The Turkish lira weakened further in April, falling to its lowest inflation-adjusted value since October 2024, according to data released Tuesday by the Central Bank of the Republic of Türkiye (CBRT).

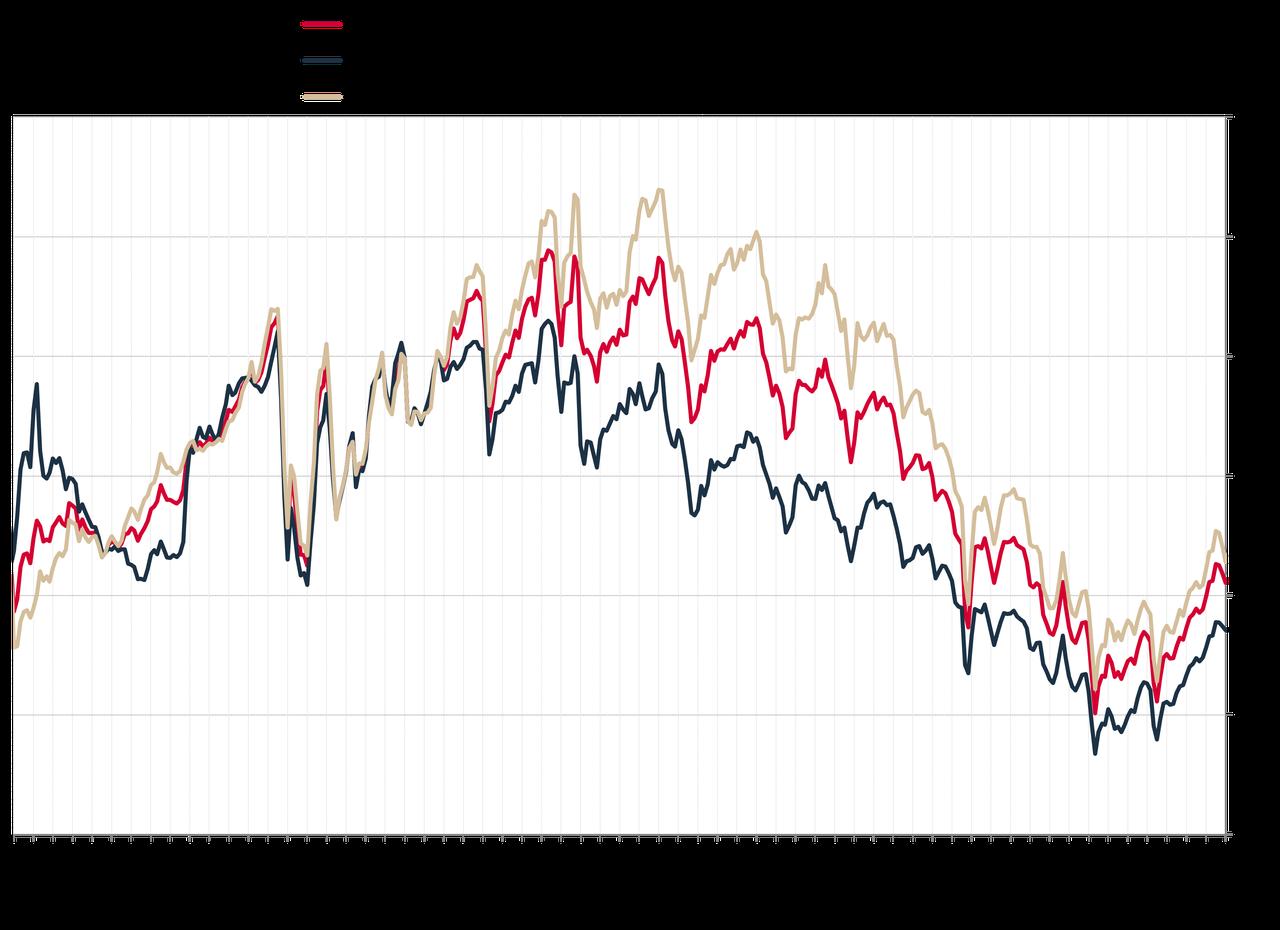

The central bank reported that the Consumer Price Index (CPI)-based real effective exchange rate (REER) fell to 72.12 in April, down 1.55 points from the previous month. This figure, which reflects the Turkish lira’s inflation-adjusted value against a basket of currencies from key trade partners, suggests that domestic inflation was not fully offset by gains in the nominal exchange rate, resulting in further loss of real purchasing power abroad.

The Producer Price Index (PPI)-based REER also declined, dropping by 2.34 points to 93.22. The sharper fall indicates that Turkish-manufactured goods have become relatively cheaper on global markets, reinforcing export appeal but also highlighting the lira’s underlying weakness.

The CBRT attributed the fall in both indexes to the nominal appreciation of major foreign currencies outpacing domestic inflation. According to the bank, the U.S. dollar rose 2.84% and the euro 6.96% against the lira in April. Over the same period, consumer prices in Türkiye rose by 3%, and producer prices by 2.76%, widening the real exchange rate gap.

Detailed data from the central bank also show that Türkiye’s relative competitiveness diverged by market group. The REER against developing countries decreased to 59.82, while the REER against developed countries fell to 78.63. This suggests that Turkish exports have gained further price competitiveness, particularly in developing markets, but it also reflects broader depreciation in real terms.

The real effective exchange rate is a critical indicator for assessing a country's trade position. A falling REER typically indicates improved export competitiveness but also reduced real income and purchasing power at home. The current trajectory reinforces concerns about imported inflation and the real economy’s vulnerability to external shocks.