Türkiye's stock exchange, Borsa Istanbul’s benchmark BIST 100 index jumped 5.78% on Monday, closing the day at 9,948.51 points, marking its fastest single-day gain since May 11, 2023.

The rally came after a court decision to postpone a lawsuit aimed at annulling the upcoming congress of the main opposition Republican People’s Party (CHP), easing fears over political instability.

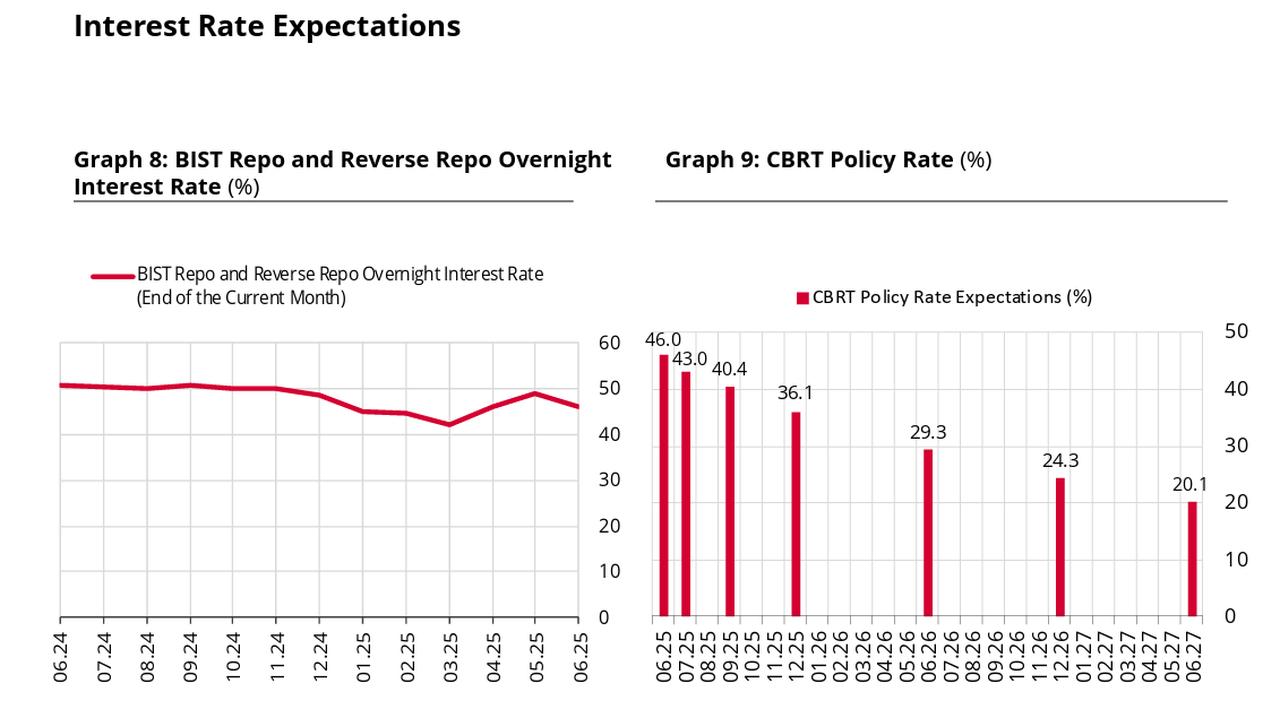

The case was deferred to September 8, a move seen as helping preserve short-term political clarity. Market watchers interpreted the delay as a supportive factor for the Turkish central bank’s July monetary policy decision, with expectations growing that the bank may resume interest rate cuts.

Investor optimism was especially strong in banking stocks, which soared 9.64%. Analysts pointed to the prospect of lower borrowing costs as the primary driver, with the banking sector likely to benefit most from a looser monetary stance. The holding index also climbed 4.42%.

In June, the Turkish central bank's market participant survey indicated expectations for a 300-basis-point cut in the benchmark interest rate, which could bring it down to 43%.

Compared to the previous close, the BIST 100 index added 543.62 points, with total trading volume reaching ₺165 billion ($4.13 billion).

Market analysts described the current upward move as technically significant and noted resistance levels around 10,000 and 10,100 points, while identifying 9,600 and 9,500 as key support zones.