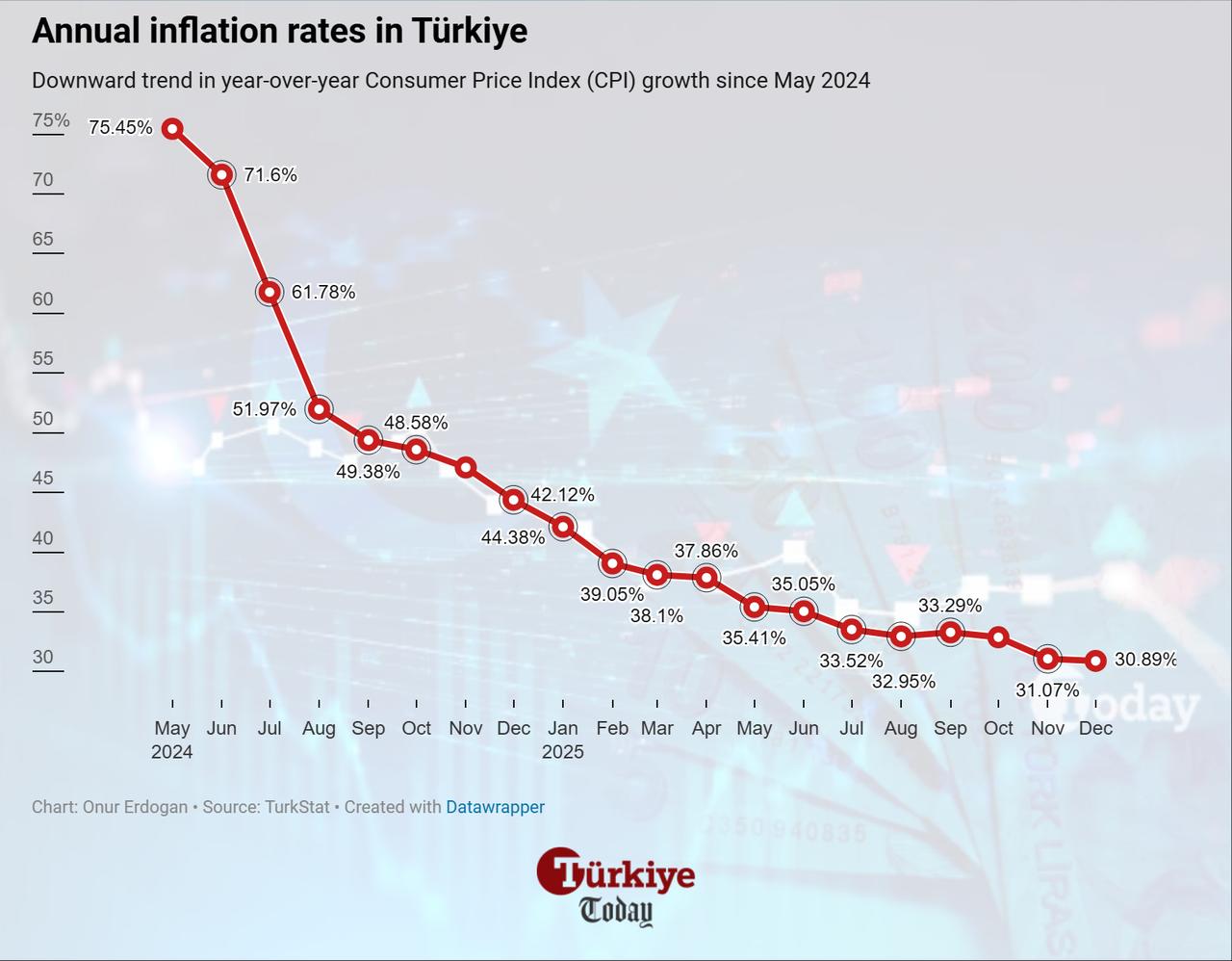

Annual inflation in Türkiye dropped to 30.89% at the end of 2025, with consumer price growth coming in at around 0.89% in December, the Turkish Statistical Institute (TurkStat) reported on Monday.

