Türkiye’s Treasury and Finance Minister Mehmet Simsek said those anticipating instant relief from inflation should not expect miracles, emphasizing that the economic program currently in place is delivering results through persistent and realistic policymaking.

In a televised interview with TGRT Haber on Monday, Simsek commented on recently released inflation figures by the Turkish Statistical Institute, underscoring the government's commitment to tackling inflation with a multi-pronged approach that includes tight monetary policy, fiscal discipline, and structural efforts to boost supply. “There may be people expecting a miracle,” he said. “But miracles don’t exist in real life. What people should see is a determined, consistent program that produces steady results.”

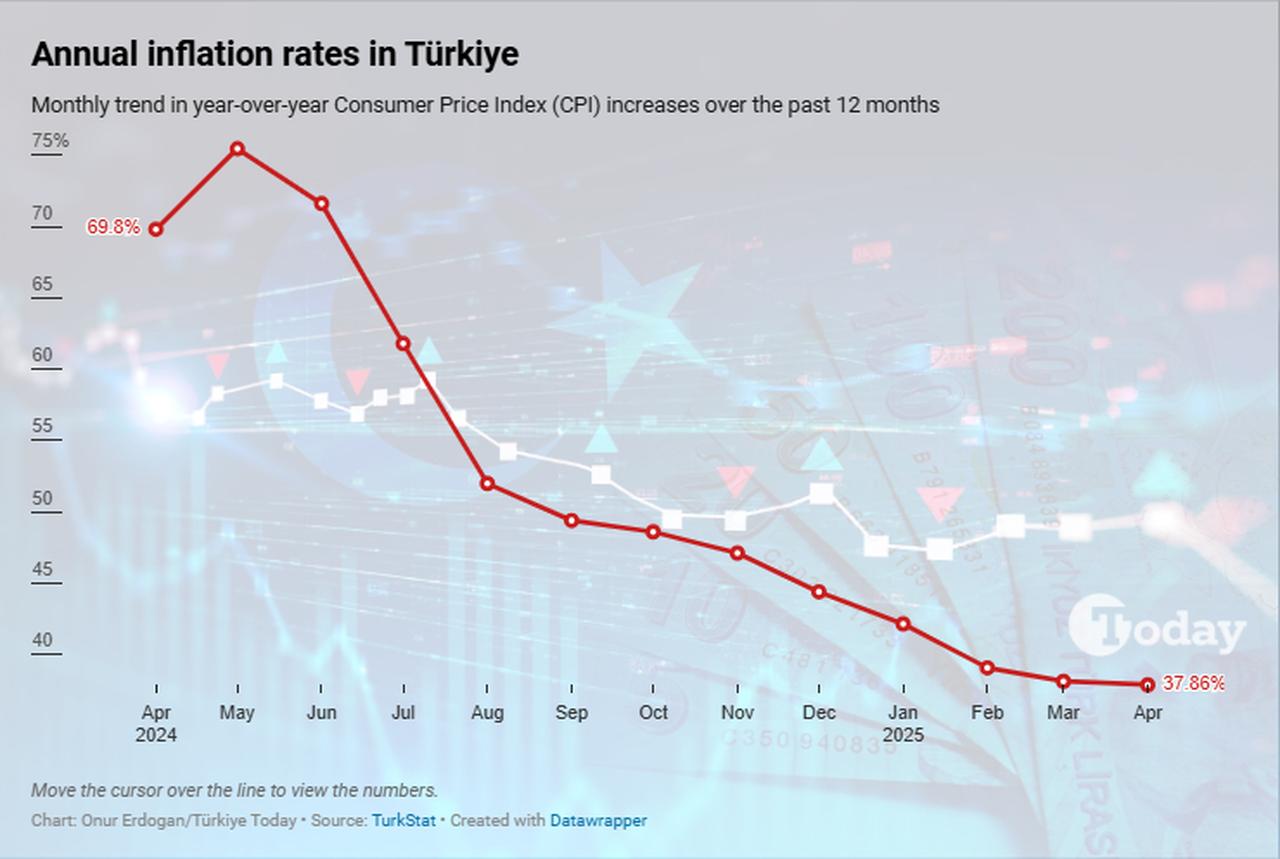

Simsek stated that inflation is already trending downward and will continue to do so in the coming months. “We had foreseen a one-year transition period when we launched this program. Annual inflation has been declining for 11 months now, despite recent domestic and international shocks. That it continues to fall, even slightly, is a positive sign,” he noted.

Simsek pointed out that, according to TurkStat, the annual inflation rate declined to 37.86% as of April, with food inflation at 36.09% and producer inflation dropping to 22.5% year-on-year during the same period. However, services inflation remained elevated at around 55% as of March.

Simsek added that multiple forces are now working to lower inflation. “The delayed impact of monetary tightening has become visible. Fiscal and income policies will also be supportive this year, alongside efforts on the supply side, from housing to broader production.”

He expects the downward trend to become more pronounced in the second half of the year. “We foresee annual inflation falling below the 30% range, into the 20s, particularly after July, when last year’s temporary rental cap expires, contributing to normalization,” he said.

Responding to questions on the public’s perception of economic hardship, Simsek acknowledged concerns over high prices but rejected claims that the government’s policies are ineffective. “Our number one priority is fighting the cost of living,” he stated. “The most crucial target of the program is to bring down inflation—and it is falling.”

Simsek also addressed structural achievements beyond inflation, stating that Türkiye’s current account deficit has been placed on a more sustainable path and that foreign financing access, once a major challenge, has improved significantly. Türkiye's current account posted a $4.4 billion deficit in February 2025, up from $3.33 billion a year earlier, with the 12-month rolling deficit reaching $12.8 billion, according to the Turkish central bank.

Regarding inflation forecasts, Simsek reaffirmed confidence in the Turkish central bank's year-end estimate, which falls between 19% and 29%. He cited declining oil prices and tight financial conditions as factors that will help lower inflation, while acknowledging modest risks from exchange rate movements and inflation expectations. “If oil prices stay where they are—around $60 per barrel, compared to our assumption of $84—this alone could shave off 1.2 percentage points from inflation,” he explained.

Global oil prices fell sharply on Monday, reaching their lowest levels since 2021, after eight members of the OPEC+ alliance announced a substantial increase in output. The move has raised concerns over a potential oversupply in global crude markets at a time when economic uncertainty continues to dampen demand. In early trading across Asian markets, West Texas Intermediate (WTI) crude dropped 3.8% to $56.08 per barrel, while Brent crude declined 3.5% to $59.17.

He also emphasized that employment growth is the most important indicator of the real economy, citing TurkStat data showing that 980,000 jobs were created last year and the unemployment rate fell to 7.9%, the lowest level since 2005. While acknowledging a slowdown in headline growth, Simsek stressed that ongoing job creation reflects continued resilience in the labor market.

Simsek also addressed concerns over the broader global economic environment, including recent U.S. trade actions. Referring to the reciprocal tariffs announced by U.S. President Donald Trump on April 2, he criticized the one-sided focus on their negative impacts. “People say there’s capital outflow from Türkiye, reserves have declined—but they ignore the opportunity side,” he said. “In our book, there is no pessimism. If there’s a problem, there’s also a potential.”

He highlighted the newly imposed U.S. tariffs, which include an additional 10% customs duty, describing the rate as relatively modest. “If I were an Asian manufacturer, I would consider shifting production to Türkiye,” he said. “There are other countries also subject to the 10% tariff, but Türkiye stands out as the most capable industrial base among them.”