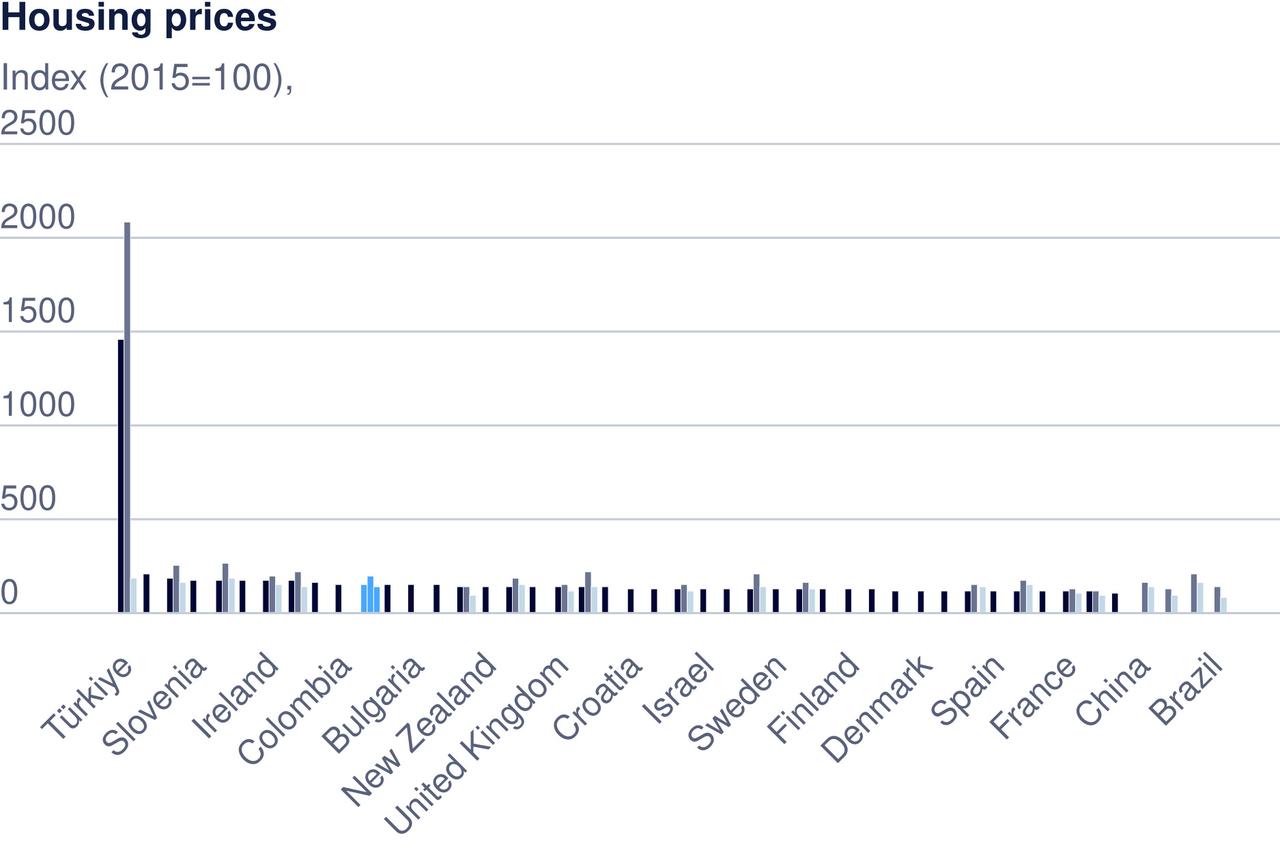

Türkiye has recorded a staggering 20-fold increase in housing prices over the past decade, with residential property prices surging by 1,975.7% from 2015 to the first quarter of 2025.

Rents have also soared by 1,352.3% over the same period, far exceeding global averages, placing the country at the top of the OECD rankings.

OECD data reveals that Türkiye’s housing price surge is nearly 20 times the 90.2% average increase seen across member countries. Iceland, the second-highest on the list, reported a 160.9% rise in housing prices, placing it 12-fold behind Türkiye.

In real terms, which account for inflation, Türkiye still leads with a 78.4% increase, while the OECD average remained at 33.4%.

The dramatic rise in both housing and rent prices is largely driven by a combination of internal migration, a growing refugee population, and the broader economic disruptions caused by the COVID-19 pandemic. These overlapping pressures began to intensify in the second half of 2021, particularly as shifting labor dynamics and remote work trends prompted increased mobility within the country.

