U.S. consumer inflation edged higher in May, in line with market expectations, as broad-based import tariffs imposed by President Donald Trump started to filter through the economy, according to official data released on Wednesday.

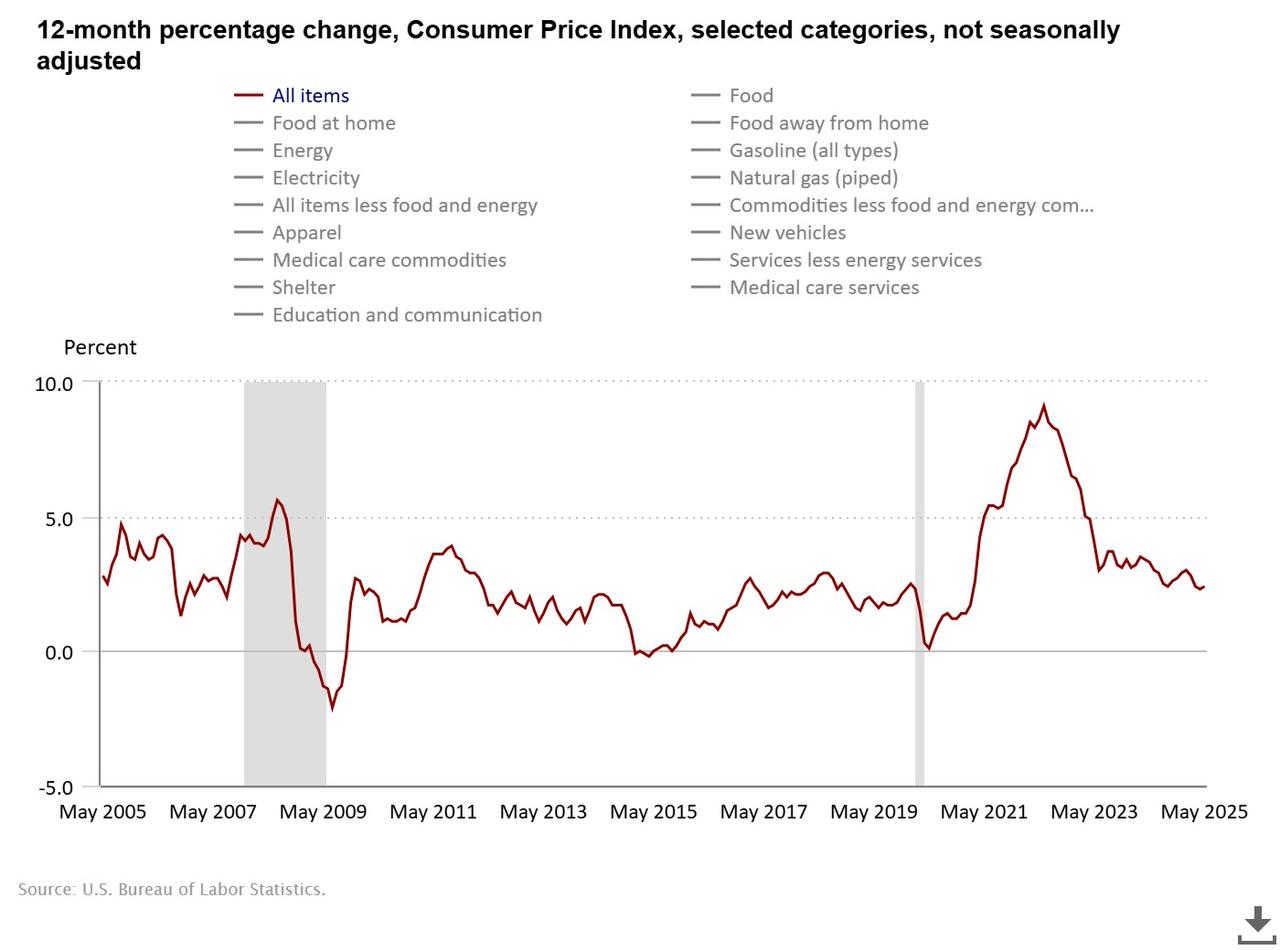

The Consumer Price Index (CPI), a widely used measure of inflation that tracks the average change in prices paid by urban consumers for goods and services, rose by 2.4% year-over-year. This marked a slight increase from April’s annual rate of 2.3%, the U.S. Department of Labor reported.

The inflation uptick comes after the Trump administration introduced a blanket 10% tariff in April on nearly all imported goods from major trade partners. Additional higher tariffs targeting specific countries, including India and European Union member states, were also announced but have been temporarily suspended until early July. Furthermore, a separate round of tit-for-tat tariffs has been exchanged with China.

Despite these sweeping trade measures, economists noted that the inflationary effect has so far remained muted. Businesses have reportedly stockpiled goods in anticipation of the tariffs, relying on pre-tariff inventories to meet consumer demand, which has delayed price increases for end consumers.

On a monthly basis, the CPI rose by just 0.1% between April and May, reflecting a slowdown from the previous month’s pace. The report highlighted that housing and food prices continued to climb, while energy prices declined slightly, helping to moderate the overall inflation figure.

Analysts cautioned that the full impact of the tariffs on inflation could take several more months to materialize, depending on how quickly businesses deplete their existing inventories and begin passing higher import costs on to consumers.