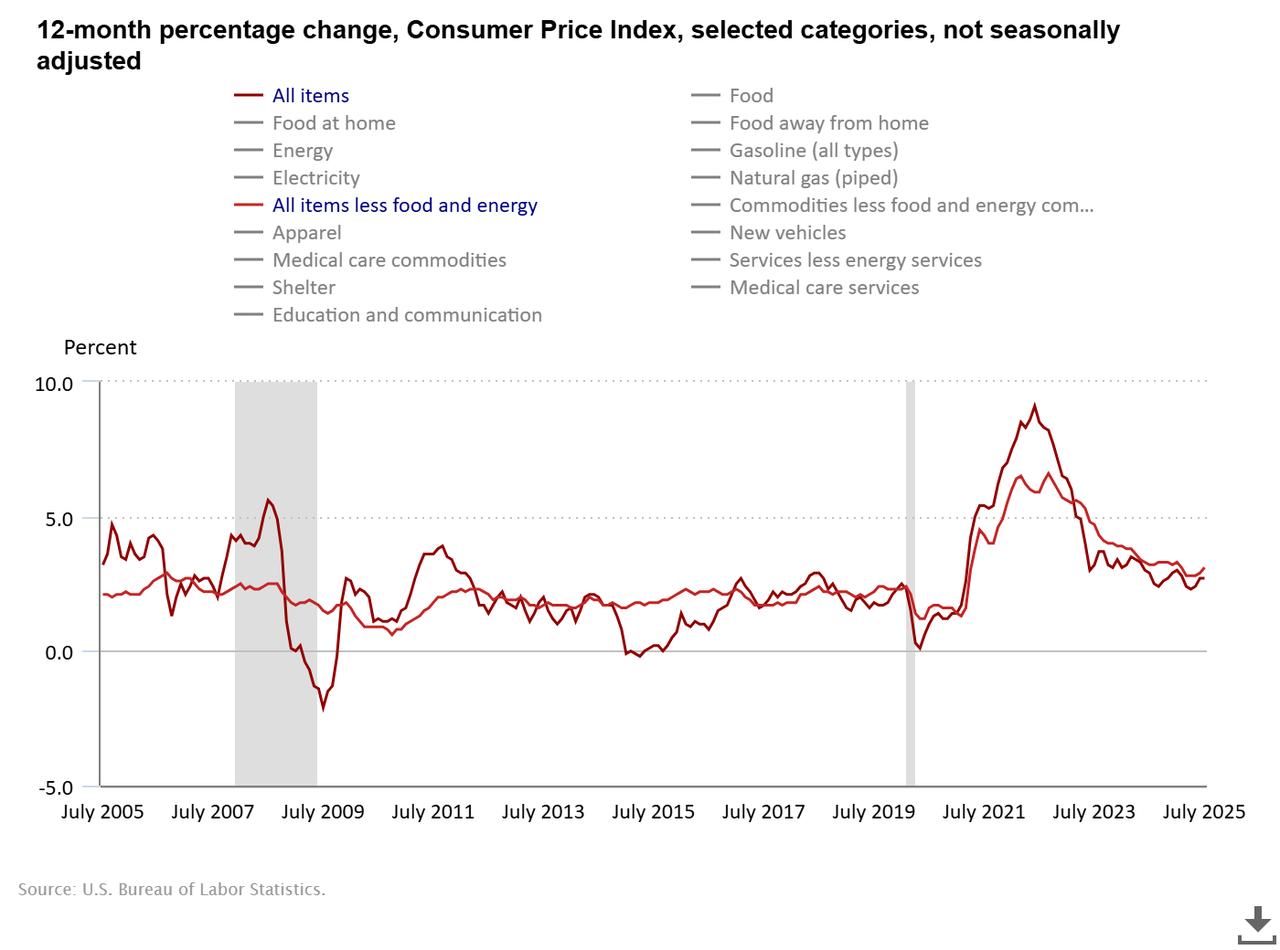

U.S. inflation held steady in July at 2.7%, as consumer prices rose 0.2% on a monthly basis, the U.S. Bureau of Labor Statistics reported on Tuesday.

The figure matched June’s pace but was slightly below the 2.8% rate expected in a median forecast of analysts surveyed by Dow Jones Newswires and The Wall Street Journal.

While the headline inflation rate remained unchanged, underlying price pressures increased in July. The Department of Labor reported that core inflation—which excludes volatile food and energy prices—rose 0.3% on a monthly basis, up from 0.2% in June. From a year earlier, core CPI accelerated to 3.1%, marking a faster pace than in the previous month.

The data showed that while the indexes for energy and gasoline declined during the month, shelter costs increased. Other categories posting gains included medical care, airline fares, and household furnishings.

The Federal Reserve had previously warned that President Donald Trump’s broad trade tariffs, implemented in stages throughout the year, are beginning to influence consumer prices across multiple sectors.

However, on Tuesday, Trump announced that the tariff truce—which applies 30% tariffs on Chinese goods and 10% on U.S. goods—has been extended for 90 more days to allow progress in ongoing trade talks.

The current tariff rates, agreed upon in May, will remain in place until November or until a new agreement is reached.

The latest figures come as Fed policymakers assess the economic impact of this year’s new tariffs on imports. The levies, aimed at goods from several major trading partners, have added to cost pressures for some businesses, which in turn can feed through to consumers.

Investors were betting that the inflation report was tame enough for the Federal Reserve to cut interest rates multiple times this year. According to CME’s FedWatch Tool, the market is currently pricing in a nearly 91% chance of a rate cut next month, up from 85% before the data release.

Traders also increased their expectations for additional cuts in October and December.