Gold futures surged to a record high on Friday after speculations over the potential of new U.S. tariffs on imported gold bars, expanding the gap between futures and spot prices to approximately $100.

New York gold futures for December rose above $3,530 in early trading, while spot gold hovered around $3,390 after hitting its highest level since late July earlier in the session.

As of 6:44 a.m. GMT, gold prices per ounce remain flat at $3,390.3, while the December contracts secure a 1.18% daily gain at $3,494.3.

According to the Financial Times, a letter from U.S. Customs and Border Protection dated July 31 confirmed that 1-kilogram and 100-ounce gold bars are now classified under a customs code subject to higher import tariffs. The shift is expected to impact countries like Switzerland, which serves as the world’s primary hub for gold refining and export.

The reclassification comes as part of a broader increase in U.S. import tariffs introduced by President Donald Trump. The latest round took effect Thursday, targeting imports from more than 180 countries, including key trading partners such as Switzerland, Brazil and India.

Gold continues to attract demand as a safe-haven asset during periods of financial and political stress. Market sentiment was further supported by weaker-than-expected U.S. payroll data, which boosted expectations for a rate cut by the Federal Reserve.

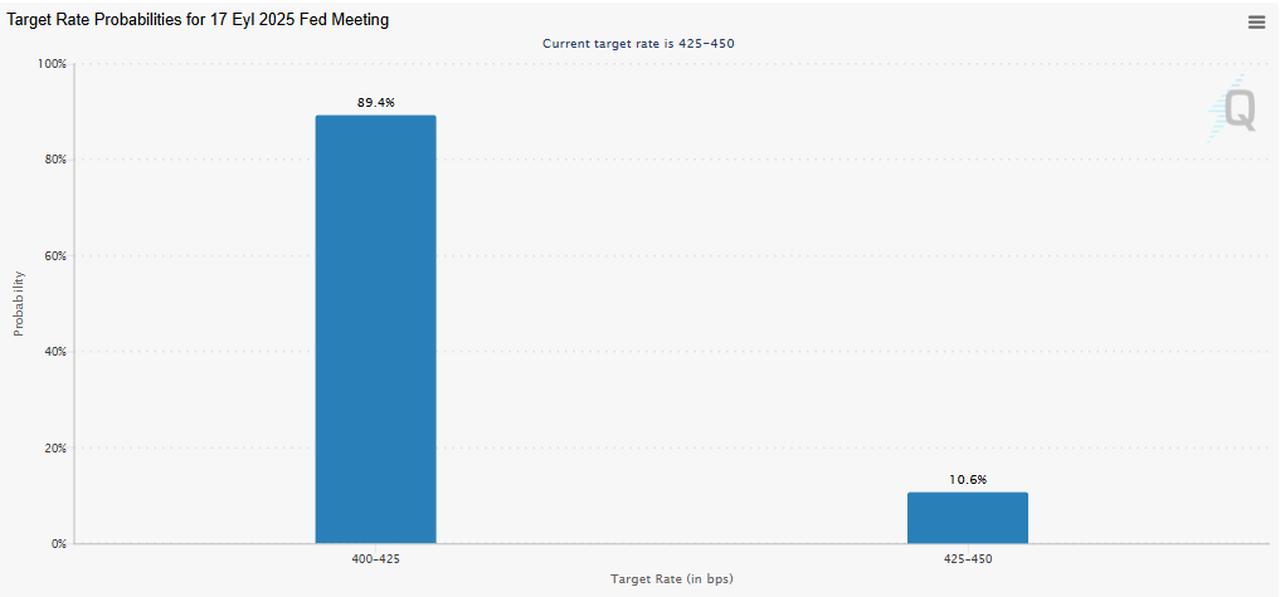

The CME Group’s FedWatch Tool now shows a 89% probability of a 25-basis-point cut at the next policy meeting.

The Federal Reserve has maintained its benchmark interest rate in the 4.25%–4.5% range since December 2024.

The recent rally follows gold’s previous record of $3,500.33 per ounce in April, reached amid heightened fears of a global recession and deteriorating U.S.-China trade relations.

Citi, the New York-based investment bank, recently raised its short-term gold price target to $3,500 from $3,100, citing recession risks linked to the Fed’s continued restrictive monetary stance.

The bank also highlighted renewed trade barriers, noting that the brief tariff truce had ended in August, with new duties ranging from 15% to 50% now in force globally.