Türkiye's equity market, Borsa Istanbul, is attempting to stage a comeback after a muted performance in the first half of 2025, underpinned by improving inflation figures, growing expectations of interest rate cuts, and a temporary return of political calm.

Investors appear to be regaining confidence as Türkiye’s macroeconomic landscape shows signs of normalization, and policy signals point to a more supportive environment for financial markets in the second half of the year.

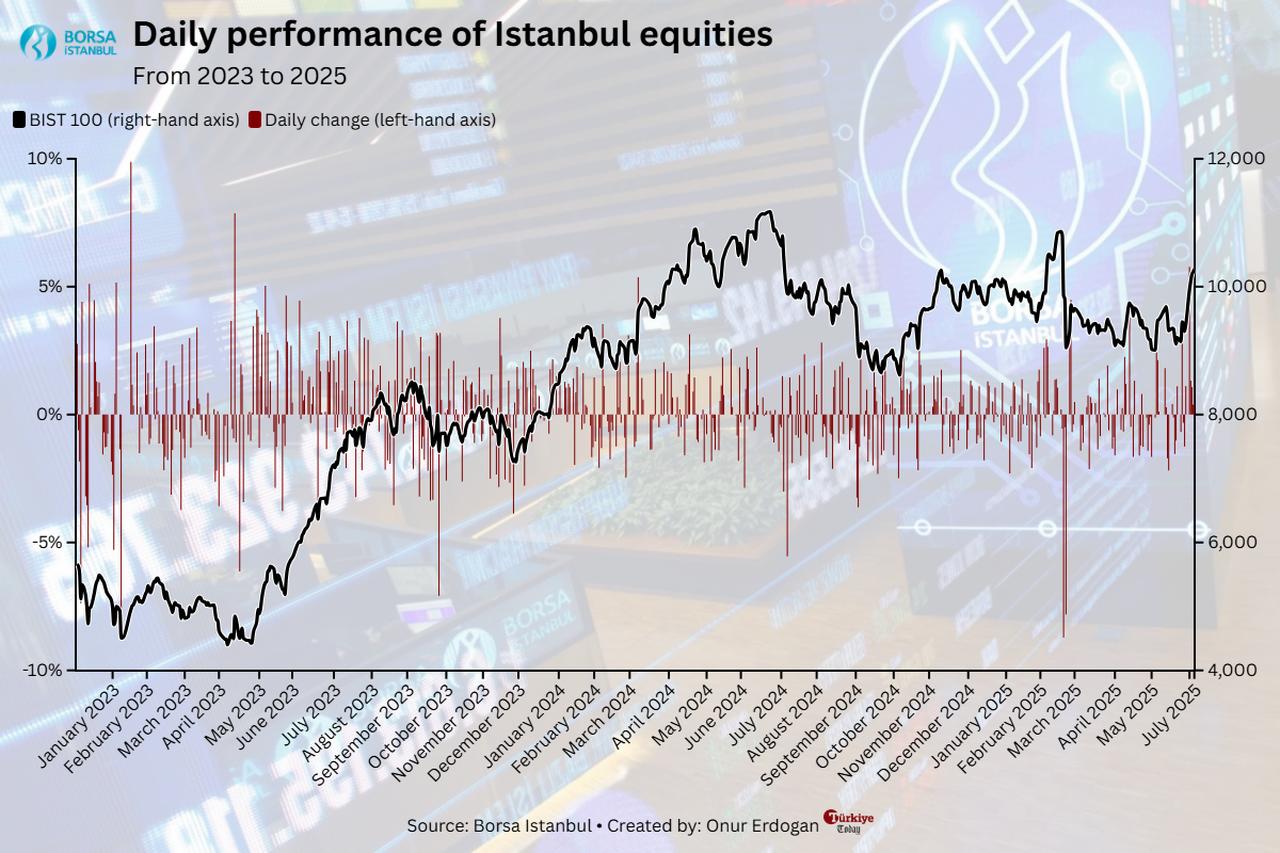

The BIST 100 index, Türkiye’s main equity benchmark, climbed 9.26% in the first week of July to close at 10,275—the highest closing level since March. During the same week, the index also tested a 15-week high of 10,379 points.

