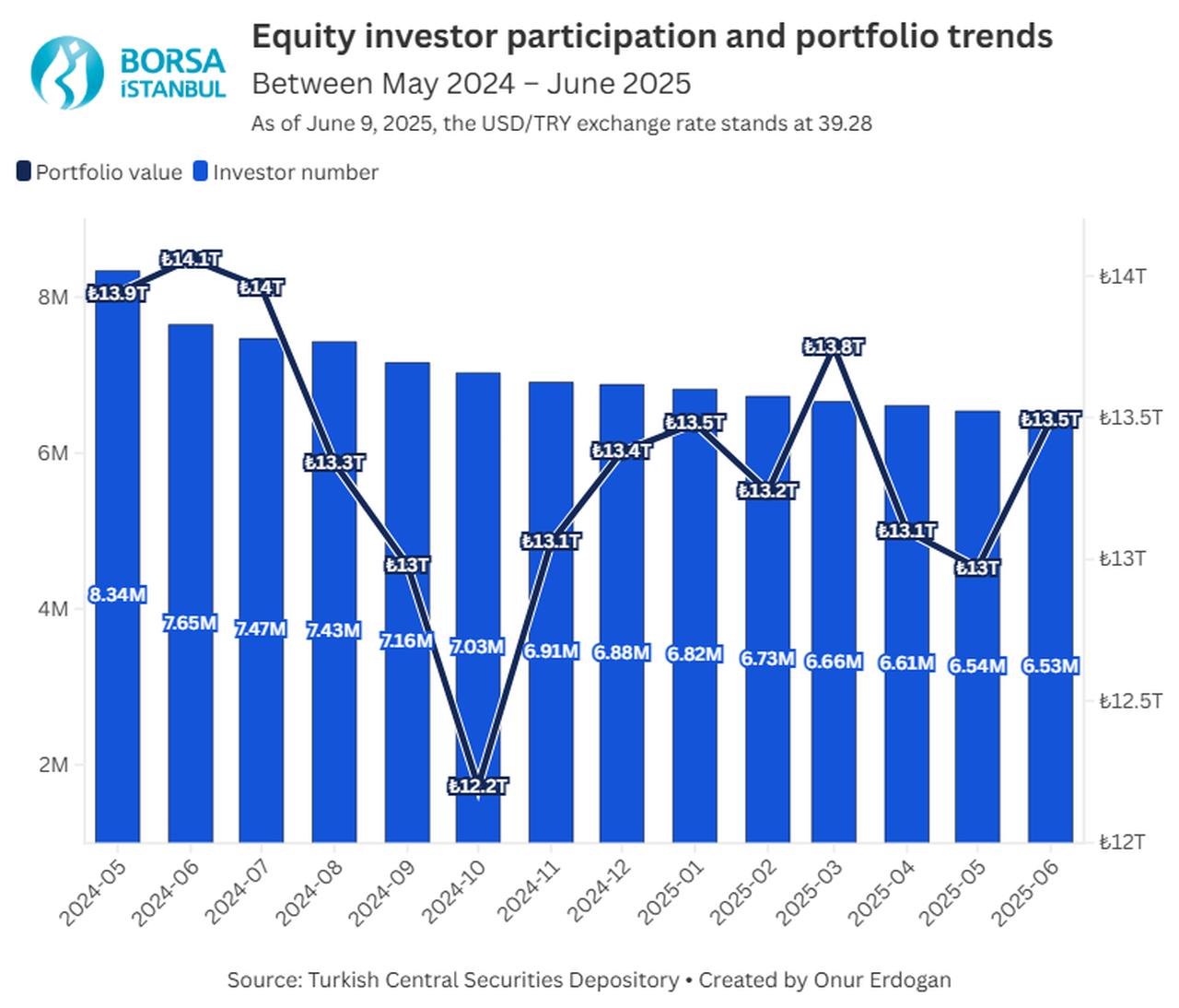

More than 1.81 million investors have left Türkiye’s stock exchange, Borsa Istanbul, year-over-year, as the number of equity investors fell from 8.34 million at the end of May 2024 to 6.53 million by June 8, 2025.

According to data released by the Central Securities Depository of Türkiye (MKK), this contraction in retail participation contrasts with the market’s partial recovery in valuation.

After bottoming out at ₺12.2 trillion (equivalent to $310.59 billion as of June 9, 2025) in October 2024, the total value of equity portfolios rose to ₺13.49 trillion by early June 2025.

The rebound followed a period of low investor sentiment and weak performance in the final quarter of 2024, when both investor numbers and portfolio value reached their lowest levels in the observed period.

Among Borsa Istanbul participants, the benchmark BIST 100 index remained the most favored, drawing 4.93 million investors as of the end of May 2025. Despite this strong interest, the index traded at 9,486 in the latest session, marking an 8.81% decline compared to the same period last year.

In terms of sectoral indices, the industrial index led with 4.60 million investors, followed by the services index with 4.17 million. The banking index, one of the most closely tracked in the domestic market, recorded 1.07 million investors by the end of May.

Data by age group shows that investors aged 45–49 held the largest equity portfolios, totaling ₺295.7 billion, followed closely by those aged 50–54 and 40–44.

The highest number of investors, however, fell in the 35–39 age range, with ₺149.1 billion in holdings.

Although investor counts decline with age, older groups still control substantial assets. Investors aged 55–64 managed over ₺375 billion collectively, while those aged 75 and above held ₺112.8 billion.

In contrast, portfolio sizes among younger groups remained limited, with the 15–19 and 0–14 brackets holding just over ₺5 billion combined.