Türkiye's year-end inflation outlook remains unchanged, as the Turkish central bank maintained its projection at 24% for 2025 and 12% for 2026 in its second Inflation Report of the year, Governor Fatih Karahan announced.

"We will continue to do whatever is necessary to bring inflation down," Karahan said, reaffirming the commitment to tight monetary policy.

Governor Fatih Karahan shared the outlook during a press conference held Thursday at the Istanbul Finance Center to present the second Inflation Report of the year.

Karahan explained that as the year-end approaches, the forecast range for 2025 had to be mechanically narrowed but was kept at 19–29% due to heightened uncertainties.

The forecast range for end-2026 remains between 6% and 18%.

He reiterated the bank's aim for inflation to ease to 8% in 2027 and eventually stabilize around 5% in the medium term.

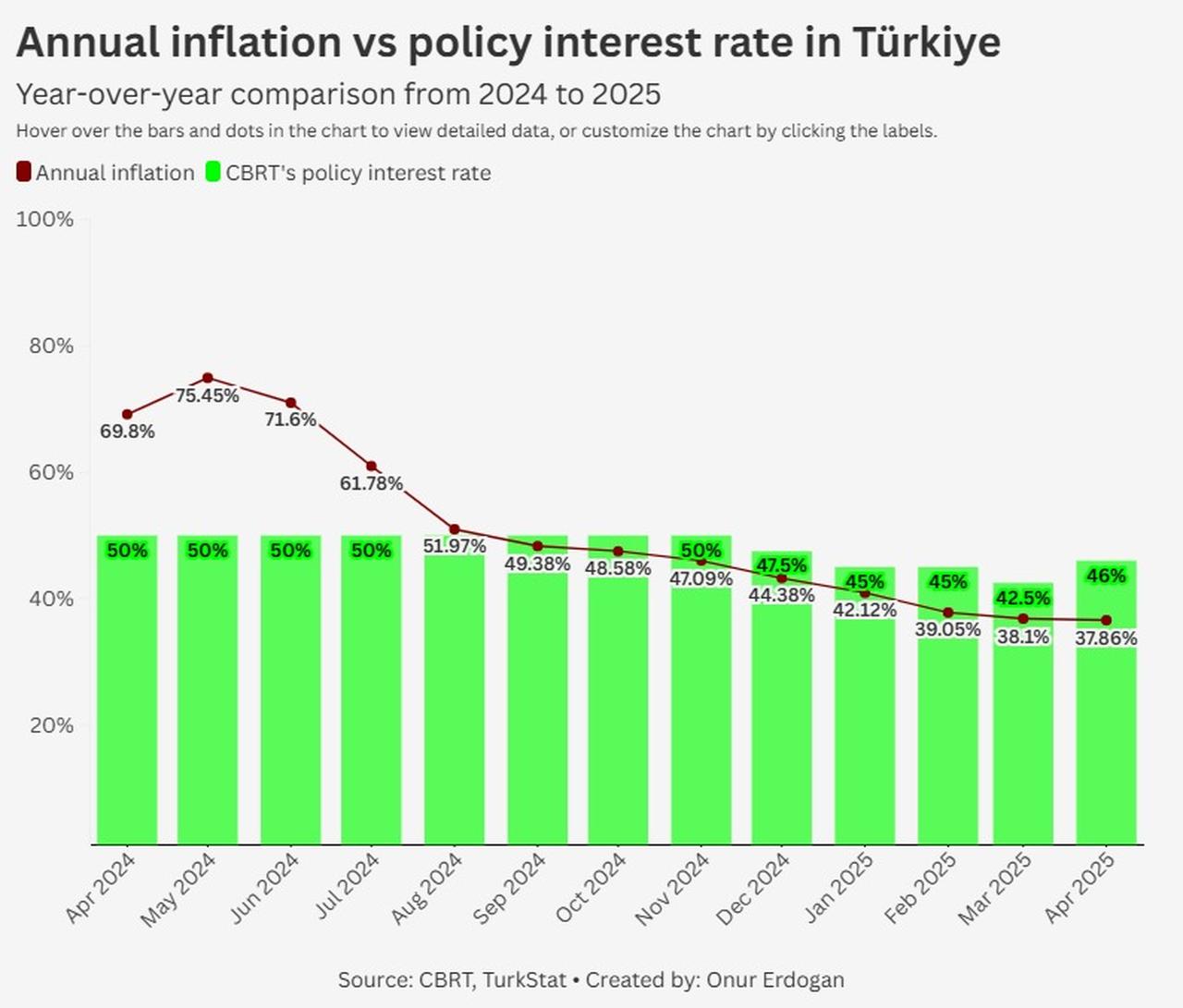

Türkiye’s annual inflation declined for the 11th consecutive month in April, falling to 37.86%, according to official data.

The downward trend is expected to persist, supported by the CBRT’s tightening policies. In line with a more cautious global outlook, Karahan said the bank revised its external demand assumptions significantly downward, citing growing protectionist tendencies and risks to global growth.

Karahan also noted that the central bank has lowered its assumptions for crude oil and import prices for both 2025 and 2026, aligning with expectations of easing energy-related costs.

However, food price assumptions for 2025 have been revised upward, driven by unprocessed food inflation.

Karahan emphasized that the central bank’s medium-term projections assume the continuation of a tight monetary stance until a clear and lasting improvement in inflation is achieved.

He highlighted that stronger coordination across economic policies has also been factored into the forecasts.

"The resolute stance in monetary policy will continue to reinforce the disinflation process through rebalancing domestic demand, real appreciation of the Turkish lira, and improvements in inflation expectations," Karahan said.

In April, the central bank surprised markets with a 350 basis point hike in the policy interest rate to 46%, marking its first increase since June 2023 and ending a three-month easing cycle to counter global headwinds that had intensified inflationary pressures in Türkiye.

Karahan stated that as long as inflation expectations continue to trend downward and services inflation declines, the underlying inflation trend will keep improving throughout the rest of 2025.

He also said that enhanced coordination between monetary and fiscal policies would contribute to this process.

"We set the policy rate at a level that delivers the tightness required for the projected disinflation process. If we foresee a marked and lasting deterioration in the inflation outlook, we stand ready to tighten monetary policy further," Karahan added.

He underlined that price stability is a prerequisite for sustainable growth and increased social welfare, and the central bank remains committed to taking all necessary steps to bring inflation in line with its interim targets throughout the disinflation process.