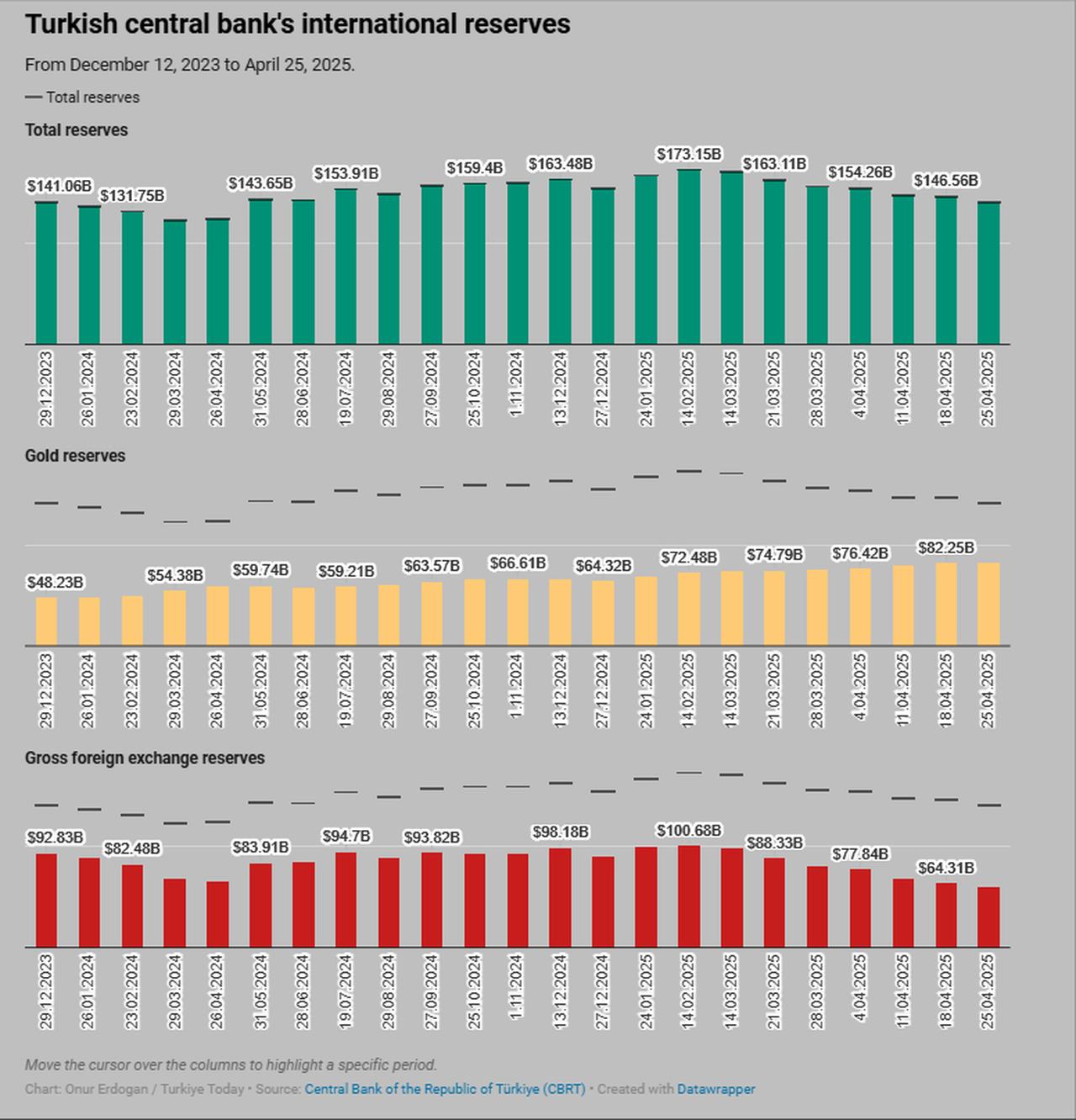

The Central Bank of the Republic of Türkiye (CBRT) saw its total reserves decline by $5.51 billion in the week ending April 25, falling to $141.05 billion.

According to official data, gross foreign exchange reserves decreased by $5.05 billion from the previous week, reaching $59.25 billion. On April 18, the reserves had stood at $64.31 billion. Meanwhile, gold reserves dropped by $452 million, from $82.25 billion to $81.8 billion.

As a result, the CBRT’s total reserves declined from $146.56 billion to $141.05 billion over the one-week period.

Turkish lenders' deposits fall

Meanwhile, total deposits in the Turkish banking sector also declined. According to data from the Banking Regulation and Supervision Agency (BRSA), as of April 25, total deposits in Türkiye declined by ₺101.62 billion ($3.15 billion), bringing the overall figure to ₺22.53 trillion. During the same week, Turkish lira deposits decreased by 0.3% to ₺12.39 trillion, while foreign currency (FX) deposits increased by 0.3% to ₺7.44 trillion.

The total volume of FX deposits in banks stood at $232.74 billion, of which $194.85 billion belonged to domestic residents. When adjusted for exchange rate effects, domestic residents’ FX deposits fell by $147 million over the week.

Domestic residents’ consumer loans rose by 1.5% in the week ending April 25, reaching ₺4.24 trillion. This total included ₺558.73 billion in housing loans, ₺63.97 billion in auto loans, and ₺1.6 trillion in personal loans.

The total loan volume in the banking sector, including the CBRT, increased by ₺121.75 billion over the same week, reaching ₺17.62 trillion.