The figure marks a year-over-year decline of around 13 percentage points in the annual inflation rate, while the monthly reading came in well below market expectations at 1.08%, according to the Central Bank of the Republic of Türkiye's (CBRT) December survey.

According to Turkstat, in the three main expenditure groups with the highest weight, annual prices rose by 28.31% for food and non-alcoholic beverages, 28.44% for transportation, and 49.45% for housing. On a monthly basis, prices increased by 1.99% for food and non-alcoholic beverages, fell by 1.03% for transportation, and rose by 1.39% for housing.

Among the main expenditure groups, annual price growth was led by education at 66.27%, followed by housing at 49.45% and alcoholic beverages and tobacco at 30.80%. On a monthly basis, the largest increases were seen in communications (2.91%), health (1.97%), and furnishings and household equipment (1.56%), while prices in clothing and footwear and transport declined by 2.94% and 1.03%, respectively.

Core inflation, excluding energy, food and non-alcoholic beverages, alcoholic beverages, tobacco, and gold stood at 0.62% month-on-month in December, bringing the annual rate to 31.08%.

Producer prices rose 0.75% in December, bringing the annual increase to 27.67%, TurkStat data showed in another report.

Among sectors, producer prices rose 33.92% in mining, 27.10% in manufacturing, 28.69% in energy supply, and 57.15% in water annually. By industrial group, prices increased 24.28% for intermediate goods, 33.03% for durables, 30.81% for non-durables, 27.06% for energy, and 29.79% for capital goods.

Monthly, prices rose 1.63% in mining, 1.05% in manufacturing, 1.27% in water, and fell 3.00% in energy supply. By group, prices increased 1.61% for intermediate goods, 1.30% for durables, 0.82% for non-durables, 1.98% for capital goods, and dropped 3.63% in energy.

