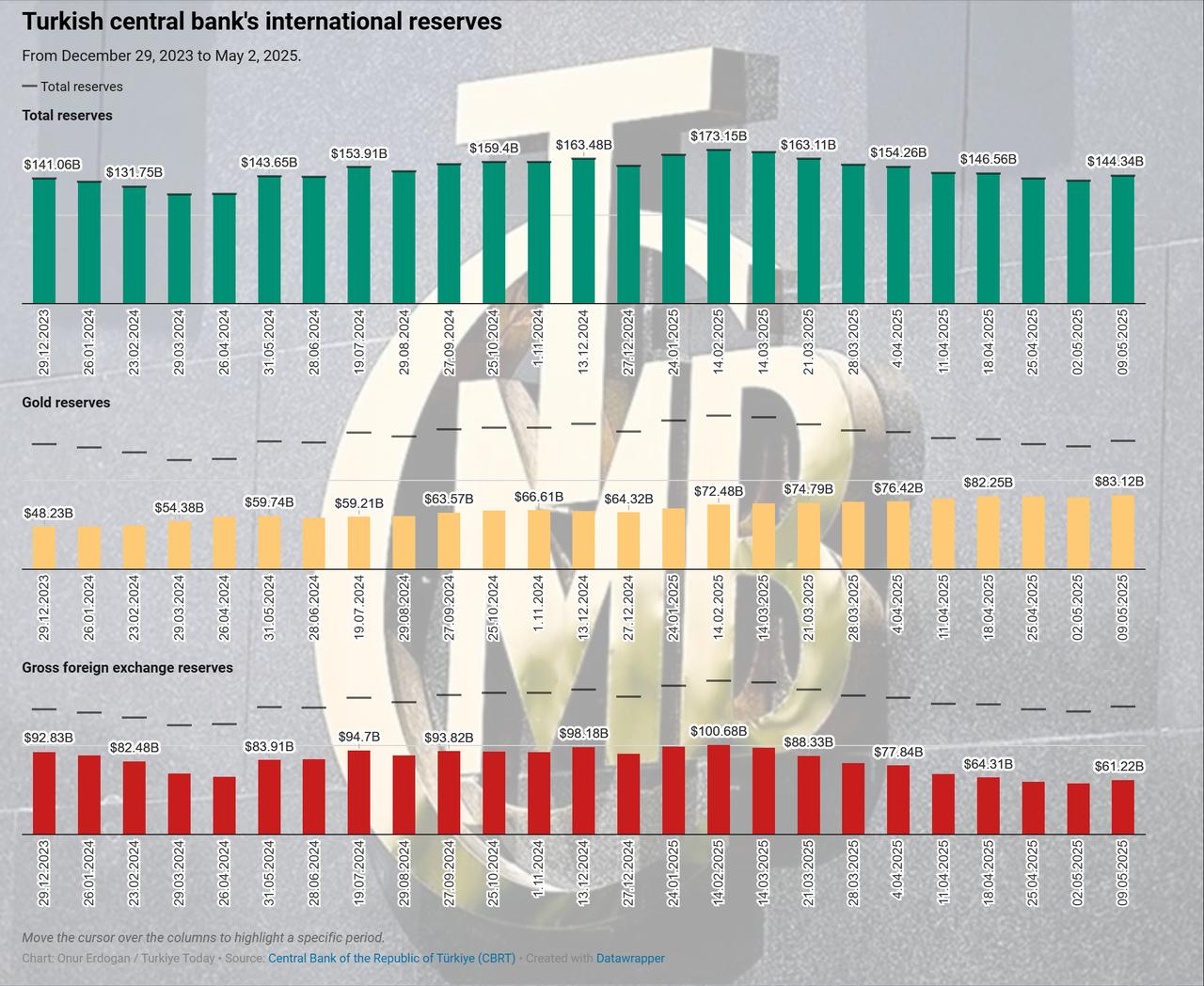

Türkiye’s central bank reserves rose sharply in the week ending May 9, marking the first increase since mid-February, when they last peaked at $173 billion. The Central Bank of the Republic of Türkiye (CBRT) reported a $5.81 billion week-over-week rise, bringing total reserves to $144.34 billion.

According to the CBRT’s weekly data release on Thursday, gross foreign exchange reserves rose by $3.65 billion to $61.22 billion, up from $57.58 billion a week earlier. Meanwhile, the central bank’s gold holdings also climbed by $2.17 billion, reaching $83.12 billion.

The improvement in gross reserves helped reverse a monthslong downward trend, underscoring renewed strength in external buffers amid stabilizing macroeconomic indicators.

The positive trend in Türkiye’s international reserves also appeared to buoy investor sentiment in capital markets. During the same week, foreign investors showed a strong appetite for Turkish assets, particularly equities and government bonds.

According to the central bank’s Weekly Securities Statistics, non-resident investors purchased a net $102 million in equities and $933.7 million in government domestic debt securities (GDS). On the other hand, they offloaded $7.3 million worth of private sector bonds, categorized as non-governmental sector (NGS) assets.

The total value of foreign-held Turkish equities rose to $28.38 billion as of May 9, up from $27.81 billion the previous week. Their holdings in government debt also increased to $10.11 billion, compared to $9.12 billion a week earlier. However, foreign-held non-government debt instruments declined to $329.8 million from $338.6 million.

Finance Minister Mehmet Simsek welcomed the rise in reserves and noted a broader shift in investor perception, highlighting the ongoing decrease in foreign-currency deposits (commonly referred to in Turkish as DTH) and Türkiye’s credit default swap (CDS) premiums—a key measure of country risk.

Simsek stated on the social media platform X that “the resumption of reserve accumulation, along with easing global uncertainties, improving financial indicators, and moderating domestic demand, will support the disinflation process.”

Pointing to the $5.8 billion weekly increase in CBRT’s gross reserves, he emphasized that the government remains committed to its economic roadmap: “We will decisively continue to implement our policies to achieve lasting price stability, which is the ultimate goal of our economic program.”