Türkiye’s central bank reserves fell by over $1.2 billion in the week ending June 27 as gold reserves slightly declined due to market fluctuation, while foreign investors continued to show confidence in local financial assets, purchasing hundreds of millions of dollars' worth of Turkish securities.

Meanwhile, banking sector deposits surged significantly, reflecting continued lira and foreign currency inflows.

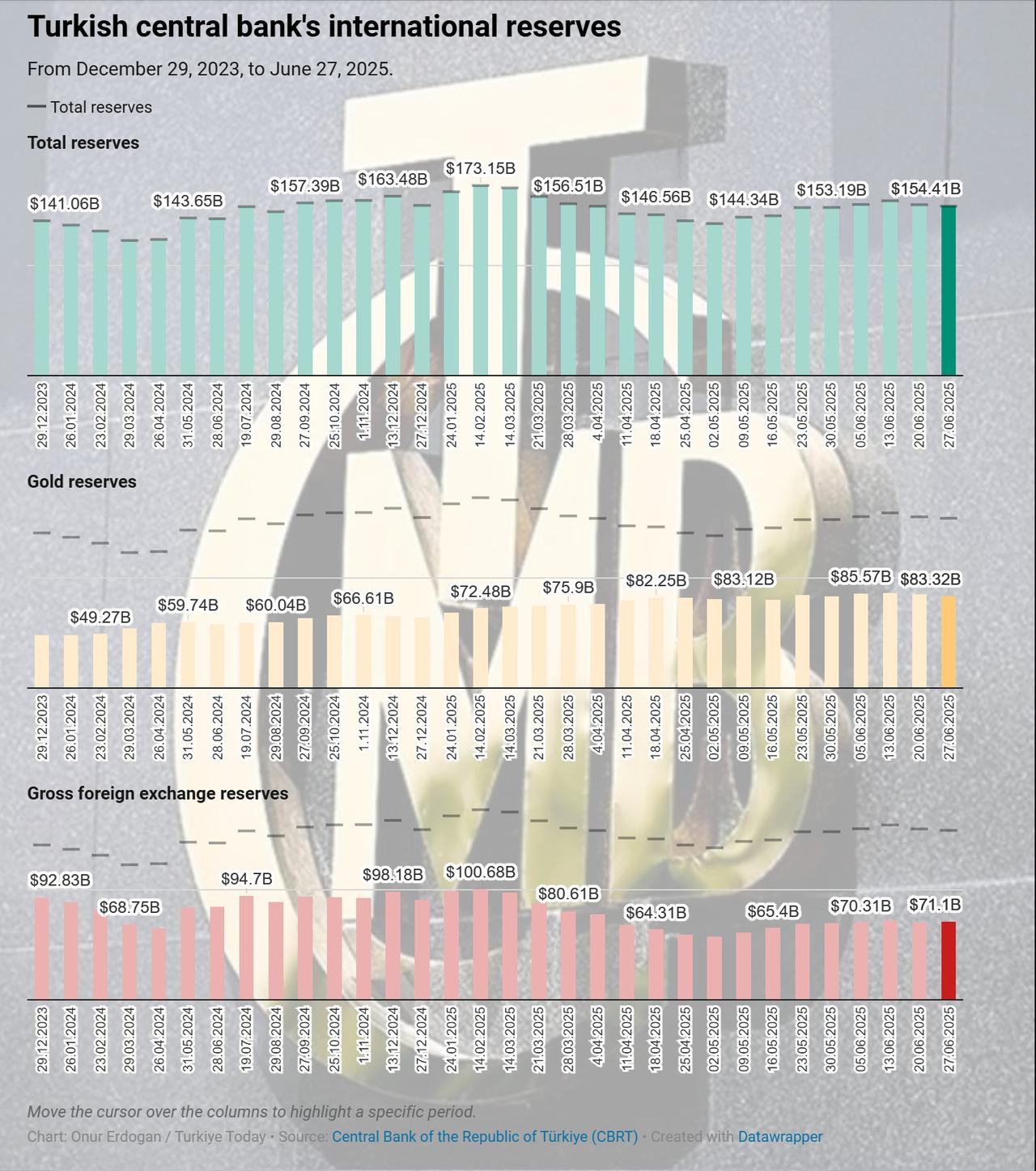

The Central Bank of the Republic of Türkiye (CBRT) reported that total international reserves dropped to $154.4 billion in the week ending June 27, down from $155.7 billion the previous week. This $1.29 billion decline was largely driven by a sharp fall in gold reserves.

Gross foreign currency reserves increased slightly by $398 million, reaching $71.1 billion. However, gold holdings dropped by $1.69 billion, settling at $83.3 billion. As a result, the net reserves excluding swaps declined by $1.8 billion to $28.4 billion.

Despite the decrease in reserves, Türkiye attracted substantial foreign capital over the same week. According to the CBRT’s weekly securities statistics, non-resident investors purchased $247.7 million worth of equities and $305.1 million of domestic government bonds, officially known as Government Debt Securities (GDS). Additionally, they acquired $110.5 million of private sector debt instruments.

Foreigners’ total holdings of Turkish stocks rose to $28.64 billion from $28.06 billion a week earlier. Their GDS holdings also increased, reaching $11.9 billion, while their investments in non-sovereign domestic debt grew to $777.6 million from $670.2 million.

Türkiye’s banking sector saw notable growth in total deposits during the week ending June 27. Total deposits rose by ₺486.6 billion to reach ₺24.27 trillion ($956.39 billion), posting a significant increase from ₺23.78 trillion the previous week.

Breaking this down, Turkish lira-denominated deposits increased by 2.6% to ₺13.51 trillion. Foreign currency deposits also edged up by 0.8%, reaching ₺7.7 trillion. The total foreign exchange deposits in banks stood at $234.1 billion, with $194.1 billion held by domestic residents.

After adjusting for exchange rate effects, the foreign currency holdings of residents rose by $677 million over the week.

In parallel with deposit growth, the banking sector’s total loan volume—including credits extended by the central bank— expanded by nearly ₺299 billion, reaching ₺18.89 trillion. This trend indicates rising domestic lending activity, likely spurred by improving investor sentiment and a gradual easing in financial conditions.