Russian Deputy Prime Minister Alexander Novak stated that Russia is “making good progress in gas supply” and wants to expand cooperation with Türkiye, a message that has brought renewed attention to Türkiye’s evolving position in Moscow’s natural gas strategy.

During the 19th meeting of the Türkiye-Russia Joint Economic Commission in Moscow on Saturday, Novak said that one arm of the TurkStream pipeline supplies Türkiye’s domestic market, while the other delivers gas to Europe, and reaffirmed that Russia views Türkiye as a reliable partner and vital transit country for energy exports.

“We look forward to continuing our long-term cooperation on natural gas supply and are ready to expand this partnership,” Novak added.

Russia maintained its position as Türkiye’s leading natural gas provider in 2024, according to official figures from the Energy Market Regulatory Authority (EPDK). Russian exports to Türkiye reached 21.57 billion cubic meters (bcm), making up 41.3% of the country’s total gas imports.

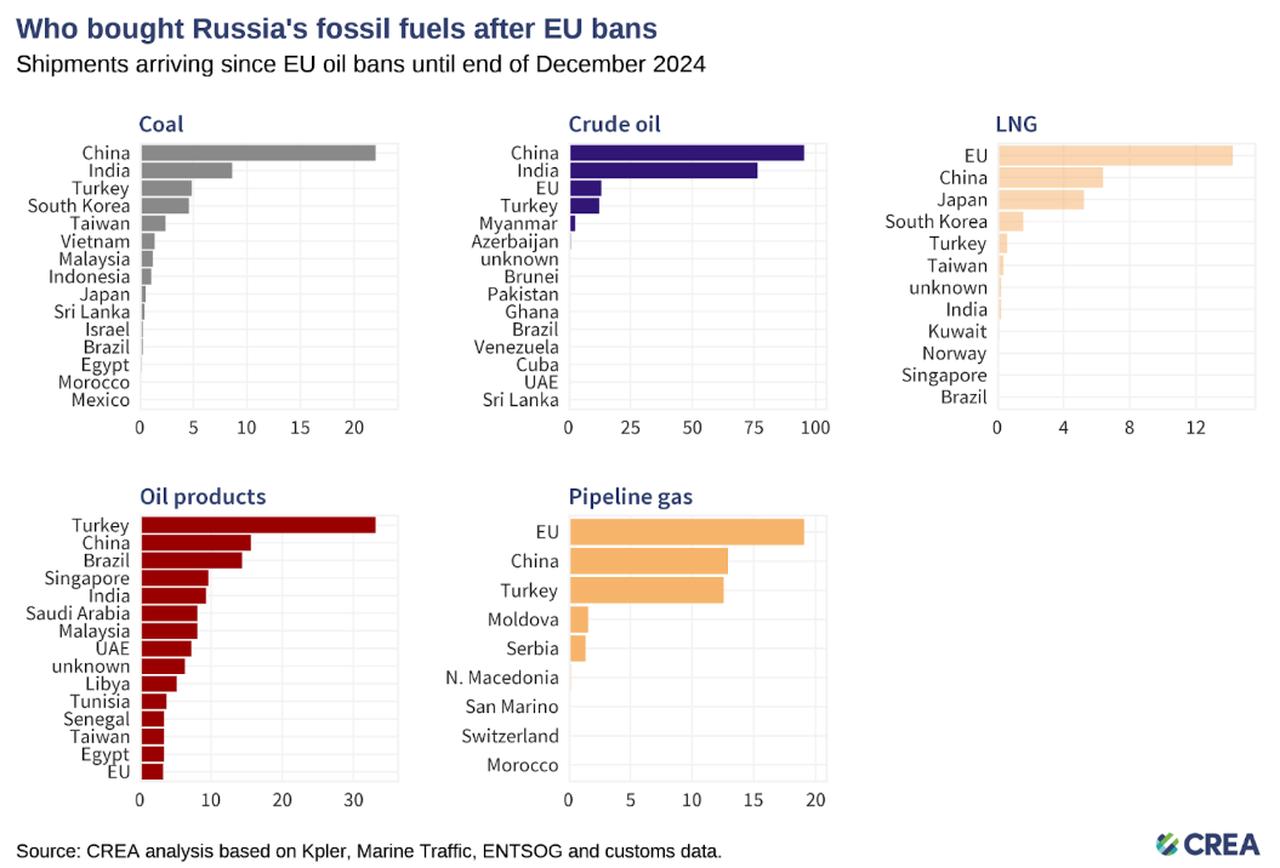

Data from the Centre for Research on Energy and Clean Air (CREA) further illustrates Türkiye’s central position in Russia’s energy trade. As of the end of December 2024, Türkiye ranked third globally in imports of Russian pipeline gas, trailing only the European Union and China. According to CREA, Türkiye also emerged as the top buyer of Russian oil products after the EU ban, and maintained a notable presence among importers of Russian coal and LNG.

