The U.S. Federal Reserve is widely expected to deliver its first interest rate cut of the year at the conclusion of its two-day policy meeting on Wednesday, as a slowing labor market prompts the central bank to ease borrowing costs.

The move would follow months of pressure from President Donald Trump, who has repeatedly urged the Fed to lower rates.

Since December, the Fed has held its benchmark rate between 4.25% and 4.50% while monitoring the effects of tariffs imposed under Trump’s protectionist trade policy on inflation.

CME Group’s FedWatch Tool shows that markets are now fully pricing in at least a 25-basis-point cut, based on probabilities derived from 30-day federal funds futures prices traded at the Chicago Mercantile Exchange.

The upcoming decision comes at a time of heightened political tension over the central bank’s independence. Trump’s confrontations with the Fed have included a dispute over the cost of renovating its Washington headquarters and attempts to remove senior officials.

In August, the president moved to dismiss Governor Lisa Cook over mortgage fraud allegations. Cook, who was appointed by former President Joe Biden and is the first Black woman to serve on the Fed’s board of governors, has legally challenged the dismissal and continues in her role while the case proceeds.

Another vacancy was created in August when Governor Adriana Kugler resigned. Trump quickly nominated his chief economic adviser, Stephen Miran, to fill the seat.

Miran, who also chairs the White House Council of Economic Advisers, has drawn criticism from Democratic lawmakers for planning to take only a leave of absence from his administration role rather than resign if confirmed. The Republican-controlled Senate is advancing his nomination.

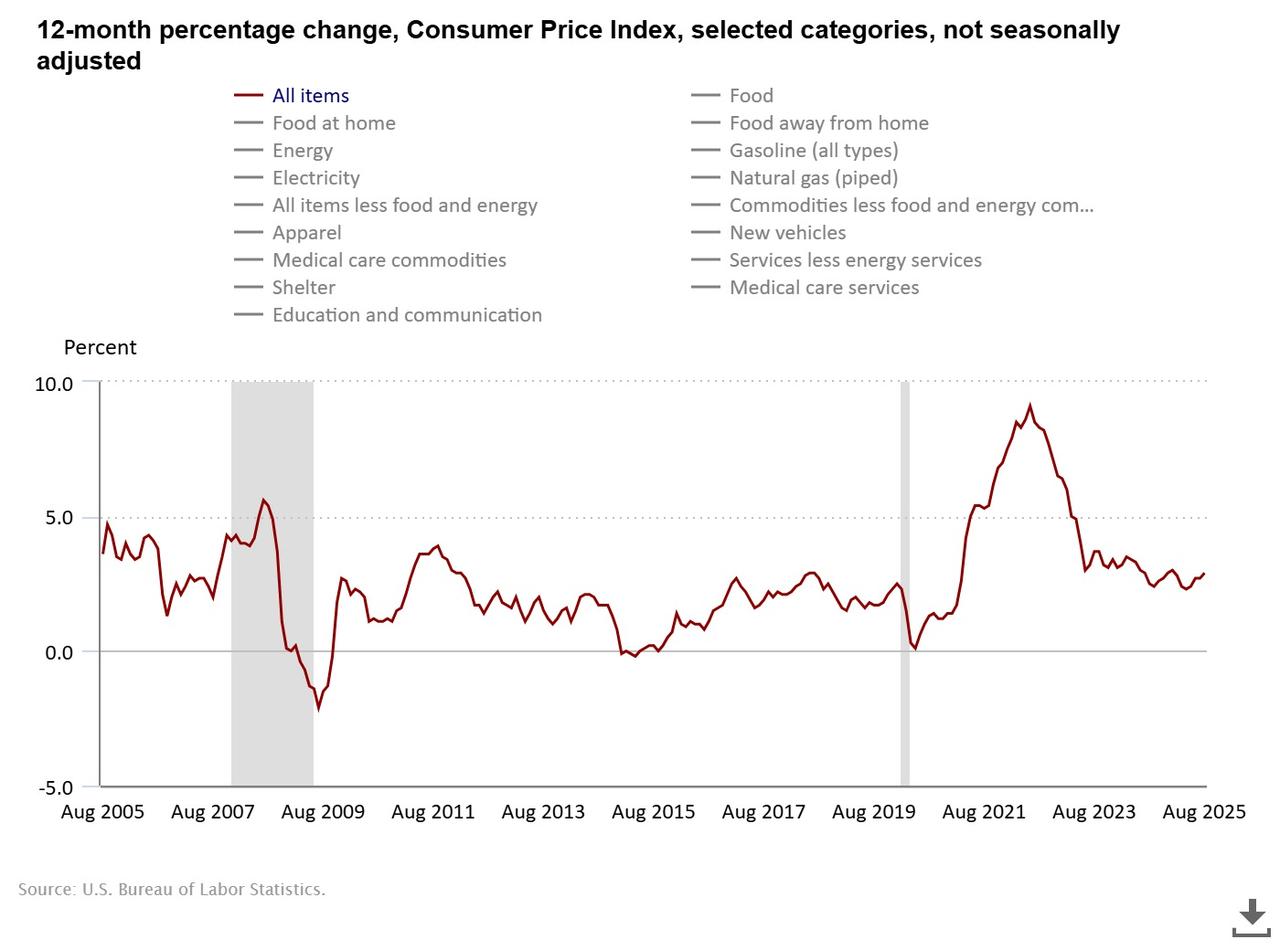

Market attention will also be on Fed Chair Jerome Powell’s remarks about the outlook for inflation and future rate moves. While inflation pressures have eased compared with recent years, consumer price index data released last week showed a rise to 2.9% in August, the fastest pace so far this year.

Economists at Wells Fargo cautioned that "the inflation genie has not quite been put back into the bottle."

They added that labor market conditions are fragile, with job growth nearly stalled, worker sentiment deteriorating, and unemployment edging above estimates of full employment.

"With so little positive momentum in the labor market, recession risks have ticked higher," a Wells Fargo report noted.

Observers are also watching how much internal disagreement emerges within the Federal Open Market Committee (FOMC), the body that sets interest rates. Analysts say there are competing views over whether the Fed should proceed with a 25 basis point cut, consider a larger 50 basis point reduction, or keep rates unchanged.

Josh Lipsky, chair of international economics at the Atlantic Council, said that markets are not used to seeing divisions within the Fed, which has historically voted in near unanimity.

"The markets, I think, are underpricing some of the risks to central bank independence and what it would mean for monetary policy going forward," he added.