U.S. financial institutions are ready to provide funding for nuclear energy projects in Türkiye, particularly small modular reactors (SMR), as the two countries work to expand their strategic partnership in the nuclear sector.

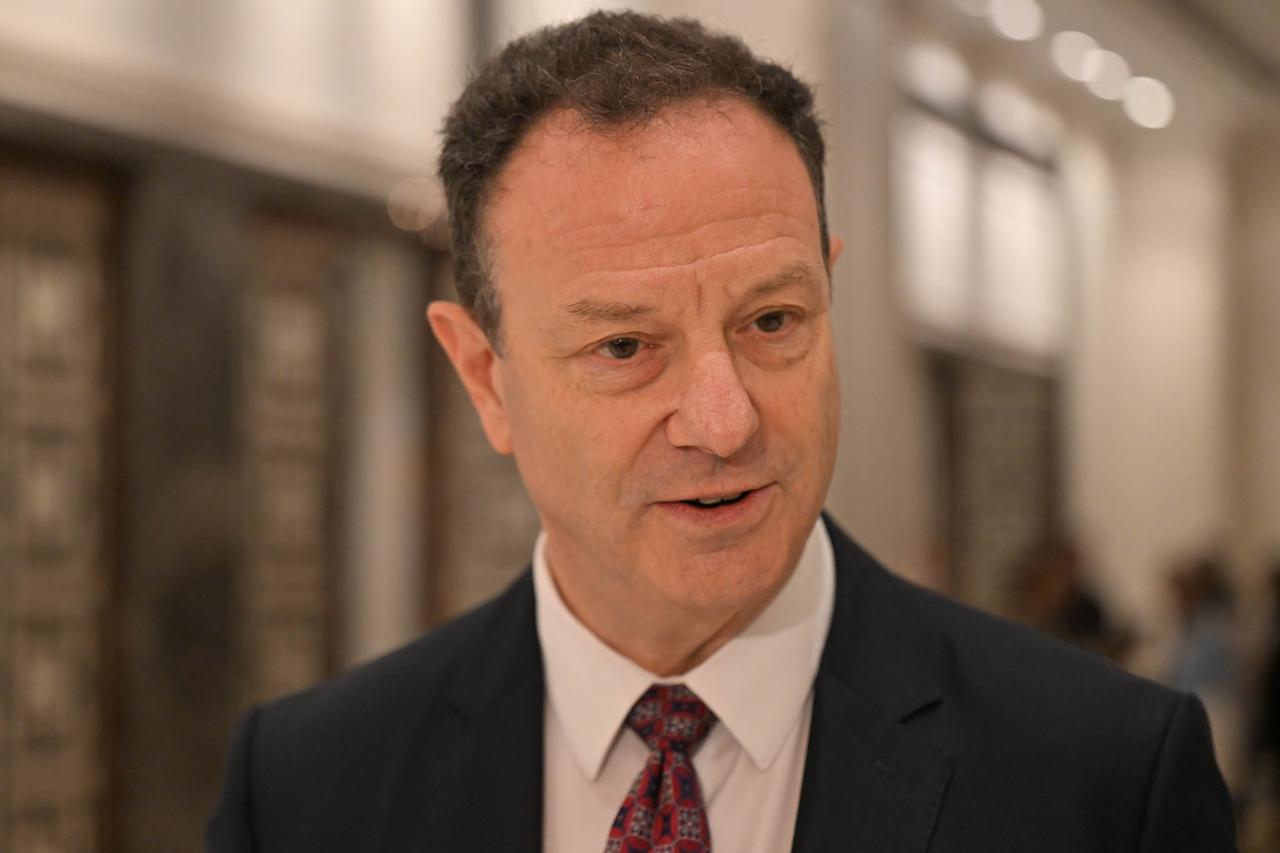

Justin Friedman, senior nuclear energy advisor at the U.S. State Department, said American financial institutions have programs specifically designed to support progress in the small modular reactor field.

"(American financial institutions) have programs that will support progress, especially in the small modular reactor area. We are waiting for projects to come so we can match them with financing," Friedman told Anadolu Agency (AA) reporters.

Friedman made his remarks during the 11th Nuclear Power Plants Summit (NPPES 2025) in Istanbul, organized by the Ankara Chamber of Industry and Nuclear Industry Association with support from the Ministry of Energy and Natural Resources.

The U.S. official emphasized America's long-term partnership goals with Türkiye, drawing from his experience as a political advisor at the U.S. Embassy in Türkiye a decade ago.

"Nuclear is part of this, and we hope to expand and develop this partnership by working together on nuclear energy," Friedman said.

Friedman highlighted Türkiye's potential to become a leader in nuclear energy, citing the country's "net and determined" 20-gigawatt nuclear installed capacity target and corporate interest in the sector.

During his visit, Friedman met with approximately five major Turkish industrial companies, all of which expressed interest in nuclear energy both for supply chain participation and their own energy needs.

"When goals are combined with a clear roadmap, Türkiye can become a leader," Friedman noted, adding that the U.S. is working with the Turkish government to develop regulations that will enable Türkiye's leadership in this field.

The U.S. official described the cooperation between American and Turkish companies in small modular reactor technology as "natural and organic."

"Turkish companies provide parts, materials, and services to nuclear projects abroad. It's very natural for U.S. companies to want to benefit from this expertise," Friedman explained.

He emphasized that U.S. companies seek partnerships because they believe accessing the highest quality products and services at the most suitable prices serves their interests.

Friedman revealed that American financial institutions, including EXIM Bank and the U.S. International Development Finance Corporation (DFC), have committed to being part of the global nuclear movement.

These institutions have provided letters of intent totaling over $17 billion for nuclear projects in Romania and Poland.

"I know they are exploring opportunities in Türkiye as well. They have programs that will support progress, especially in the small modular reactor area. We are waiting for projects to come so we can match them with financing. They are ready, just waiting for good projects to come," Friedman said.

Washington is significantly expanding its nuclear energy efforts under U.S. President Donald Trump's administration, aiming to increase nuclear capacity from 100 gigawatts to 400 gigawatts by 2050.

"This is quite an ambitious target, and that's why the US is in a leading position worldwide in this field," Friedman said.

Friedman expressed satisfaction with the World Bank's announcement to lift its ban on funding nuclear energy projects, calling it "an important step that the U.S. has wanted for a long time."

"The World Bank's move in this direction is a very strong signal. It's important not only for the financing the bank can provide but also for sending the message to private capital markets that "nuclear is a good investment, a safe investment," he evaluated.

When asked about the possibility of a nuclear energy agreement between the two countries in the near future, Friedman responded optimistically: "I hope there will be an agreement soon. I would like to be part of the team developing this agreement."