Türkiye’s shadow economy accounted for 16.1% of its gross domestic product (GDP) in 2023, equivalent to approximately ₺7 trillion ($179 billion)—significantly exceeding the global average of 11.8%, according to UK-based professional services firm Ernst & Young.

The shadow economy—also referred to as the informal or unregistered economy—encompasses all economic activities that are not reported to the authorities and therefore escape taxation, regulation, and statistical recording. It includes everything from unregistered businesses and off-the-books employment to underreported corporate revenues and cash-based transactions that leave no paper trail.

Although not always illegal, these activities deprive governments of tax revenue, distort market competition, and weaken institutional trust.

According to Ernst & Young’s March 2025 report "Shadow Economy Exposed: Estimates for the World and Policy Paths," Türkiye’s fiscal loss from shadow economy activity is estimated at approximately 3% to 4% of GDP, which corresponds to ₺1.3 trillion to ₺1.7 trillion (or $33 billion to $44 billion) in foregone tax revenues—primarily from value-added tax (VAT), personal income tax, and corporate income tax.

This figure reflects ongoing structural challenges—such as high tax burdens, widespread informal employment, limited institutional trust, and regulatory inefficiencies—which continue to hinder Türkiye’s progress toward full economic formalization and prevent the effective integration of informal activity into the registered economy.

Informality is widespread across both employment and business transactions, with many companies and individuals operating outside the official system either deliberately or through habitual practice.

The report identifies both “active” informality—where taxpayers intentionally evade their obligations—and “passive” participation—where consumers may unknowingly engage in unregistered transactions. In Türkiye’s case, active underreporting is dominant, particularly among businesses seeking to avoid compliance costs and regulatory burdens.

This persistent informality not only limits government capacity to invest in public goods like healthcare, education, and infrastructure but also undermines fair competition by placing registered firms at a disadvantage.

Türkiye has made tangible progress in deploying digital solutions to address informality. EY commends the country’s widespread adoption of electronic invoicing, digital archiving systems, and the integration of financial and tax authority databases.

These systems have significantly improved the government’s ability to monitor and detect unregistered activity, the report highlighted.

However, digital oversight alone is not enough, the report cautions. Broader reforms are needed to simplify tax compliance, improve labor registration processes, and restore public trust in government institutions.

EY emphasizes that youth and women, particularly in informal sectors such as agriculture and domestic services, should be prioritized in targeted policy interventions.

Türkiye is also highlighted as an example of how technical capacity can be leveraged for reform. Still, the report concludes that building trust and simplifying the formalization process are critical to sustaining long-term progress.

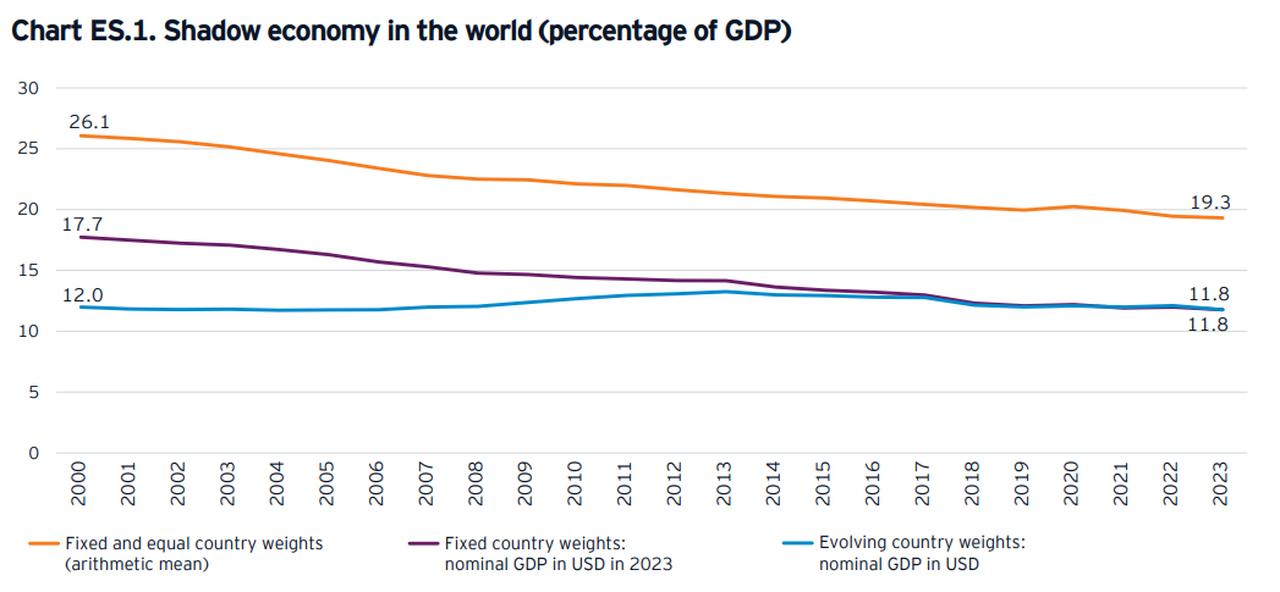

At the global level, EY estimates the shadow economy at 11.8% of world GDP in 2023. However, the average across the 131 countries analyzed was significantly higher—19.3% of gross domestic product (GDP)—indicating that lower-income countries continue to struggle with widespread unregistered activity.

The report finds that 119 out of 131 countries have managed to reduce informality since 2000, with notable progress in low-income nations.

In contrast, advanced economies have seen relatively smaller improvements, as informality there typically takes more subtle forms, such as underreporting by registered firms.