Israel’s economy is showing signs of strain as the country continues its military operations in Gaza and southern Lebanon. With thousands of soldiers deployed and airstrikes carried out, the financial burden is mounting.

Israeli officials estimate that the conflict could cost the country up to $60 billion, according to local reports.

Israel’s Finance Minister Bezalel Smotrich addressed the Israeli Parliament, also known as Knesset in September, warning that the ongoing conflict may become the longest and most expensive war in Israel’s history.

The estimated cost ranges between $54 billion and $68 billion.

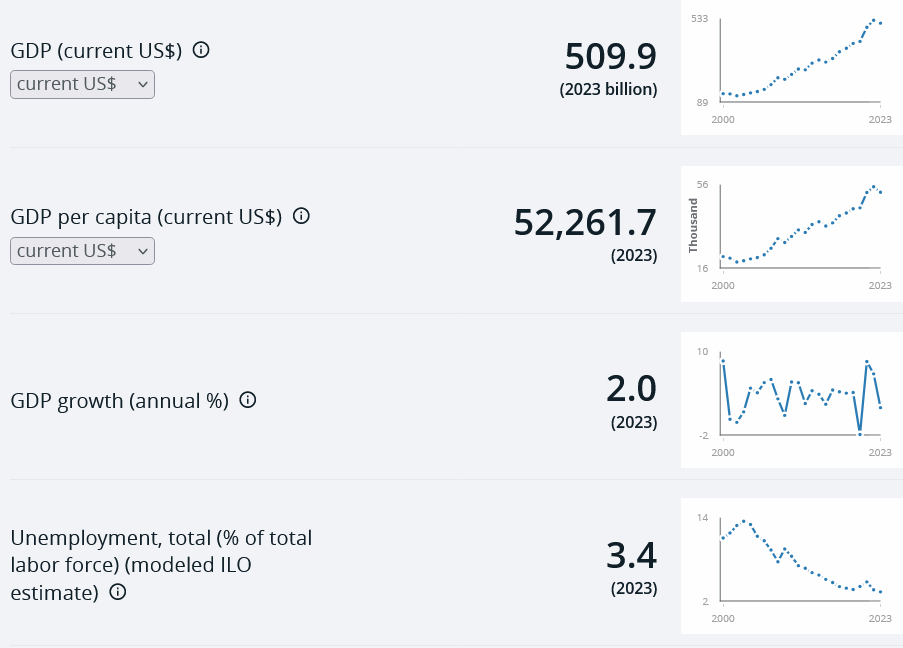

Economists suggest that if the war continues into next year, costs could rise to $93 billion, or approximately one-sixth of Israel’s gross domestic product (GDP).

The Bank of Israel is financing the war by selling government bonds, including "diaspora bonds" purchased by Jewish individuals living outside Israel.

A record $8 billion was raised through bond sales in March. However, foreign interest in these bonds has declined, with only 8.4% held by foreign investors, compared to 14.4% before the war began.

International credit rating agencies Moody’s, Fitch and Standard and Poor’s have downgraded Israel’s government bonds.

Economists such as Dr. Tomer Fadlon from Tel Aviv University suggest that the downgrades reflect concerns about future public spending rather than Israel’s ability to repay its debt.

Former Bank of Israel Governor professor Karnit Flug predicted that Israel may need to implement up to $10 billion in budget cuts and tax increases to control its growing deficit. However, she noted that these measures are likely to face resistance from unions and certain coalition members.

The conflict has also led to labor shortages. Over 350,000 reservists have been called up to serve in the military, and although many have been discharged, 15,000 additional Israeli troops were mobilized for a ground offensive in Lebanon.

Additionally, 220,000 Palestinian workers from Gaza, who typically play a vital role in Israel's construction sector, have been barred from entering the country. Israel has begun replacing these workers with laborers from India, Sri Lanka and Uzbekistan.

Professor Karnit Flug emphasized that while Israel's high-tech sector could fuel future growth, recovery may be slower because of the prolonged nature of the conflict and its impact on a larger portion of the population.

According to the World Bank, Israel’s economy contracted by 0.1% last year and the Bank of Israel recently lowered its 2024 growth forecast to 0.5%.