Global investment banks Citi and JPMorgan expect the Central Bank of the Republic of Türkiye (CBRT) to begin cutting interest rates as early as July, following what they interpret as a dovish shift in the central bank’s latest policy statement.

Both institutions anticipate a 250-basis-point reduction at the next meeting, which could signal the beginning of a gradual easing cycle.

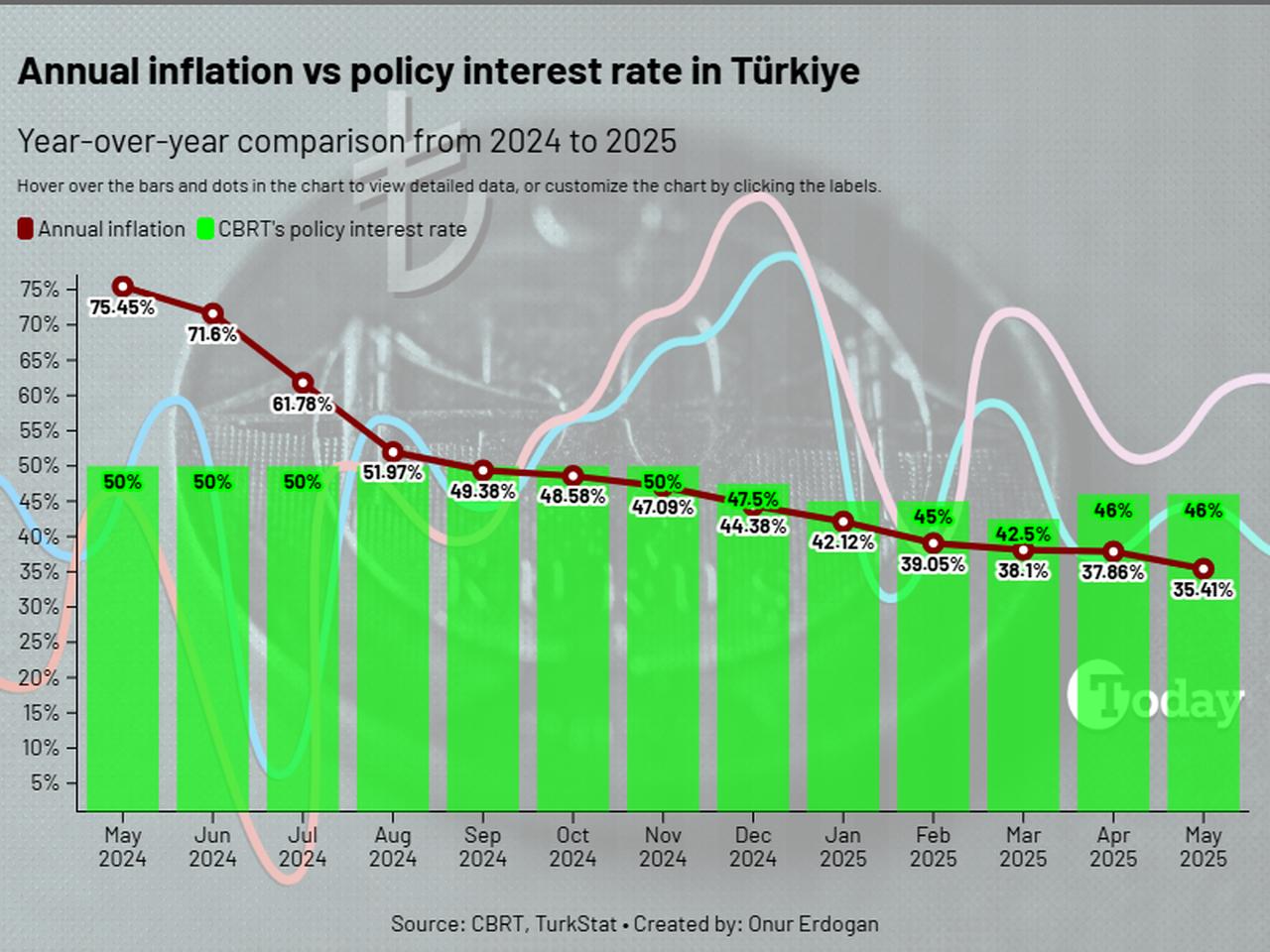

The CBRT held its benchmark interest rate steady at 46% during its June meeting, in line with market expectations.

However, it notably removed a previous reference to further tightening, replacing it with a broader pledge to use “all monetary policy tools effectively.” Analysts have taken this as a sign that the bank may be preparing to ease policy amid a moderating inflation outlook.

Citi emphasized that the CBRT’s latest decision was consistent with forecasts and highlighted the possibility of a 250 bps rate cut in July.

JPMorgan echoed this view, suggesting the central bank could follow a path of sequential reductions in the second half of the year, trimming the rate by 250 bps at each meeting.

German Deutsche Bank's Türkiye economist, Yigit Onay, speaking to business-focused CNBC-e, also expects rate cuts to begin in July, assuming improved financial conditions. He projected an initial 250 bps cut, stating that the CBRT appears to be preparing for a cautious transition rather than a sharp policy reversal.

He forecasted a 1.5% increase in June inflation and noted potential volatility from recent weather-related shocks to food prices and rising fuel costs. Despite this, he emphasized that the core inflation trend remains downward, in line with the CBRT’s assessment.

Onay said Deutsche Bank expects the policy rate to fall to 37.5% by year-end, slightly above the market consensus of 36%.

He added that the current high real interest rate gives the CBRT space to ease policy without undermining its disinflation goals. He also forecasted the USD/TRY rate to reach 45 by the end of the year.

According to the CBRT’s May market survey, Turkish participants expect a more aggressive move, projecting a 300 bps rate cut in July.

Despite growing rate cut expectations, another German lender, Commerzbank, voiced concerns about the implications for the Turkish lira.

The bank’s emerging markets economist, Tatha Ghose, said the change in tone suggests upcoming rate cuts, which may intensify downward pressure on the lira.

Ghose argued that the removal of policy-tightening language and the improving inflation trend together point to renewed monetary loosening.

The USD/TRY rate is currently trading at 39.67, having risen more than 1.1% in June. Ghose cautioned that if easing begins prematurely, the currency could weaken further unless disinflation proves to be sustainable.