One of the three major international credit rating agencies, Fitch, projects that inflation will ease to 28% by the end of 2025, while gross domestic product (GDP) is expected to grow by 3.5%, in line with the government’s Medium-Term Program estimates.

In its latest report on Eastern European economies, Fitch estimates that Türkiye’s inflation will further ease to 21% by the end of 2026, with economic growth remaining at 3.5%, while 4.2% growth is projected for 2027.

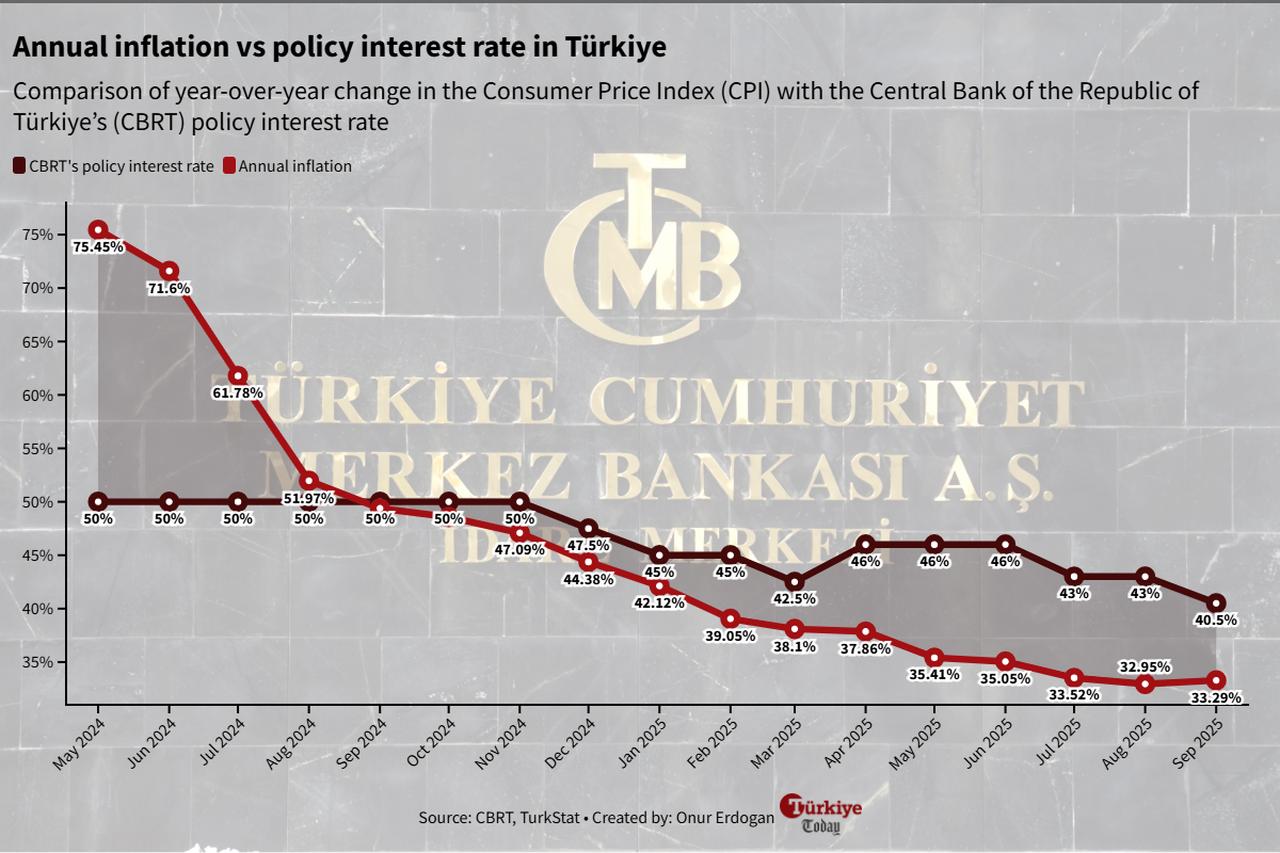

As of the latest data, Türkiye’s inflation rose to 33.29% in September, while the year-on-year GDP growth rate was recorded at 4.8% in the second quarter of 2025.

Fitch added that Türkiye’s real interest rate—the policy rate adjusted for inflation—is forecast to fall to around 3% by the end of 2026.

While the agency noted that policy easing could occur before the 2027 general elections, it does not anticipate a return to deeply negative real interest rates, which previously weighed on investor confidence and price stability.

The real interest rate in Türkiye stands around 7% as of September.

The credit rating agency also projected the U.S. dollar to Turkish lira (USD/TRY) exchange rate—currently hovering around 41.84—to be 53 by the end of 2027, implying a continued but gradual depreciation of the lira in line with domestic inflation differentials.

The report highlighted Türkiye’s gross international reserves, which rose to $184 billion at the end of September, and noted improved external balance conditions and steady inflows through tourism, exports, and foreign investment.

Türkiye recorded a $5.5 billion current account surplus in August, the highest on record, while foreign direct investment (FDI) rose to $15.6 billion year-on-year.

Fitch said this improvement underscores the economic board's success in maintaining access to foreign financing amid tighter global conditions.

It added that Türkiye’s economic outlook will depend largely on the government’s ability to sustain monetary discipline, strengthen investor confidence, and navigate external pressures tied to global commodity prices and capital flows.

In its latest credit rating review in July, Fitch affirmed Türkiye’s sovereign rating at "BB negative" with a stable outlook.