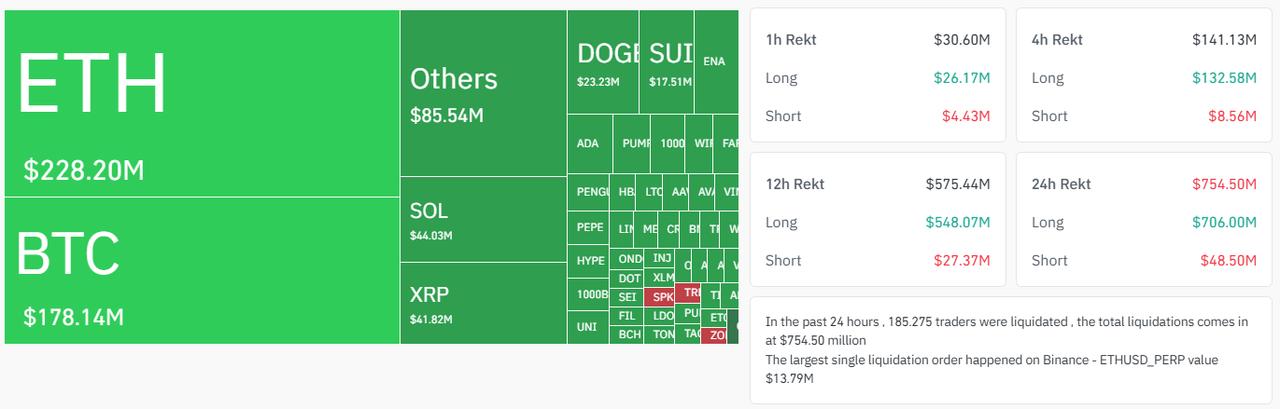

According to CoinGlass data, approximately $705 million in long positions were liquidated in the last 24 hours. This sudden market turmoil signals that investors are starting to move cautiously.

A new report published by CryptoQuant reveals that the third-largest profit realization wave of the 2023-2025 bull cycle has occurred so far. The $6-8 billion in realized gains recorded toward the end of July highlights the intensity of profit realization in Bitcoin.

With short-term investors leading the sell-off, there was a noticeable increase in the Spent Output Profit Ratio (SOPR).

On July 25, a large investor dubbed an “OG whale” executed a massive sale of 80,000 BTC. Immediately following this sale, the amount of BTC entering exchanges reached 70,000 BTC in a single day. This level is often seen as a strong indicator that investors are closing positions at peak prices.

The selling wave is not limited to BTC. Ethereum-based whales also made up to $40 million in daily profits on WBTC, USDT, and USDC assets. This activity has sparked speculation that a broad-based capital rotation has begun in the crypto markets.

Another notable aspect of the report is that new whales who accumulated BTC over the past 155 days played a dominant role in this sell-off. Their sales at high levels were decisive for the market's short-term direction.

Bitcoin (BTC) fell 2.3% to $115,500 amid selling pressure in Asian markets caused by the White House's renewed tariffs. Despite the intraday decline, BTC is largely maintaining its horizontal trend.

Ethereum (ETH), meanwhile, posted its best monthly performance since 2022 with a 50% increase in July. Trading around $3,800 on Thursday, ETH is being supported by bullish expectations circulating on social media. A popular analyst predicts that ETH could reach $15,000–16,000 in the current cycle thanks to $5.3 billion in spot ETF inflows and institutional demand.

Gold fell 0.38% to $3,287.39 after testing the $3,296 level on Thursday morning, following the strengthening of the U.S. dollar. The pullback was driven by the Fed's decision to keep interest rates unchanged and Chairman Powell's comments that strong employment and rising core PCE data dampened expectations for a rate cut in September.

Asia-Pacific markets started the last trading day of the week with declines due to tariff tensions. Japan's Nikkei 225 index lost 0.65%, while the broader Topix index remained flat.

In the U.S, S&P 500 futures fell on Thursday night. Investors are focused on the July employment report as they assess the financial results of major technology companies.