The devastating earthquakes in February 2023, which struck Türkiye’s southeastern provinces and claimed the lives of over 53,000 people, further deepened the housing crisis by triggering a large wave of displacement. Thousands were forced to relocate to urban centers, particularly Ankara. This sudden surge in demand, combined with limited new housing development, drove both home prices and rents even higher.

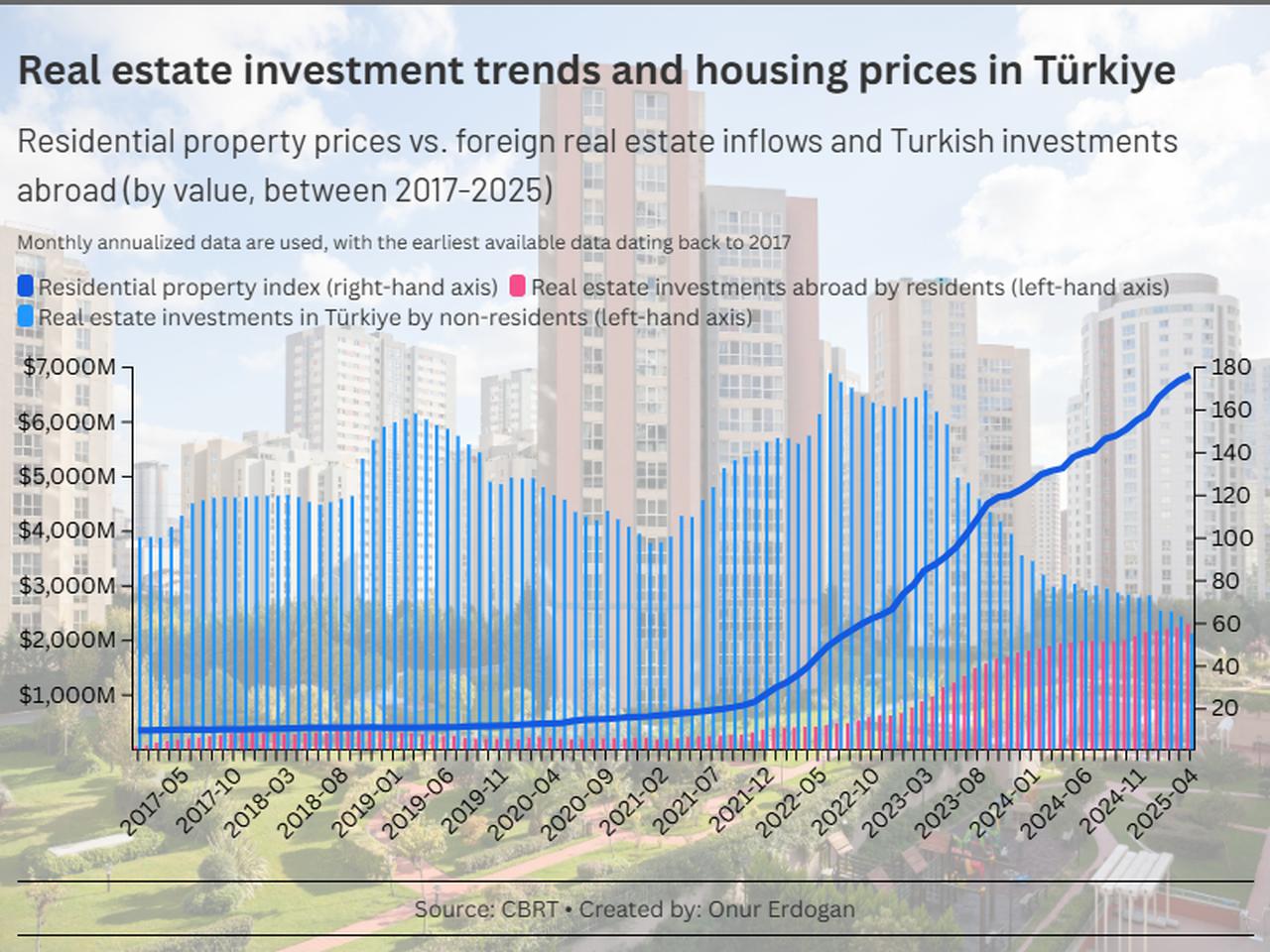

The Central Bank of the Republic of Türkiye’s (CBRT) Residential Property Price Index (RPPI) also aligns with OECD figures, rising from 8.12 in 2015 to 182.38 in 2025.

Yet this explosive growth appears to be changing investment patterns. For the first time in April 2025, Turkish residents spent more on real estate abroad than foreign investors did on property in Türkiye, according to central bank data.

Türkiye’s housing inflation reached 67.43% in May 2025, almost double the national inflation rate of 35.41%.