U.S. President Donald Trump announced Wednesday plans to impose a 100% tariff on imported computer chips and semiconductors, unless manufacturers commit to producing them within the United States.

The proposed tariff—still lacking a specific implementation timeline—aims to force global tech companies to shift operations to American soil.

Speaking at the White House, Trump clarified that companies with active or committed investments in domestic chip manufacturing would be exempt from the proposed duties, even if production has not yet started. “If you’re building in the United States of America, there’s no charge,” he said.

The announcement came during a meeting with Apple CEO Tim Cook, as the tech giant unveiled an additional $100 billion investment in the U.S., raising its total commitment to $600 billion over four years. Trump confirmed that Apple would not be subject to the incoming tariffs.

While the president emphasized that the policy is designed to bring semiconductor production “back home,” he did not specify what portion of a product must be manufactured domestically or how far along a facility must be in its construction to qualify for an exemption.

Despite the lack of details, Trump remained confident that the measure would drive reshoring. “I think the chip companies are all coming back home,” he stated.

Following Trump’s remarks—where he emphasized that chipmakers would be exempt from the steep tariffs if they invest in U.S. production—shares of major global semiconductor firms rallied.

Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker, rose nearly 5% in Taipei trading. Taiwan’s National Development Council chief Liu Chin-ching told lawmakers that TSMC would be exempt from the proposed tariffs due to its existing U.S. operations. While some smaller Taiwanese firms may still be affected, their international competitors would also be subject to the same tariff burden.

TSMC, which is expanding production in Arizona, has pledged to invest up to $165 billion in the United States—a figure the company described in March as the largest single foreign direct investment in U.S. history.

Other major Taiwanese firms also posted gains, with Foxconn rising more than 4% and Pegatron up 0.2% in Taipei trading.

Samsung Electronics gained 2% in Seoul, supported by its substantial U.S. investments, which position the company for exemption. In contrast, South Korean chipmaker SK hynix traded flat, suggesting more limited exposure to either risk or benefit.

Meanwhile, in Japan, shares of major chip-related firms declined amid concerns over their minimal U.S. manufacturing presence. Tokyo Electron fell 3.2%, Renesas 3.4%, Disco Corporation 1.3%, and Sumco 1.2%.

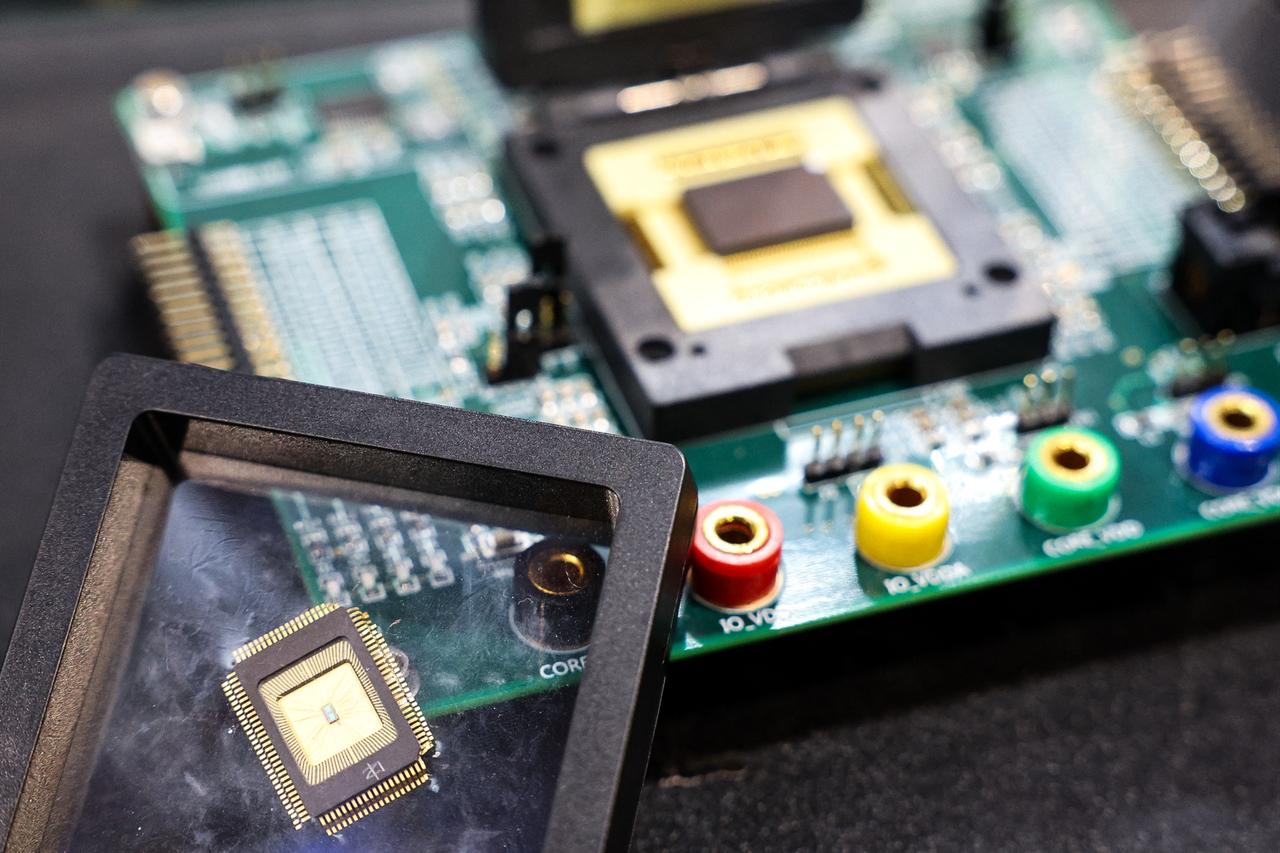

Semiconductors are a foundational component of a wide range of consumer electronics—from smartphones and personal computers to cars and household appliances. If implemented, a 100% import tariff could lead to higher prices for many of these goods in the United States, depending on how exemptions are applied and whether supply chains adjust accordingly.

No formal decree has been issued yet, and key definitions—such as what qualifies as “building in the United States”—remain to be clarified.