In July, President Recep Tayyip Erdogan outlined one of Türkiye’s most ambitious digital infrastructure targets to date — reaching 1 gigawatt of data center capacity by 2030.

Following a Cabinet meeting in Ankara, Erdogan announced plans to establish “data center zones” backed by over $10 billion in investment, underscoring the administration’s intent to position data and infrastructure at the core of its national AI strategy.

Currently operating at around 250 megawatts, Türkiye’s data center capacity is set to expand gradually in regions with secured energy supply. Erdogan also emphasized efforts to train a new generation of AI specialists and expand technical education, supported by a forthcoming Artificial Intelligence Fund designed to scale domestic innovation.

A newly created National AI Council is expected to play a central role in converting public-sector data into economic and social value, marking an attempt to bridge the gap between policy ambition and technological reality.

Policymakers and industry leaders increasingly describe data centers not simply as warehouses for servers but as “geotechnological bases.”

In Türkiye, those critical assets in a new era of digital sovereignty and economic competition, mostly thrives on banks, payment processors, and capital market firms.

It is betting on becoming a regional data hub, and the numbers point to a fast-expanding market with 83 data centers across the country currently.

Türkiye’s data center industry was valued at roughly $471 million in 2023 and is expected to approach $688 million by 2029, with some forecasts placing the figure closer to $971 million by 2033. Growth projections average around 7% per year, driven by the twin forces of regulatory pressure and rising domestic demand for cloud computing.

Yet for all its promise, Türkiye’s data ambitions remain caught between the drive for localization and the need for global integration, constrained by structural power gaps and limited cloud infrastructure.

If Türkiye’s digital infrastructure were a map, Istanbul and Ankara would stand out as its twin anchors. Istanbul dominates the landscape, hosting nearly half of third-party data centers. Its geographic position, international fiber connectivity, and business ecosystem make it the natural hub for colocation and enterprise clients.

Further east, Ankara is emerging as the capital of capacity expansion. Around 60–70% of upcoming data center capacity is concentrated in the city, reflecting both the state’s push for secure domestic storage and the clustering of government and financial institutions.

Türkiye’s total data center capacity currently hovers around 120 megawatts (MW), with another 150 MW projected to come online in the near future.

The lack of diversified regional infrastructure means new investments tend to cluster where the grid, cooling, and fiber conditions are most reliable.

Behind Türkiye’s rapid digitalization lies a state-driven logic: data should reside within the country’s borders.

This approach has been formalized through a series of laws and sectoral regulations. Financial institutions—including banks, payment processors, and capital market firms—must host their information systems domestically. Social media companies with over one million daily users are also required to store Turkish user data within national borders.

Supporters of these policies see them as necessary to protect national security and privacy, and to ensure digital sovereignty in an era of extraterritorial cloud control. But critics argue that strict localization creates barriers to investment and limits access to advanced global cloud services.

The dilemma is clear: Türkiye wants to strengthen control without isolating itself. It is a delicate balance—one that defines not just the country’s regulatory posture but also its ability to attract the capital and expertise needed to sustain its digital economy.

While policy debates dominate headlines, the more immediate challenge may lie in something as fundamental as electricity. Türkiye’s power grid capacity is increasingly stretched. Reports suggest that nearly two-thirds of license-free renewable projects applying for grid connection have failed to receive approval, reflecting broader transmission bottlenecks.

Data centers, by their nature, are energy-intensive operations requiring constant cooling and stable supply. In Türkiye, this has already caused delays in new projects and uneven growth across regions as it is not possible to build a data hub without a power hub.

The government’s push for renewables and microgrid projects could eventually ease some of this strain, but for now, power remains a bottleneck for a market otherwise primed for expansion.

Türkiye’s regulatory environment for digital infrastructure is often described as fragmented. Localization requirements differ across sectors, creating uncertainty for companies operating in multiple industries. For instance, while financial institutions face strict domestic hosting obligations, general-purpose cloud users face looser rules.

The Competition Authority is reportedly preparing new regulations aimed at improving interoperability among dominant digital platforms, mirroring similar efforts in the EU. Meanwhile, a Presidential Circular requires public institutions to use domestic cloud and data center providers, in a move intended to strengthen the local ecosystem while protecting the citizens rights.

Still, the absence of a unified digital infrastructure policy leaves many investors cautious. And the lack of dedicated regions by major hyperscalers such as Amazon Web Services, Google Cloud, or Microsoft Azure hints Türkiye’s halfway status that it's connected enough to matter, but not yet indispensable to the global cloud architecture.

Türkiye’s policymakers face a familiar paradox of regulation. The very laws designed to assert control over data may also slow down the growth of the industry itself. Overly rigid localization can deter foreign investment, limit cross-border integration, and constrain access to the most advanced digital services.

But a laissez-faire approach is equally risky. Without robust localization rules, Ankara fears it could lose control over critical data flows and erode its own digital autonomy.

This balancing act—between sovereignty and scalability—isn’t unique to Türkiye. But its geopolitical position as a transit gateway between Europe and Asia adds an extra layer of complexity. The country sits at the heart of regional internet routes, giving it the potential to serve as a data corridor for both continents, provided infrastructure and policy align.

