Over the past 24 hours, leveraged crypto trades have seen liquidations exceeding $500 million, with Ethereum, Bitcoin, and SOL leading the losses.

According to CoinGecko shows that the global cryptocurrency market dropped to around $3.7 trillion on Friday. This pullback comes after four weeks of gains that pushed many cryptocurrencies close to all-time highs. In the last 24 hours, Bitcoin fell 2.4% to about $116,090, Ethereum dipped 0.6% to $3,708, and XRP dropped 3.1% to $3.12.

The slide was mainly due to liquidations in leveraged positions and a drop in investor confidence.

Lookonchain data shows, Galaxy Digital sold around 10,000 BTC worth approximately $1.18 billion, creating serious selling pressure in the crypto market. Additionally, about $370 million worth of USDT was withdrawn from exchanges like OKX, Binance, and Bybit.

Shortly after, Galaxy Digital moved roughly 2,850 BTC valued at $330.44 million to centralized exchanges. This move suggests the company hasn’t finished selling yet, and more market volatility could be on the horizon..

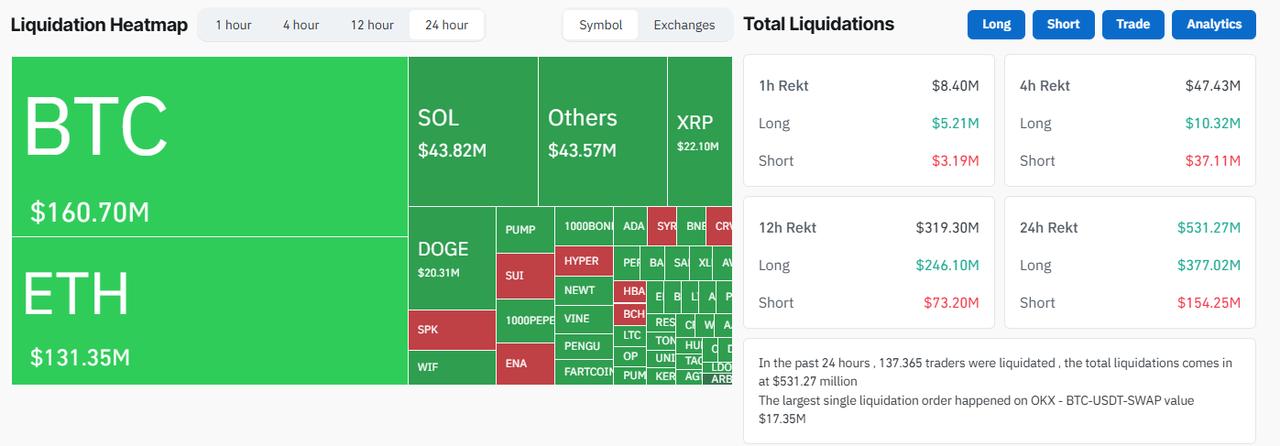

According to CoinGlass, leveraged positions suffered losses exceeding $721 million in the past 24 hours.

Bitcoin saw the largest liquidations, around $160.7 million, followed by Ethereum with $131.3 million, and SOL with around $43 million. The biggest single liquidation order came from OKX’s BTC-USDT-SWAP market, totaling $17.35 million.

Institutional activity continues to play a key role in the current market volatility. While Bitcoin ETF inflows support a long-term bullish trend, rotation strategies from major investment firms like BlackRock and Fidelity are causing short-term price fluctuations.

These factors, combined with global macroeconomic conditions and profit-taking by large investors, have put pressure on the market’s short-term performance. However, despite the declines, retail investor confidence remains surprisingly strong.