The same report revealed that Russia earned €5.8 billion ($6.79 billion) from pipeline gas exports to the EU in 2024, the highest annual revenue since December 2022. This spike in income came as Russia's five-year gas transit deal with Ukraine expired at the end of 2024—prompting renewed reliance on routes through Türkiye, including TurkStream.

The foundation of the Russia–Türkiye natural gas relationship was laid during the final decade of the Cold War, at a time when geopolitical and economic pragmatism shaped bilateral energy policies. In 1984, Türkiye signed its first-ever natural gas import agreement with the Soviet Union. Actual gas deliveries began in 1987, initiating a long-term supply arrangement that would shape Türkiye’s energy landscape for decades.

Throughout the 1990s and early 2000s, the partnership matured through a series of high-volume contracts and major infrastructure projects. The most significant of these was the Blue Stream pipeline, agreed upon in 1997 and launched in 2003. Running under the Black Sea, it became the first direct gas connection between Russia and Türkiye, eliminating the need for intermediary transit states and enhancing energy security for both sides.

Even as Türkiye actively pursued diversification of its gas portfolio—bringing in suppliers such as Iran, Azerbaijan, Algeria, and Nigeria—Russia consistently retained the dominant position in overall volumes. This was largely due to long-term take-or-pay contracts, pricing advantages tied to oil-indexation, and the dedicated pipeline infrastructure that ensured stable and uninterrupted supply.

By the early 2000s, Russia had become deeply embedded in Türkiye’s gas architecture not just as a supplier, but also as a strategic partner in building out the physical and contractual frameworks of gas trade. This entrenched position allowed Russia to weather market fluctuations and political shifts, even as Türkiye moved to liberalize its gas market and attract private sector participation.

The launch of the TurkStream pipeline in January 2020 marked a transformative chapter in the Russia–Türkiye energy partnership. Designed to strengthen both energy security and commercial ties, the project represented a strategic realignment of Russian gas exports following growing instability in Ukraine and the decommissioning of legacy transit systems through Eastern Europe.

TurkStream consists of two parallel subsea pipelines, each 930 kilometers in length, running across the Black Sea from the Russian coastal city of Anapa to Kiyikoy in northwestern Türkiye. Each line is engineered to carry 15.75 billion cubic meters (bcm) of natural gas per year, giving the system a combined annual capacity of 31.5 bcm. The first line delivers gas directly to the Turkish domestic market, while the second extends onward to Bulgaria, forming a key conduit for Russian gas supplies to southeastern and central Europe.

Between January 2020 and December 2024, TurkStream transported a total of 104.1 bcm of natural gas, of which 44.4 bcm were delivered to Türkiye and 59.8 bcm to European consumers. In 2024 alone, Russian pipeline gas exports to Türkiye increased by 2.6%, surpassing 21 bcm, reflecting not only growing demand but also the operational reliability of the infrastructure.

Looking beyond delivery, Türkiye and Russia are working to establish a regional natural gas trading hub. Following a bilateral meeting in Sochi on Sept. 4, 2023, between Presidents Recep Tayyip Erdogan and Vladimir Putin, the project gained new momentum. With Europe moving away from Russian gas and legacy pipelines like Nord Stream 1, 2, and Yamal-Europe offline, the hub would offer Russia alternative export pathways.

In terms of existing supply frameworks, Gazprom Export and BOTAS signed a four-year natural gas agreement for TurkStream deliveries on Jan. 6, 2022, according to company disclosures at the time.

This agreement ensures a stable supply through one of the region’s most critical energy corridors. Additional long-term contracts signed in previous decades—such as the 1997 Blue Stream agreement and other import deals from the late 1990s and 2000s—continue to govern portions of Türkiye’s Russian gas intake.

If successful, the hub is expected to enhance the competitiveness of Russian gas in an increasingly fragmented European market, while positioning Türkiye as a regional price-setting actor, capable of mediating energy flows between East and West amid evolving geopolitical and commercial dynamics.