China has expanded its official gold holdings for the seventh month in a row, underlining its continued push to diversify foreign exchange reserves as global uncertainty drives up demand for safe-haven assets.

According to the People's Bank of China (PBOC)'s latest figures released on Saturday, the bank's gold reserves reached 73.83 million fine troy ounces at the end of May, a slight rise from 73.77 million ounces the previous month.

The increase in volume comes despite a slight dip in valuation. Gold reserves stood at $241.99 billion at the end of May, down from $243.59 billion in April, reflecting the stabilization of spot prices after gold hit a record high of $3,500 per ounce in April.

Spot gold prices remain steady throughout May, fluctuating between $3,100 and $3,300. As of Friday’s close, spot gold stands at $3,309, marking a 26% gain year-to-date.

China’s persistent gold purchases—even at elevated price levels—signal a broader policy direction aimed at reducing reliance on the U.S. dollar. The PBOC has not officially commented on the motives behind its recent buying streak, but the move is seen as part of a longer-term diversification strategy. Gold, traditionally considered a hedge against economic and geopolitical risks, has become more appealing as global tensions persist.

The PBOC had paused its gold accumulation for six months in 2024 following an 18-month buying spree. However, the central bank resumed purchases in November after Donald Trump won the U.S. presidential election, ahead of reignited concerns over global trade tensions.

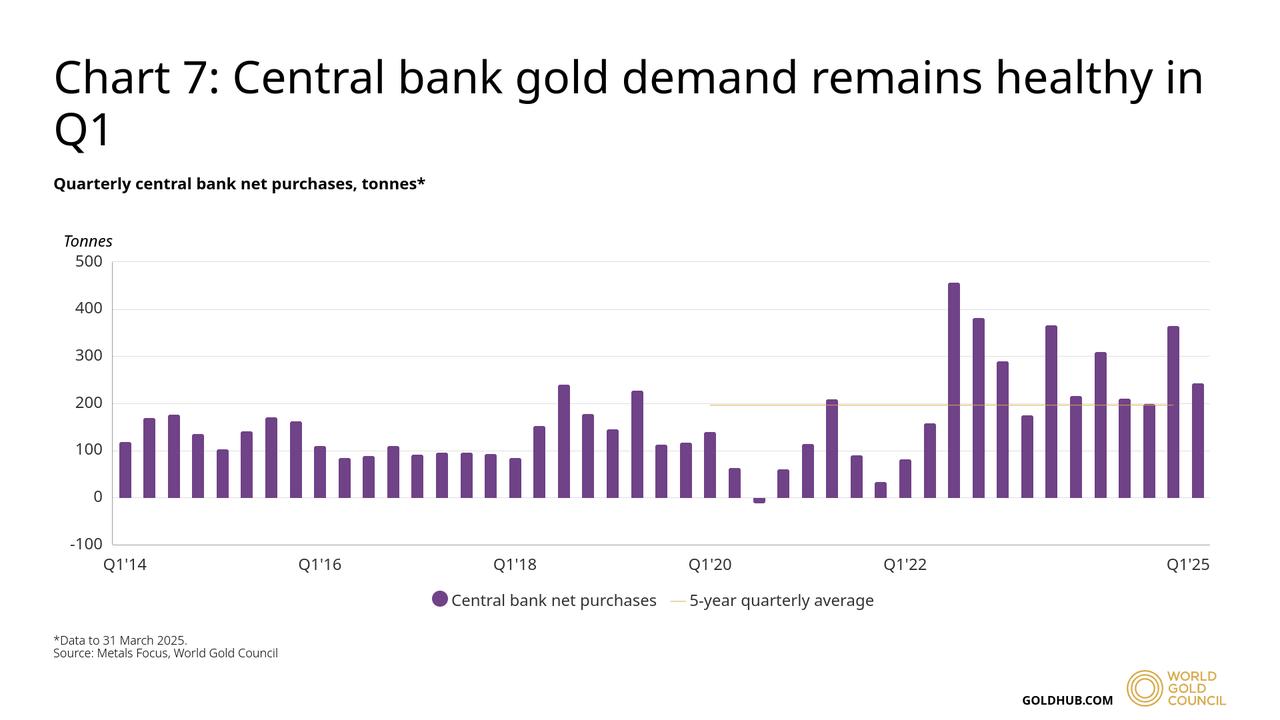

According to data from the World Gold Council, central banks added 244 metric tons (t) of gold to official reserves in the first quarter of 2025. While this was lower than the previous quarter, it still marked a 24% increase over the five-year quarterly average and just 9% below the average of the past three years, during which central bank demand has remained at historically high levels.

According to the World Gold Council's report, the surge in central bank demand has been driven by heightened uncertainty. Gold’s reputation as a reliable store of value has prompted policymakers in emerging economies to maintain or increase their holdings.

Discussions over storage strategies have also gained attention, with some countries exploring the repatriation of their gold reserves from storage in the United States, though many have opted to keep their existing arrangements.