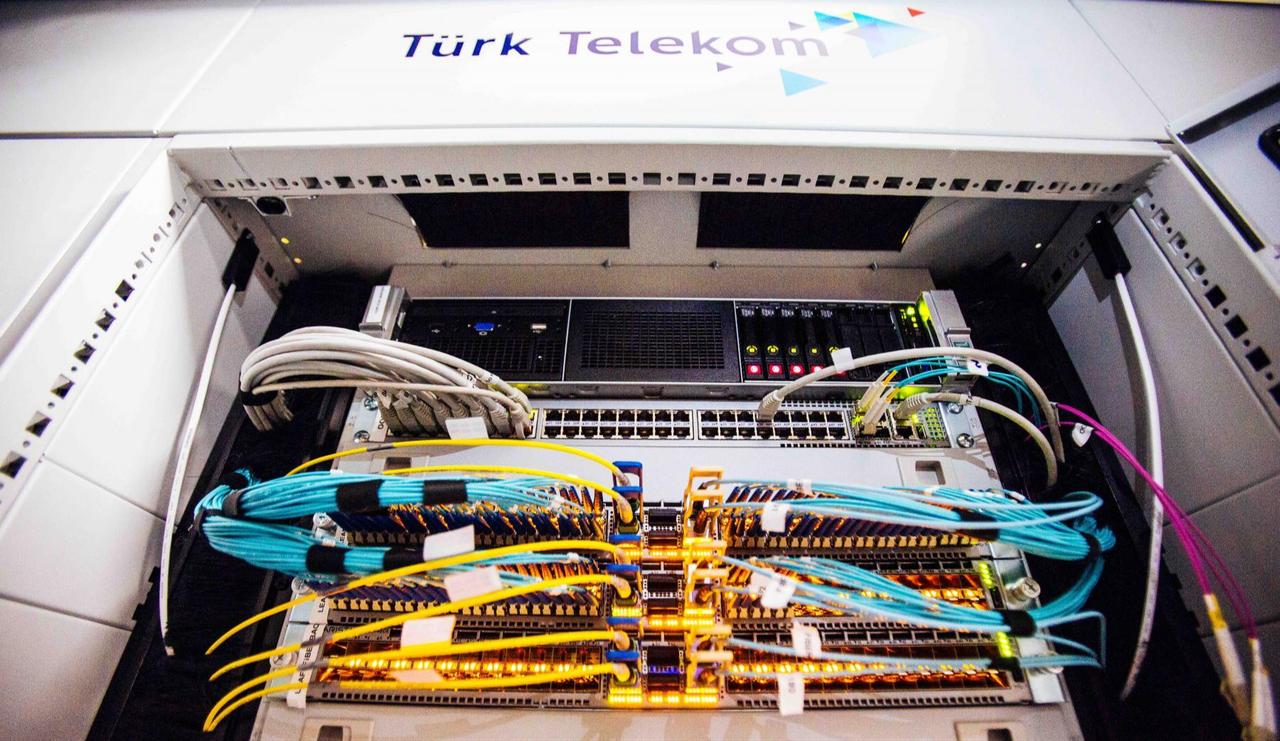

Türkiye’s data center landscape is led by a mix of telecom operators, independent colocation providers, and global entrants. Major players include Turkcell, Turk Telekom, Vodafone, Equinix, Radore, VeriTeknik, NGN Bilgi, Vital Technology, PenDC, and Telehouse. Recently, EdgeConneX and EDGNEX have joined the market, bringing growing international confidence.

Telecom operators hold most of the market’s capacity, giving them leverage in pricing and partnerships as tech giants like Google first negotiate with them. However, competition is intensifying as new entrants bring in different models—particularly colocation and managed services catering to multinational clients seeking localized hosting.

Market composition also reflects technological segmentation. The solutions and services segment—comprising design, management platforms, and operational software—remains the largest. Colocation and enterprise facilities dominate overall, while hyperscale investments are still in their infancy.

Analysts expect edge computing to gain traction with 5G rollout, especially in metropolitan areas.

Several factors are propelling Türkiye’s data center expansion. Digital transformation across finance, e-commerce, and government sectors continues to deepen. Localization mandates guarantee steady domestic demand. And geography remains an advantage as a transit hub for regional internet traffic.

But headwinds persist. Energy grid instability, regulatory ambiguity, and high operating costs weigh on investor sentiment. Global hyperscalers benefit from economies of scale that local firms struggle to match, while unpredictable taxation—such as digital service levies—adds another layer of uncertainty.

The next phase of Türkiye’s data center growth is being defined by strategic partnerships between local tech leaders and Gulf investors. In May 2025, e-commerce giant Trendyol announced a collaboration with UAE-based Castle Investments to build and operate a 48-megawatt data center in Ankara. The project marks one of the largest private-sector digital infrastructure investments in the country and reflects Ankara’s rising status as a data-driven capital.

Around the same time, the UAE’s G42 Group, through its subsidiary Khazna Data Centers, unveiled plans for a major investment aimed at supporting Türkiye’s artificial intelligence ambitions.

Beside those investments, the coming years of Türkiye’s data center ambitions will hinge on three key variables: regulation, energy capacity, and the role of major telecom operators.