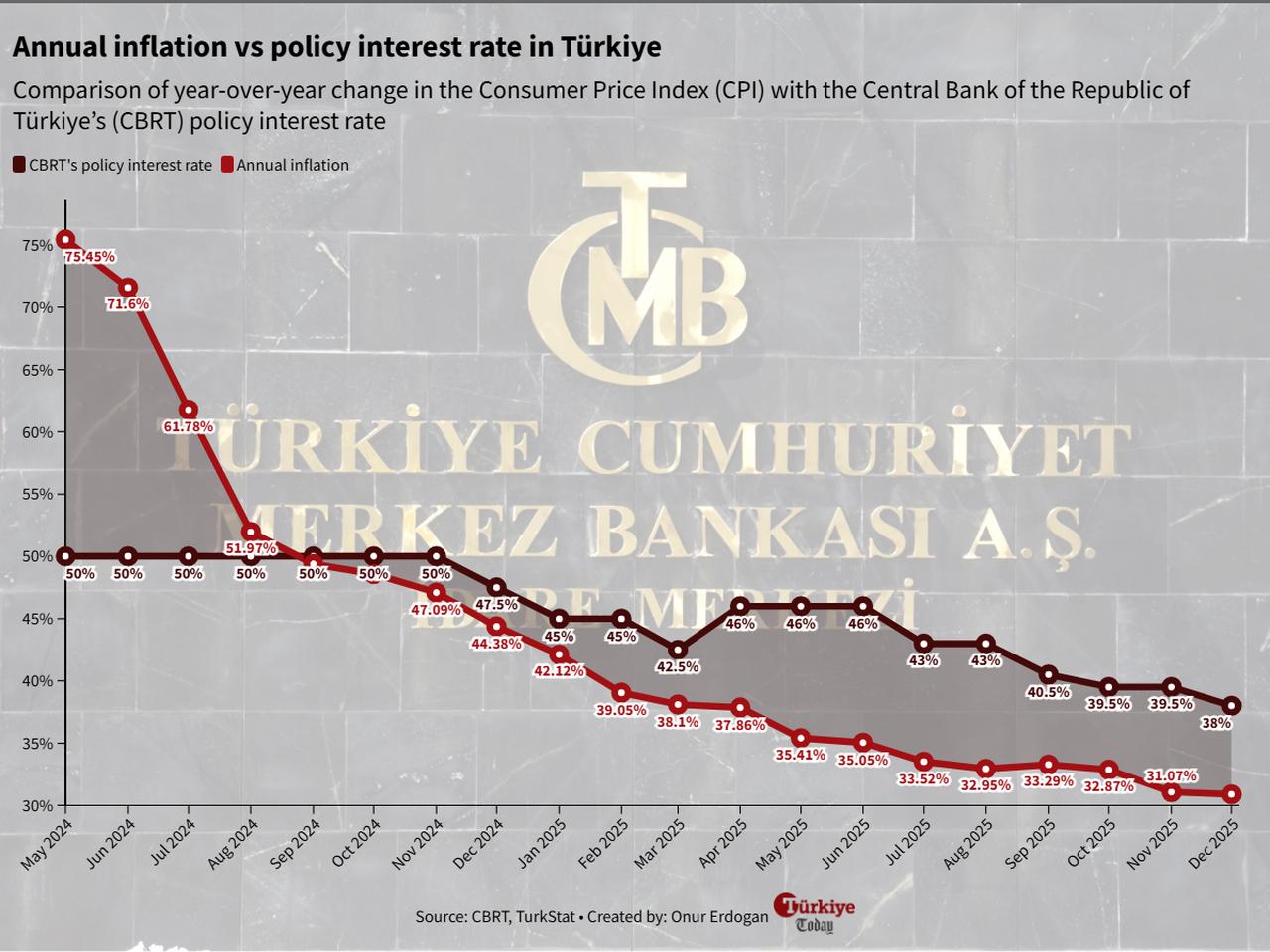

The figures are expected to provide relief ahead of the Central Bank of the Republic of Türkiye’s (CBRT) next policy decision, scheduled for Jan. 22. In the CBRT’s December survey, market participants had forecast a 100 basis point cut; however, the better-than-expected results are now seen as supporting the case for a deeper reduction.

Assessing the December inflation data, Kuveyt Turk Yatirim, the brokerage arm of Kuveyt Turk, said it expects a 150 basis point cut at the next policy meeting, which would lower the rate to 36.5% and represent the fifth consecutive reduction.

"Overall, we believe the inflation data is consistent with our expectations and slightly below the market average, which should lead to a modestly positive market response," the analysts said in a report.

Looking ahead, the brokerage projects that disinflation will continue in 2026, supported by real appreciation in the lira. "We expect year-end inflation to decline to 22.3% and the policy rate to fall to 28% by the end of 2026," the report added.

Vice President Cevdet Yilmaz said the unexpected rise in Türkiye’s inflation was largely driven by weather-related shocks, citing frost and drought events that led to a decline in agricultural output and a temporary spike in food prices in late 2025.

Referring to the Medium-Term Program (MTP), which had forecast 28.5% inflation for the year-end, Yilmaz noted that while the figure came in higher than anticipated, the broader disinflation trend remains intact.

"Despite limited and temporary shocks, the decline in inflation has reached 44.6 percentage points compared to May 2024, thanks to rebalancing in demand, normalization in pricing behavior, and improved expectations," he stated.

Looking ahead, Yilmaz said the government expects inflation to drop below 20% in 2026 as part of a broader effort to break the inertia in pricing dynamics.

"In this context, we aim for inflation to fall below 20% in 2026, to permanently break the stickiness in pricing behavior, and to return to single-digit inflation starting in 2027," he said.

He added that the disinflation process is expected to boost predictability, improve the investment climate, and lead to a lasting rise in social welfare.

Treasury and Finance Minister Mehmet Simsek supported Yilmaz’s comments, noting that supportive global financial conditions and moderate commodity prices in 2026, combined with tight monetary policy, stronger fiscal discipline, price adjustments aligned with inflation targets, improved expectations, and supply-side policies are expected to contribute to disinflation.

"We will continue to implement our program with determination until we achieve our ultimate goal of price stability," Simsek said.

The Medium-Term Program’s inflation path sees the annual rate declining to 16% by the end of 2026.