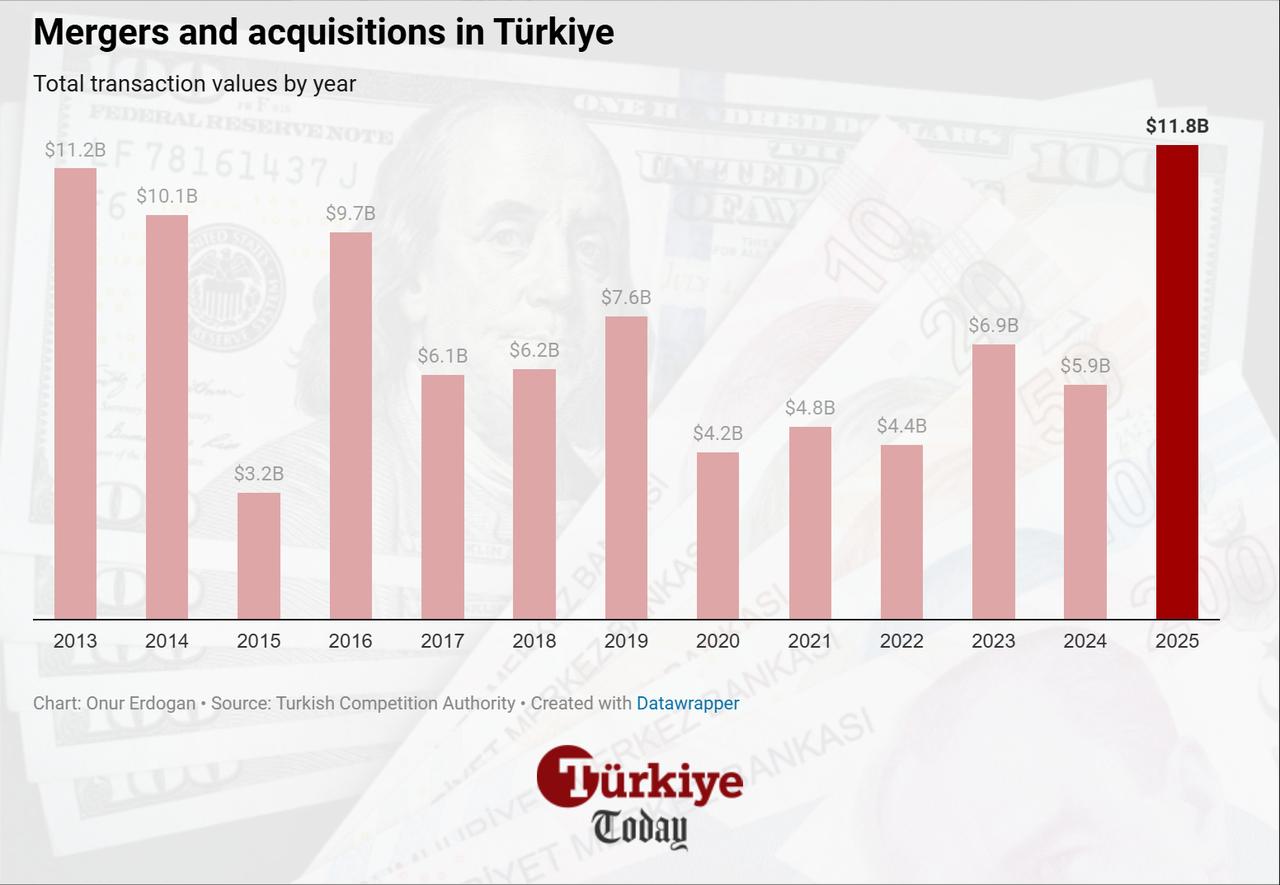

Türkiye recorded its highest-ever annual merger and acquisition (M&A) volume in 2025, with domestic transactions totaling ₺466.1 billion ($11.81 billion), the Competition Authority reported on Wednesday.

According to the report, the 2025 transaction value marks the highest annual total since the authority began publishing data in 2013, covering only deals involving Türkiye-based target companies and excluding privatizations.

Foreign-led deals accounted for the largest share, with a combined value of ₺277.5 billion, marking the second-highest annual total for international investment in Türkiye.

Foreign investors played a prominent role in the 2025 M&A landscape, initiating 55 transactions involving Türkiye-based companies. Germany accounted for the largest number of foreign-initiated transactions with nine, followed by France with six.

Among domestic transactions, the technology sector ranked first in volume, with 25 deals reported in software development, consultancy, and related IT services. The finance sector, specifically involving monetary intermediaries, recorded the highest transaction value.

Privatizations made in 2025 spanned sectors such as electricity generation and distribution, wholesale trade of household goods, and cable manufacturing, with 19 transactions totaling ₺108.05 billion.

The overall transaction volume, including privatizations, amounted to approximately ₺574.2 billion across 181 deals.

According to a list prepared by financial consultancy firm KPMG Türkiye, among disclosed amounts, the most valuable transaction in Türkiye was the $1.72 billion acquisition of vehicle inspection stations by the MOI Joint Venture consortium.

The $1 billion purchase of a 3% stake in the TANAP natural gas pipeline by U.S.-based Apollo Global Management ranked second, followed by Uber’s $700 million acquisition of an 85% stake in the delivery platform Trendyol Go.

These were followed by the $504 million acquisition of the Fenerbahce Kalamis Marina in Istanbul by Koc Holding. In the mining sector, Nurol Holding acquired the gold mining operations of Canada’s Alamos Gold in Canakkale for $470 million.

Poland-based Benefit Systems acquired 100% of the fitness chain MacFit for $431.6 million, while France’s Ceva Logistics completed a $383.2 million takeover of Borusan’s supply chain solutions unit.

Global merger and acquisition activity also picked up, with total deal value reaching $4.5 trillion, according to data from the London Stock Exchange Group (LSEG)