European stock markets fell sharply Friday, heading for their steepest one-day decline in six weeks, as renewed concerns over the health of U.S. regional banks and persistent trade tensions between Washington and Beijing rattled global investors.

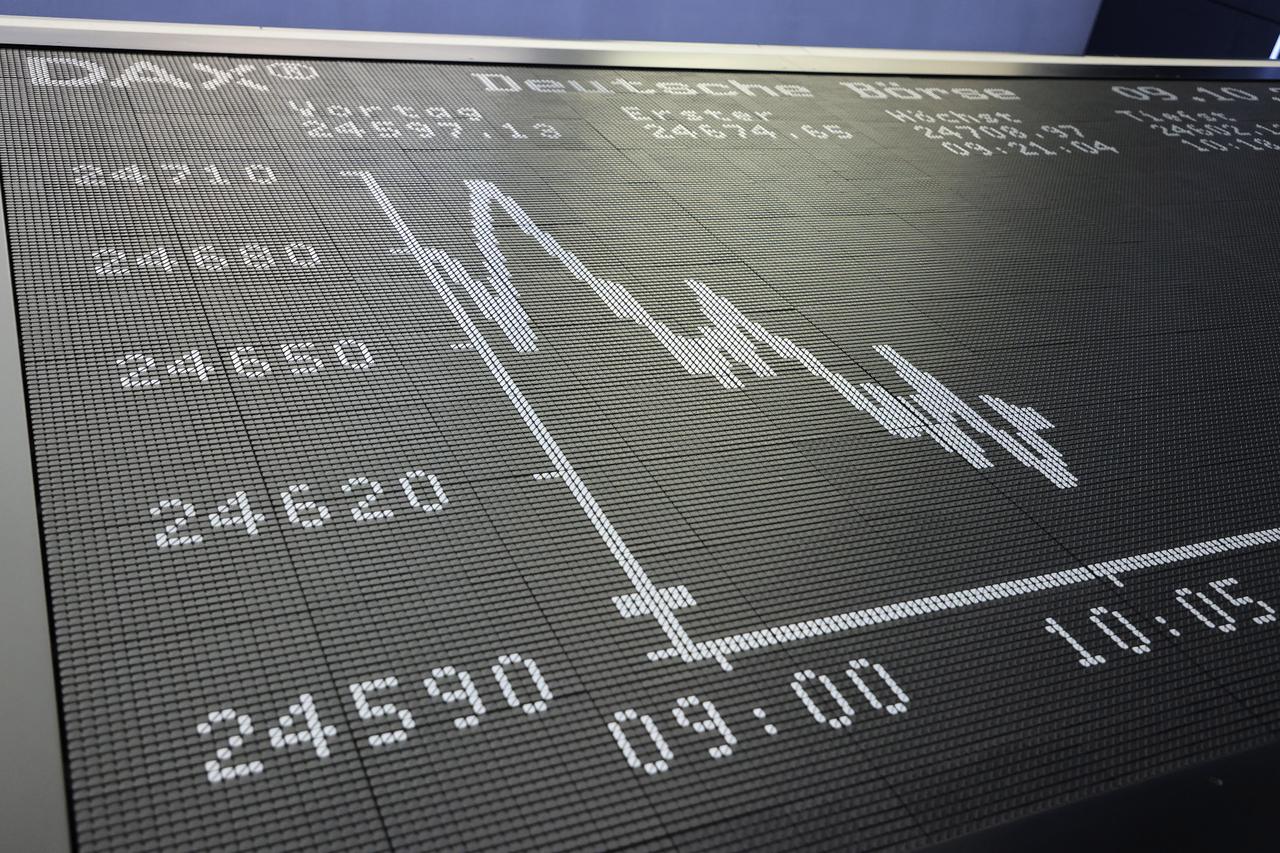

Major European indexes were deep in negative territory, with banking and financial stocks leading the sell-off. Germany’s DAX 40 dropped 2.11% to 23,759.79 points, while the UK’s FTSE 100 lost 1.52% to 9,292.50. France’s CAC 40 slipped 0.9% to 8,115.27, and Italy’s FTSE MIB 30 declined 2% to 41,530.84.

The European banks index (.SX7P) slid 2.4%, weighed down by steep losses in major lenders. Deutsche Bank shares fell 5.6%, Barclays dropped 4.9%, Standard Chartered slid 4.6%, BNP Paribas declined 3.3%, Société Générale lost 3.8%, and ING Groep retreated 3%.

The downturn followed a 6.3% plunge in the U.S. regional banks index (.KRX) on Thursday, after two lenders disclosed fraud in their loan portfolios—Zions Bancorp and Western Alliance—deepening fears of hidden credit stress in the American financial system.

Investor sentiment was further dampened by the ongoing U.S. government shutdown, which continues to cloud global economic forecasts amid budget disputes in Washington.

Among other notable movers, Danish pharmaceutical giant Novo Nordisk fell 4.6% after U.S. President Donald Trump said the price of its best-selling weight-loss drug would be reduced and that negotiations over the cuts would be “swift.”

Spain’s BBVA, meanwhile, jumped 7% after its failed €16.32 billion ($19.07 billion) hostile takeover bid for rival Sabadell. BBVA said it would immediately resume shareholder remuneration following the decision.

The sell-off in banking and financial stocks sent shockwaves across risk assets. The VIX index, known as Wall Street’s “fear gauge,” climbed to 25.31, its highest level in nearly six months, signaling growing unease among investors.

Market analysts said the heightened volatility and cross-Atlantic banking concerns could continue to pressure European equities in the short term, particularly if no resolution emerges to the U.S. government shutdown or trade tensions with China.