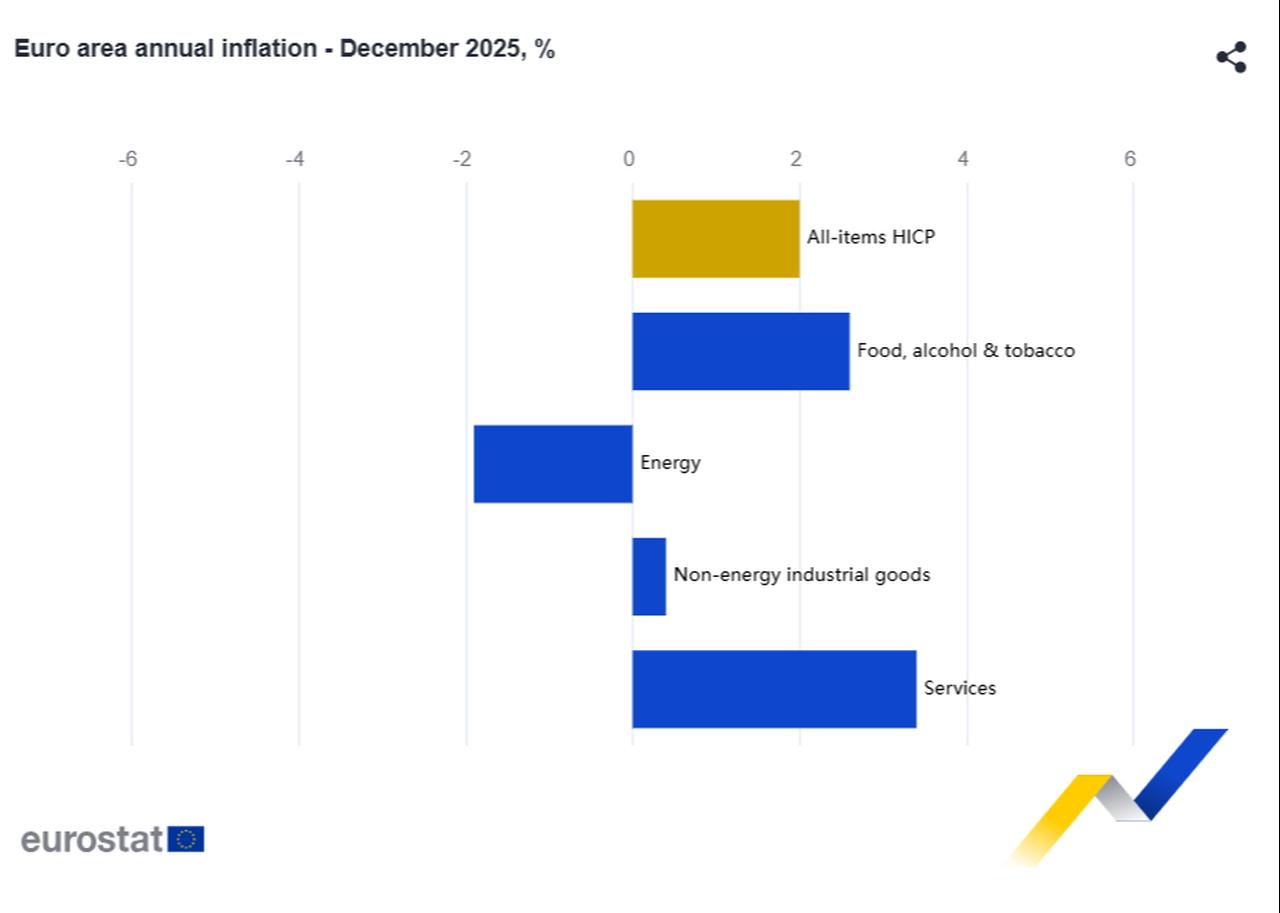

Annual inflation in the Eurozone eased to 2.0% in December, matching the European Central Bank’s (ECB) target, as a sharper drop in energy costs helped curb overall price growth.

Energy prices fell 1.9% year-on-year, compared with a 0.5% decline in November, marking the steepest decrease among all categories.

Core inflation, which excludes volatile items such as energy, food, alcohol, and tobacco, also continued its downward trend, falling to 2.3% in the year to December from 2.4% the previous month. Meanwhile, services inflation, often watched for its persistence, eased slightly to 3.4%, from 3.5% in November.

Among major categories, the annual rate for food, alcohol, and tobacco rose to 2.6% from 2.4%, while non-energy industrial goods inflation slowed to 0.4% from 0.5%.

Monthly inflation rates varied widely across the Eurozone. Ireland and Austria recorded the largest month-on-month increases in consumer prices, each at 0.6%. On the other end, Malta and Estonia posted declines of 0.5% and 0.4%, respectively.

Despite the annual rate falling to the ECB’s target, which could signal a possible easing, European markets showed little reaction to the figures. The euro remained flat against the U.S. dollar, trading near 1.1692, while the pan-European Stoxx 600 index hovered at 605.78 points.

The ECB held its key deposit facility rate at 2.0% for a fourth consecutive time in December, following its last rate cut in June. In its statement, policymakers reiterated their cautious, data-driven approach.

The next monetary policy meeting, where interest rate decisions will be made, is scheduled for Feb. 5.