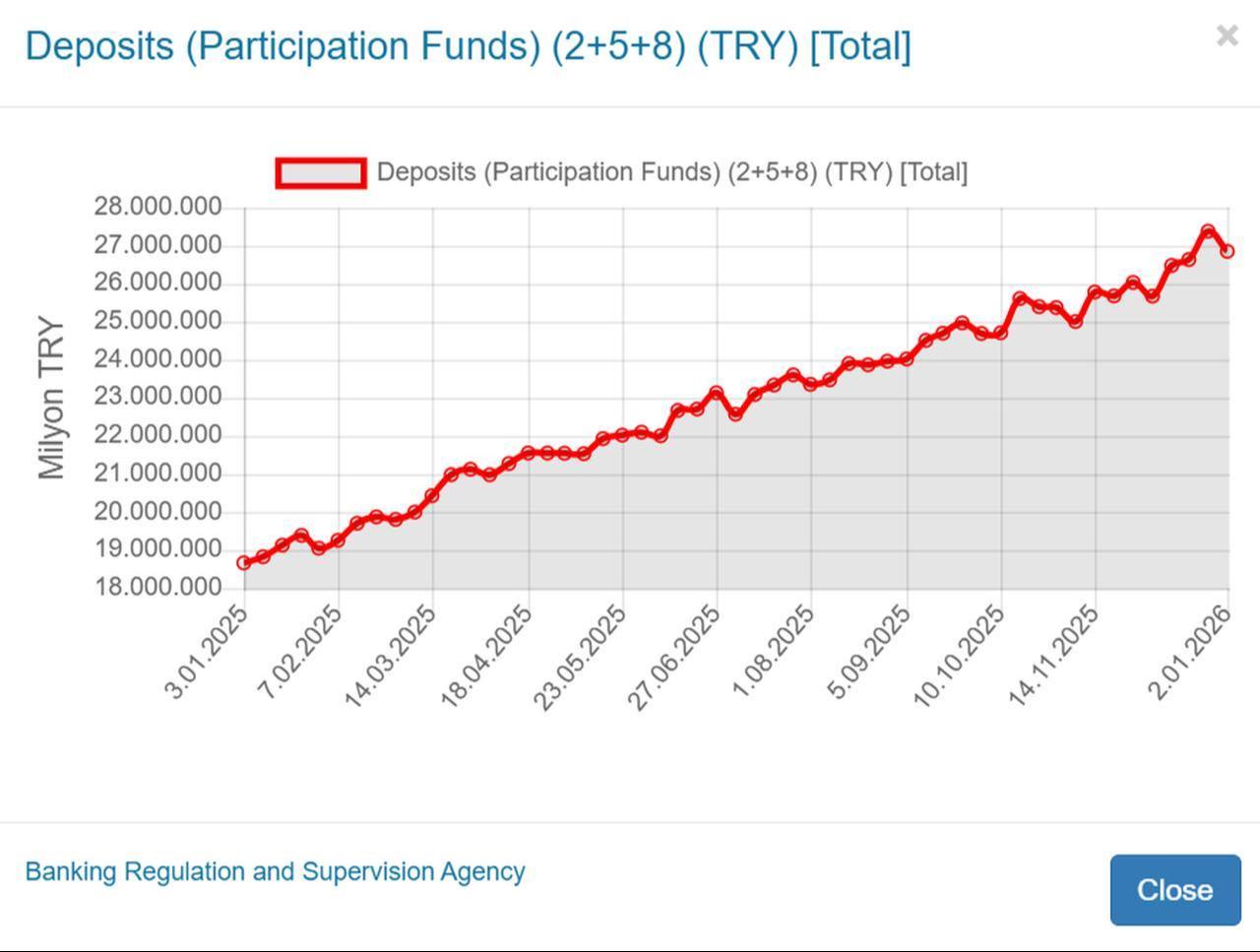

Bank deposits in Türkiye grew by 41% in 2025, reaching ₺26.85 trillion ($678.91 billion), as high interest rates boosted investor appetite, according to figures from the Banking Regulation and Supervision Agency (BRSA), while foreign exchange-protected deposit accounts (KKM) neared full phaseout.

The largest segment, deposits held by individuals, totaled ₺15.39 trillion, making up 57.3% of all deposits, with a year-on-year increase of 36.4%.

Throughout the year, the weighted average interest rate on Turkish lira deposits in domestic banks for maturities up to one year remained above 40%, while annual inflation declined to 30.9%, offering savers a real return of nearly 10%.

The strongest annual growth in percentage terms came from the "official and other institutions" category, where deposits climbed by 68.1% to reach ₺2.08 trillion. Commercial entities increased their holdings by 44.8%, bringing the total to ₺9.38 trillion by year-end.

Deposits covered by the Savings Deposit Insurance Fund (TMSF) also grew by 57.1% in 2025, rising to ₺6.89 trillion.

Under current regulations, the Savings Deposit Insurance Fund (TMSF) guarantees individual depositors’ savings up to a set limit if a bank fails or loses its operating license. In 2025, the insurance ceiling was ₺950,000 per person, per bank, and TMSF raised the coverage limit to ₺1.2 million starting in 2026.

Foreign exchange-protected Turkish lira accounts, meanwhile, approached complete closure in line with the government’s roadmap, as the scheme was viewed as a significant burden on public finances.

The total balance dropped from ₺1.13 trillion in December 2024 to just ₺6.5 million by the end of 2025.

In August, the Central Bank of the Republic of Türkiye (CBRT) halted new account openings under the scheme for all investors, aiming for a complete phaseout by the end of the year, in line with its previously stated objective to unwind the program.