Despite year-to-date gains of 4%, the index has contracted by over 4% year on year, reflecting a challenging start to the year. When adjusted for inflation, the situation appears even more severe: with six-month inflation reaching 16.67%, the BIST 100’s nominal first-half gain of 1.2% translates into a real return of -13.26%, according to calculations by Türkiye daily as of 3 July.

Investor sentiment received an early lift at the beginning of the week after political uncertainty surrounding Türkiye’s main opposition party temporarily subsided. On Monday, the Ankara 42nd Civil Court adjourned a high-profile case seeking to annul the Republican People’s Party’s (CHP) 2023 and 2025 congresses.

The hearing was postponed to September 8, delaying a potential disruption in the domestic political scene and alleviating short-term concerns for market participants.

Markets responded swiftly to the news, with the BIST 100 index surging 5.78% on Monday to close at 9,948 points—its sharpest one-day gain since May 2023. The rally was driven primarily by banking stocks, as the sector index jumped over 9% to reach its highest level since March.

Investors interpreted the temporary political stability as easing pressure on the Turkish central bank, reinforcing expectations that it would move forward with the widely anticipated interest rate cut later in July.

The Turkish lira also posted modest gains following the court decision, with the USD/TRY rate dipping from 39.88 to 39.76. Analysts identified the 10,100–9,950 range as a key support zone for the BIST 100, while emphasizing that a break above the 10,380 resistance level could unlock further upside potential toward 10,750 points.

Later in the week, market optimism was further reinforced when Türkiye’s official inflation data was released on Thursday. Annual inflation fell to 35.05% in June, down from 35.41% in May, a dramatic improvement from the 75.45% rate recorded in May 2024. The monthly inflation print came in at 1.37%, significantly below expectations, suggesting that a broad-based disinflation process is taking hold across key sectors.

The favorable data deepened expectations of a policy pivot by the Central Bank of the Republic of Türkiye (CBRT), which is widely forecast to begin cutting rates at its upcoming July 24 meeting. The bank had previously surprised markets with a 350-basis-point hike in April and kept the policy rate steady at 46% in June. Now, both international institutions and domestic banks project a cut of 250 to 350 basis points, with a consensus forming around a reduction to 43%.

Türkiye’s five-year credit default swap (CDS) also fell to 279 basis points, signaling improved investor perception of sovereign risk. This shift in both macroeconomic fundamentals and market pricing suggests that Türkiye may be entering the early stages of a new interest rate cycle.

Such a move could significantly lower borrowing costs and attract broader participation in equity markets, particularly from institutional investors seeking long-term positions.

However, while the overall outlook is being shaped by positive sentiments, Turkish regulators have opted to maintain a cautious approach. The Capital Markets Board of Türkiye announced that a set of temporary protective measures will remain in place through Aug. 29.

These include a ban on short selling in Borsa Istanbul’s equity markets, eased conditions for share buybacks by publicly listed companies, and relaxed collateral requirements for margin trading operations.

According to the statement, these measures aim to ensure orderly market functioning and preserve investor confidence during a period of heightened sensitivity. By maintaining these rules, authorities are signaling a readiness to support the market through potential volatility, even as underlying conditions improve.

As markets head into the second half of the year, the interplay between political stability and monetary policy is expected to shape investor behavior. With inflation trending lower, financial conditions easing, and political headlines momentarily subdued, Turkish equities are in a stronger position to attract renewed domestic and foreign interest.

Yet, the structural challenges remain. Despite recent rallies, equity markets have delivered negative real returns so far in 2025, highlighting the impact of persistent inflation and volatility.

Whether the expected interest rate cut will be sufficient to sustain momentum hinges on the central bank’s ability to maintain credibility while navigating the delicate balance between growth and stability.

Still, the convergence of falling inflation, supportive monetary policy, regulatory caution, and reduced political friction suggests that Borsa Istanbul may have turned a corner, setting the stage for a more constructive second half.

As the July 24 CBRT meeting approaches, markets will be watching closely for confirmation that Türkiye is indeed entering a new phase of economic and financial normalization.