Central Bank of the Republic of Türkiye (CBRT) Governor Fatih Karahan said policymakers see upside risks to inflation over the next two months, but it is expected to follow a downward path through 2026, supported by easing price rigidity in the services sector.

Speaking to international investors at meetings in London and New York on Jan. 13–14, Karahan reaffirmed the central bank’s commitment to maintaining a tight policy stance until price stability is achieved. "Monetary policy stance will be tightened in case of a significant deviation in inflation outlook from the interim targets," Karahan added.

In his presentation, Karahan recalled that inflation in Türkiye closed 2025 at 30.9%, with the disinflation trend becoming more broad-based across consumption categories. Karahan indicated that the services sector played a leading role in this shift, helped by regulatory caps on private school fees and a continued slowdown in rent inflation. These developments contributed to a reduction in structural price stickiness.

However, food inflation showed renewed volatility in the second half of the year and may potentially rise again in the early months of 2026. Despite this, the central bank expects headline inflation to continue easing, supported by improved sentiment and behavioral adjustments among consumers and firms.

CBRT data also showed that many key underlying inflation indicators fell to their lowest levels since September 2021, dropping below 2% on a seasonally adjusted monthly basis.

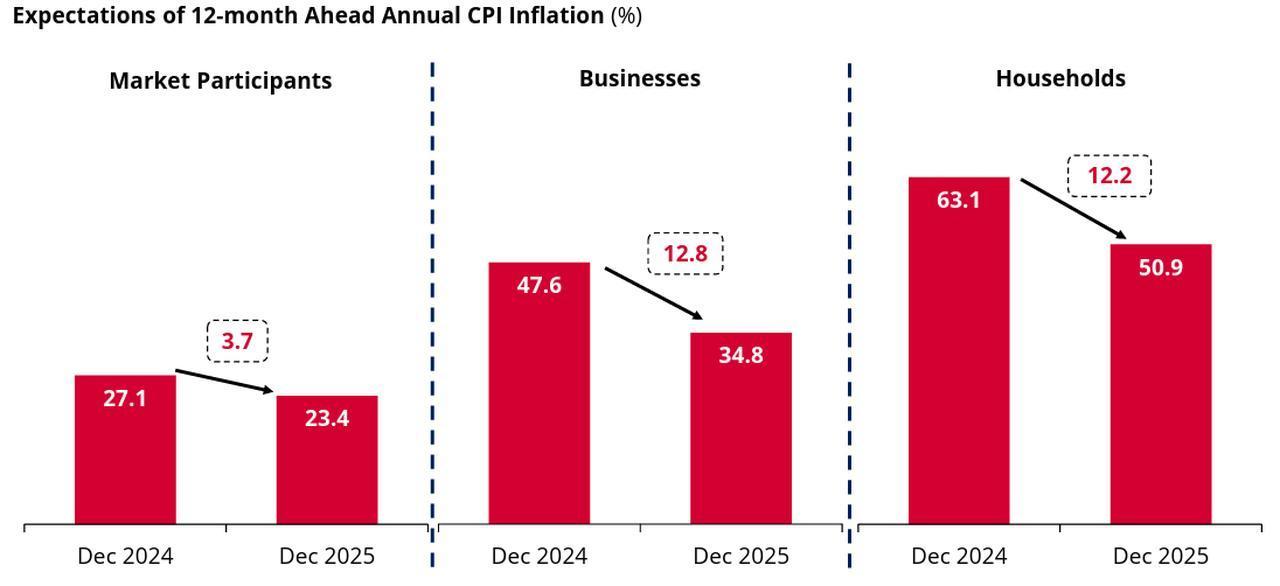

Karahan highlighted the improvement in 12-month ahead inflation forecasts among households and businesses, noting that this shift is helping to anchor more disciplined pricing behavior. Projections fell across all segments between December 2024 and December 2025, with business estimates dropping 12.8 points to 34.8%, household views down 12.2 points to 50.9%, and market participant expectations decreasing by 3.7 points to 23.4%.

Karahan emphasized that exchange rate stability in the latter half of 2025 further supported disinflation through the currency channel, while tighter credit and financing conditions continued to temper domestic demand.

Türkiye’s economy maintained momentum in the third quarter of 2025, growing 1.1% quarter-over-quarter and 3.7% year-over-year, Karahan stressed. However, Karahan also pointed to "more slack under the hood" in the labor market, as capacity utilization fell to 74.5%, the lowest level since the post-coronavirus pandemic recovery period, while labor market slack became more apparent as labor underutilization rose to 29.4%.

A rise in non-performing loans on individual credit cards to 6.4% suggests tighter financial conditions, despite relatively robust credit growth. Meanwhile, households and firms continued to operate with historically low leverage, helping to preserve macroeconomic stability throughout the tightening cycle.

The Turkish central bank has been pursuing an easing cycle since July 2025, cutting the policy rate from 46% to 38%. At the next Monetary Policy Committee (MPC) meeting on Jan. 22, policymakers are expected to deliver a 150-basis-point cut, bringing the rate down to 36.5%.