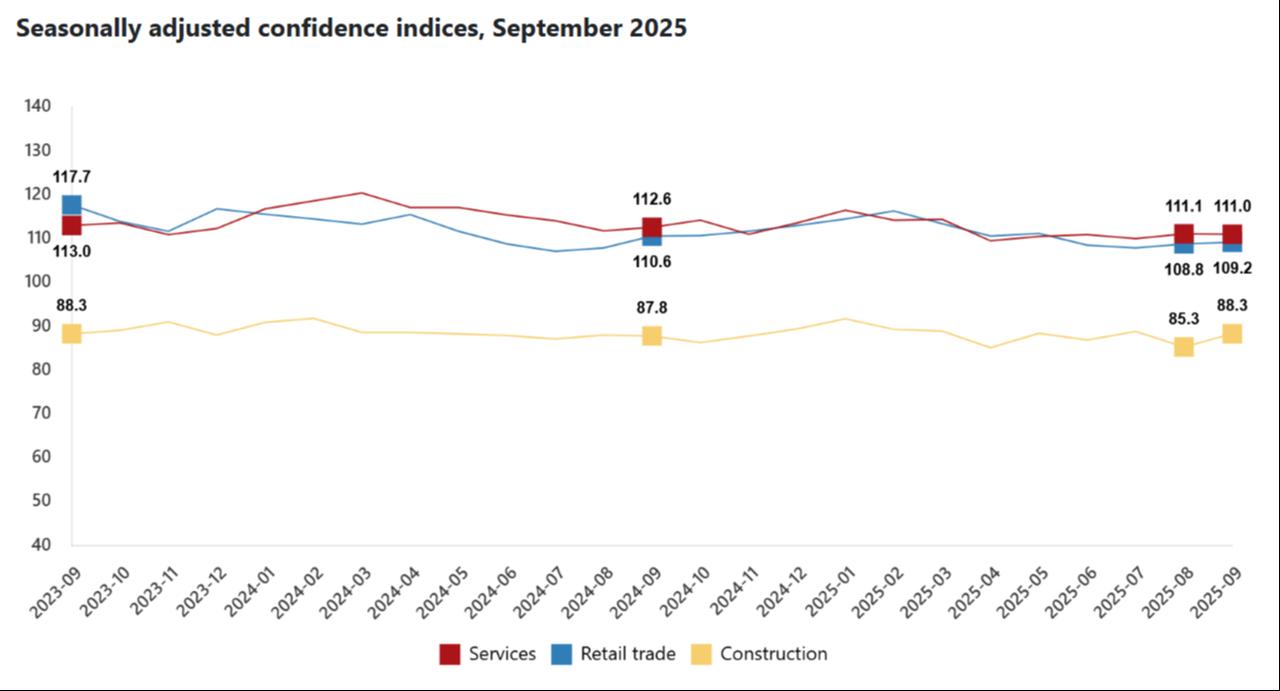

Türkiye’s construction sector showed the strongest monthly recovery in September, with the confidence index climbing 3.6% to 88.3, according to the Turkish Statistical Institute (TurkStat).

Although the figure is still below the neutral 100 level, which separates positive from negative sentiment, the rise suggests that firms expect stronger activity in the coming period.

The improvement was supported by a 0.6% increase in registered orders and a sharp 6.3% rise in employment expectations for the next three months, indicating a more optimistic outlook in a sector that has faced tight financing conditions and high costs in recent years.

Confidence in services, which include tourism, transport, and business support activities, slipped by 0.1% to 111.

While the headline index remains above 100, signaling overall optimism, the details revealed a softer picture.

Assessments of business conditions over the past three months weakened slightly, and expectations for demand in the coming quarter dropped by 0.7%.

At the same time, actual demand during the past three months rose 0.7%, showing that while firms experienced a modest pickup in activity, they remain cautious about the future.

The retail sector posted a 0.4% rise in confidence, reaching 109.2. Despite the headline increase, businesses reported a 1.2% fall in sales volumes over the past three months and a 0.3% decline in expectations for the next three months.

Meanwhile, stock levels grew by 3.5%. Rising inventories often indicate that goods are not selling as quickly as anticipated, which can put pressure on profit margins if demand does not improve in the near term.

The Real Sector Confidence Index, which reflects sentiment among manufacturers, slipped by 0.4 points to 100.2.

Survey responses showed that investment spending and order volumes provided some support, but weaker views on production, exports, and employment weighed on confidence.

Despite the softer mood, capacity utilization in manufacturing—which tracks how much of factories’ available resources are in use—rose to 74% in September, up 0.5 points from August.