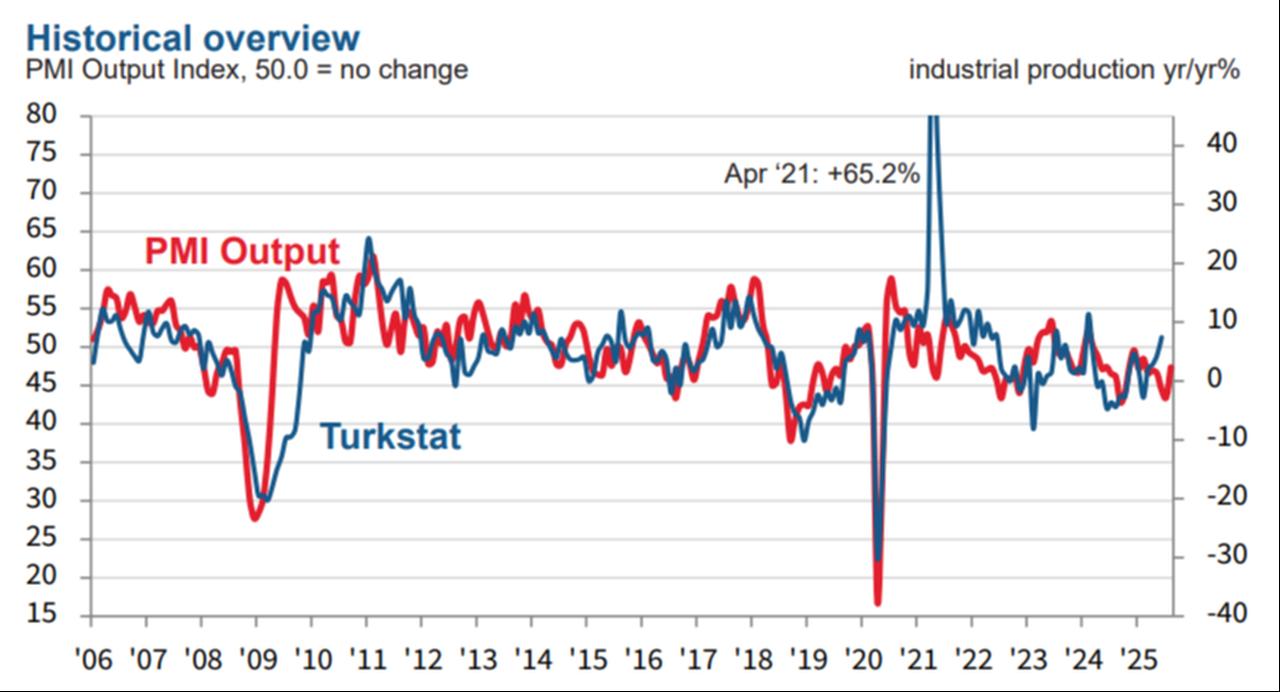

Türkiye’s manufacturing industry saw a mild improvement in August as the Purchasing Managers’ Index (PMI) rose to 47.3, up from 45.9 in July, the Istanbul Chamber of Industry (ISO) reported on Monday.

While the figure remained below the neutral 50 threshold that separates growth from contraction, it marked the slowest pace of deterioration since April.

The PMI, compiled by S&P Global through surveys of purchasing managers, is a widely used gauge of business conditions in manufacturing.

A reading above 50 signals expansion, while below 50 indicates contraction.

The survey results pointed to a continued slowdown in demand, with new orders shrinking for another month.

However, the decline in August was the weakest since February. Export orders also fell, registering a steeper drop than total new orders.

Production contracted for a sixth consecutive month but at the slowest pace since February.

Despite the moderation, the downward trend that began in April 2024 persisted.

Weaker demand translated into job losses, with employment decreasing at the fastest rate since April 2020.

The reduction was broad-based across sectors, though machinery and metals managed to add staff.

Purchasing activity also slowed, leading to lower inventories of inputs and finished goods for a second month in a row.

Survey participants highlighted a sharp increase in input costs during August, attributing it largely to the depreciation of the Turkish lira.

Since the beginning of the year, the lira has weakened by 16% against the U.S. dollar, while its real effective exchange rate—a measure of the currency’s value against a basket of trading partners’ currencies adjusted for inflation—fell to a 10-month low of 69.36.

Higher raw material costs pushed manufacturers to raise selling prices. Even so, final product inflation eased to its lowest level since the start of 2025.

According to ISO’s sectoral PMI report, eight of 10 monitored industries recorded weaker output in August, compared with nine in July.

The basic metals sector posted its strongest expansion since April 2023, while wood and paper products registered growth for the first time in five months.

Textiles performed worst, recording the steepest declines in both output and new orders.

Employment in textiles also fell at the fastest rate since the survey began in 2016.

Chemicals, plastics, and rubber saw record staff cuts as well. By contrast, machinery, metals and basic metals reported modest job creation.

Notably, two industries—wood and paper products and clothing and leather—saw their selling prices fall despite higher input costs.

For wood and paper, it was the first recorded decline in final product prices since 2019.

Andrew Harker, economics director at S&P Global Market Intelligence, said Turkish manufacturers faced challenging business conditions in August, which resulted in a marked reduction in employment.

He explained that the PMI data nevertheless provided encouraging signals.

"Business conditions remained challenging for Turkish manufacturers in August, and employment was scaled back markedly as a result," he said.

Harker also underlined that the slowdown in both output and new orders was easing.

“If these trends continue in the months ahead, then the sector could be looking brighter as we head toward the end of the year," he noted.