Israel’s airstrikes on Iran escalate Middle East tensions, triggering a global safe-haven rally as the euro hits its highest since November 2021, gold tops $3,400, and equities lose momentum on top of existing tariff pressures.

A military campaign targeting Iran’s nuclear program, dubbed “Operation Rising Lion,” was launched early Friday, with Israeli air forces striking multiple nuclear sites and reportedly killing top Iranian military officials, including Islamic Revolutionary Guard Corps (IRGC) Commander Gen. Hossein Salami and Armed Forces Chief Mohammad Bagheri.

At the onset of the conflict, the euro surpassed 1.16 against the U.S. dollar, while gold rose by over 1% as global investors shifted toward safe-haven assets amid fears of a broader regional escalation.

The most pronounced rally was seen in oil futures, which had fallen to their lowest levels since 2021 in April amid U.S. President Donald Trump's tariff blitz. On Friday, both Brent crude and WTI surged over 12%, rising above $74 and $73 per barrel, respectively.

Meanwhile, the world’s largest cryptocurrency, Bitcoin, dropped nearly 3% to the $104,000 level as the conflict dampened risk appetite for volatile assets. As a result, the total market capitalization fell to $2.02 trillion, according to CoinMarketCap.

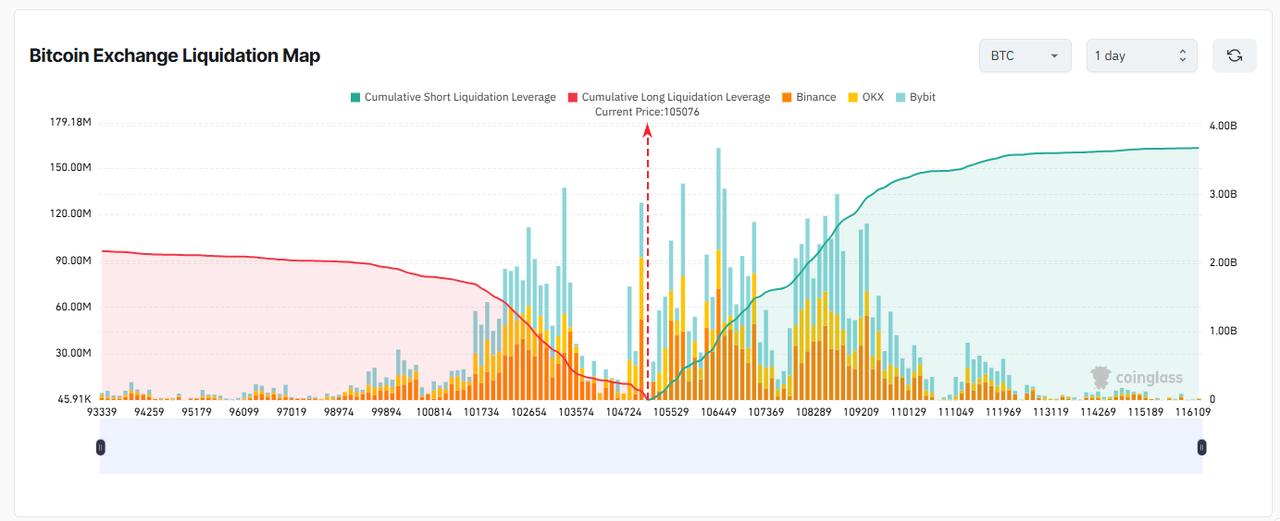

According to Coinglass’s futures liquidation map, the recent drop toward the $104,000 level triggered elevated liquidation risk for long positions. This suggests that many traders who had bet on rising prices faced increasing chances of forced liquidations, reflecting pressure on leveraged long exposure.

At the same time, the sharp rise in cumulative short liquidation leverage signals increased short positions, with liquidation risk above the $122,000 level exceeding $15 billion, reflecting high short interest.

In response to mounting headwinds, major Asian stock markets mediately lowered, with Japan’s Nikkei 225 falling 0.8%, South Korea’s KOSPI down 0.8%, and Hong Kong’s Hang Seng slipping 0.6%.

China’s Shanghai Composite Index and the Shanghai Shenzhen CSI 300 were both trading 0.7% lower. Australia’s S&P/ASX 200 fell 0.4%, while Singapore’s Straits Times Index declined 0.5%. India’s Nifty 50 slipped 0.5%, and Indonesia’s Jakarta Stock Exchange Composite Index lost 0.6%.

However, Borsa Istanbul has taken the biggest hit among major indices so far, with the benchmark BIST 100 plunging as much as 4.7% before paring losses to 3.5%. Analysts attribute the sharper reaction in Turkish markets to the country’s geographic and economic proximity to the Middle East, its dependence on imported energy, and heightened sensitivity to geopolitical risks.