Bitcoin surged to a new all-time high on Thursday morning, crossing the $110,000 mark for the first time in its history, as growing legislative support in the United States injected fresh momentum into the cryptocurrency market.

According to market data at 7.00 a.m. local time (GMT+3), the spot price of Bitcoin reached $111,746, representing a daily gain of more than 4%. This rally pushed the digital asset’s total market capitalization to a record $2.2 trillion, cementing its status as the world’s largest and most valuable cryptocurrency.

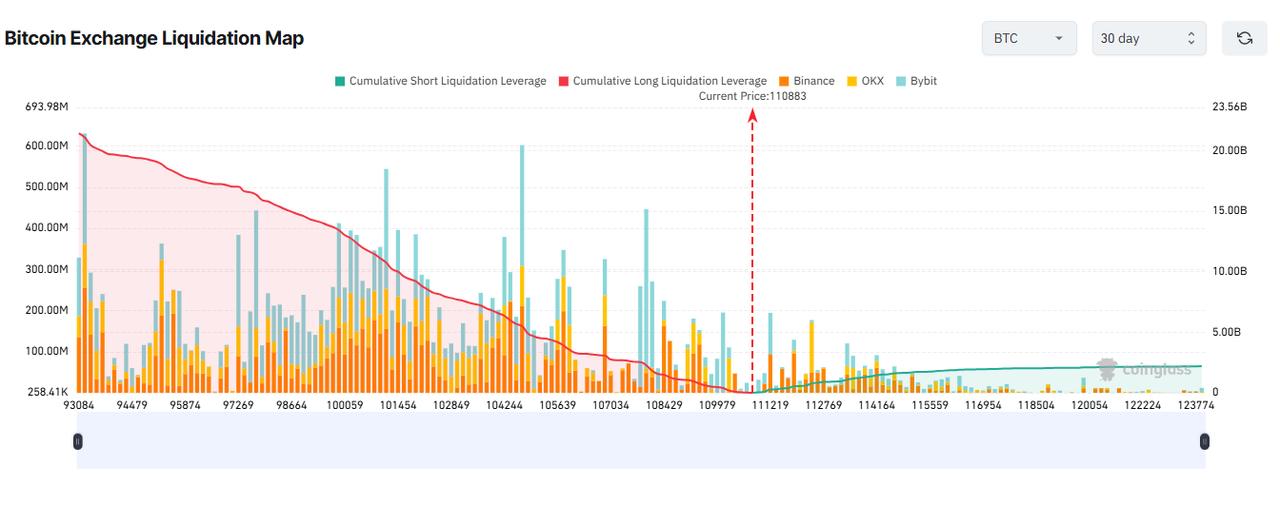

Data from cryptocurrency analytics platform CoinGlass highlights a significant cluster of short-position liquidations concentrated around the $111,000 to $112,000 range—just above Bitcoin’s current market price.

The 30-day liquidation map shows that as prices rise, cumulative short liquidation leverage sharply declines, indicating that many short sellers are being forced out of their positions.

This suggests that the current rally may be partially driven by a short squeeze, where upward momentum forces traders betting against Bitcoin to cover their positions, further accelerating the price increase.

The map also indicates relatively limited long-position liquidation pressure at these levels, suggesting the upward trend could retain stability in the near term unless a sudden reversal occurs.

The latest price spike follows an announcement by U.S. lawmakers showing increased bipartisan support for a bill aimed at regulating stablecoins.

Stablecoins are a type of cryptocurrency whose value is typically pegged to the U.S. dollar or other fiat currencies, offering price stability in a highly volatile market.

While Bitcoin itself is not a stablecoin, analysts say the prospect of clearer rules in the broader crypto space has strengthened investor confidence in the sector as a whole.

This renewed optimism comes at a time when investors are seeking clarity on how digital currencies will be treated by regulators, especially in major economies like the United States.

Beyond regulatory developments, the rally has also been fueled by a more favorable macroeconomic environment. Investor appetite for riskier assets such as cryptocurrencies has returned as tensions between the U.S. and its major trade partners show signs of easing.

Investor sentiment began to strengthen in late 2024 following President Donald Trump’s victory in the U.S. presidential elections, as he renewed his embrace of cryptocurrency during the campaign. His public commitment to supporting digital assets—promising to ease regulatory constraints and encourage broader adoption—was met with enthusiasm across the crypto community.

This renewed optimism helped drive Bitcoin to a then-record high of $109,200 on Jan. 20, the day Trump officially took office. Since the beginning of the year, the cryptocurrency has delivered nearly 20% in returns for investors, supported by both political momentum and growing institutional interest.

However, Bitcoin briefly slipped below the $100,000 mark after Trump announced a new wave of tariffs on April 2, imposing reciprocal levies on a wide range of imports. The move unsettled financial markets and triggered a short-lived wave of uncertainty.

Confidence was largely restored on May 8, when the United States and the United Kingdom unveiled a new trade agreement, prompting Bitcoin to climb back above the symbolic $100,000 threshold.

Despite the historic highs, analysts continue to caution that the cryptocurrency market remains inherently volatile. Bitcoin and its peers have faced criticism over their price swings and the collapse of several high-profile platforms, most notably FTX, once a leading global crypto exchange.

Bitcoin is mined through a decentralized process in which powerful computers solve complex mathematical puzzles to validate transactions on a tamper-proof ledger known as the blockchain.

While this system offers transparency and security, it also contributes to significant energy consumption and fluctuating transaction costs.