The cryptocurrency market is undergoing a critical phase, marked by bitcoin’s declining volatility and its gradual transition toward becoming a stable, safe-haven asset, as institutional investors now control approximately 25% of all circulating bitcoin, having absorbed nearly 500,000 bitcoin—valued at around $50 billion—offloaded by traditional “whale” holders over the past year.

Bitcoin posted a 14.78% gain in the first half of 2025, representing its weakest semiannual performance since the introduction of U.S.-based exchange-traded funds (ETFs) in early 2024. This figure stands in sharp contrast to previous years when first-half returns consistently exceeded 38%. Analysts interpret the decline not as a loss of momentum but rather as an indicator of bitcoin’s shifting role in global financial markets.

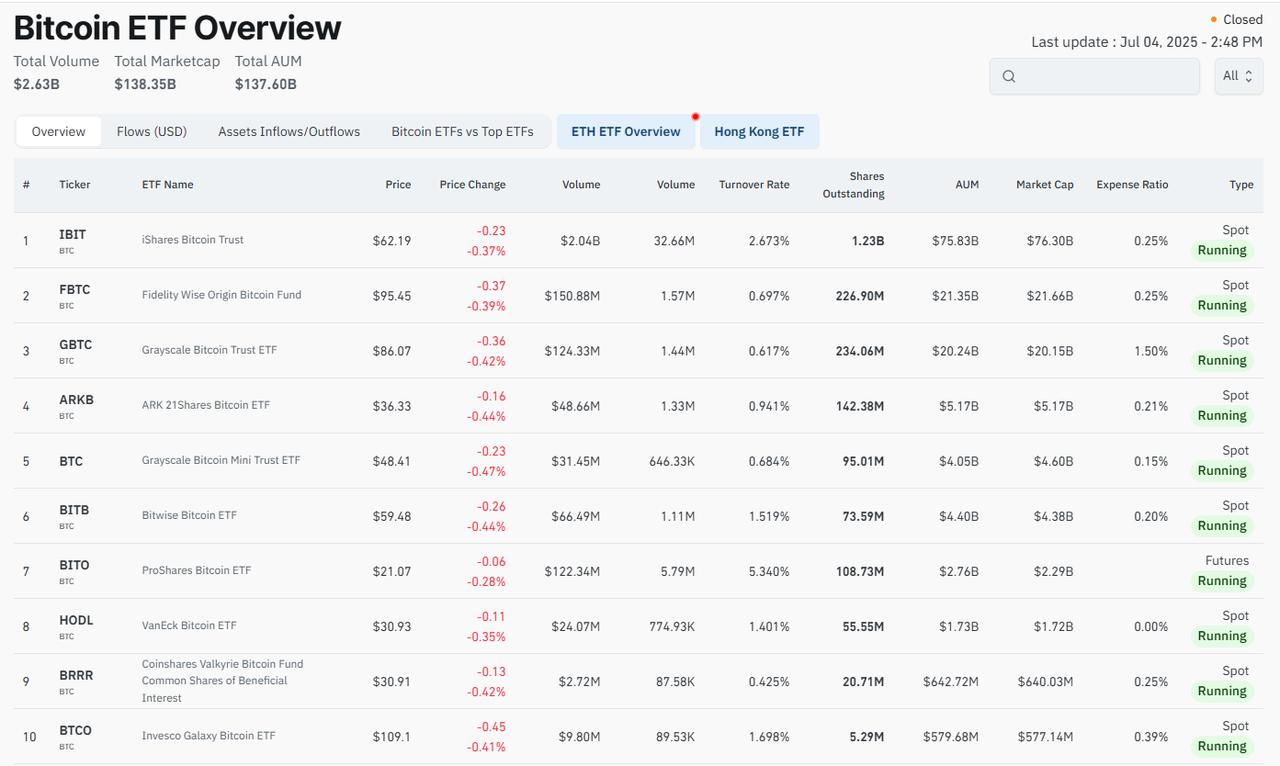

A report from Bloomberg highlights a significant investor reconfiguration: large-volume holders—including miners and anonymous wallets often referred to as “whales”—have liquidated substantial portions of their portfolios. An estimated 500,000 bitcoins have changed hands, primarily through ETF transactions. Total ETF-based bitcoin holdings now approach 900,000 bitcoins, underscoring the scale of institutional engagement.

This redistribution has catalyzed a redefinition of bitcoin’s market identity, shifting from a highly speculative vehicle toward a more stable, yield-focused asset. Analysts note that volatility is currently at its lowest level in two years, suggesting the emergence of a more predictable investment pattern.

Bitcoin’s recent price movements reflect this broader transformation. On July 3, the cryptocurrency reached $110,550—breaking through a key resistance level for the first time in three weeks—before consolidating near $109,300. That same day, U.S. ETFs recorded a net inflow of $377.3 million, highlighting continued investor appetite.

External factors have also contributed to upward price pressure. These include an increase in U.S. money supply, a weakening dollar, and a rally in Wall Street indices driven by technology stocks. On the supply side, elevated energy costs and high summer temperatures have slowed mining operations, leading to a decline in new bitcoin issuance.

The expansion of institutional control is evident in the growing influence of key corporate actors. The five largest institutional bitcoin holders are:

Their collective positions indicate a strategic long-term view, reinforcing the perception of bitcoin as a maturing asset class.

Despite strong political support for cryptocurrencies in the United States—particularly under the Trump administration—bitcoin’s price behavior has grown increasingly aligned with traditional market dynamics. Analysts observe that the dramatic price surges of previous cycles, such as the 1,400% rally in 2017, are unlikely to recur under current conditions.

Instead, bitcoin appears to be settling into a new pattern characterized by moderate annual returns in the range of 10% to 20%, reflecting attributes more commonly associated with dividend-yielding equities.