U.S. markets rallied Friday after Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole Economic Policy Symposium, where he signaled a potential rate cut at the September meeting while also highlighting higher inflation and weaker August jobs data.

All three major indices rose sharply, with the broad S&P 500 gaining 1.6%, the Dow Jones Industrial Average and the tech-heavy Nasdaq each climbing about 2%.

Powell, who has led the U.S. central bank since 2018, has frequently faced criticism from President Donald Trump over the Fed’s cautious stance on benchmark interest rates. The Federal Reserve cut rates by 25 basis points in December to a range of 4.25%–4.50% and has held them steady for the past seven months.

"Downside risks to employment are rising,” Powell said, warning that these challenges could quickly appear in the form of layoffs. He described the jobs market as “a curious kind of balance that results from a marked slowing in both the supply of and demand for workers."

The U.S. economy added just 73,000 jobs in July, while earlier estimates for May and June were revised down by a combined 258,000, leaving net gains of only 19,000 and 14,000 in those months, respectively.

Concerns over slowing job growth were also reflected in July’s policy meeting, when Fed governors Christopher Waller and Michelle Bowman voted for a rate cut rather than keeping borrowing costs steady.

Powell noted that "the effects of tariffs on consumer prices are now clearly visible" and said their impact was expected to build over the coming months. At the same time, he pledged: "We will not allow a one-time increase in the price level to become an ongoing inflation problem."

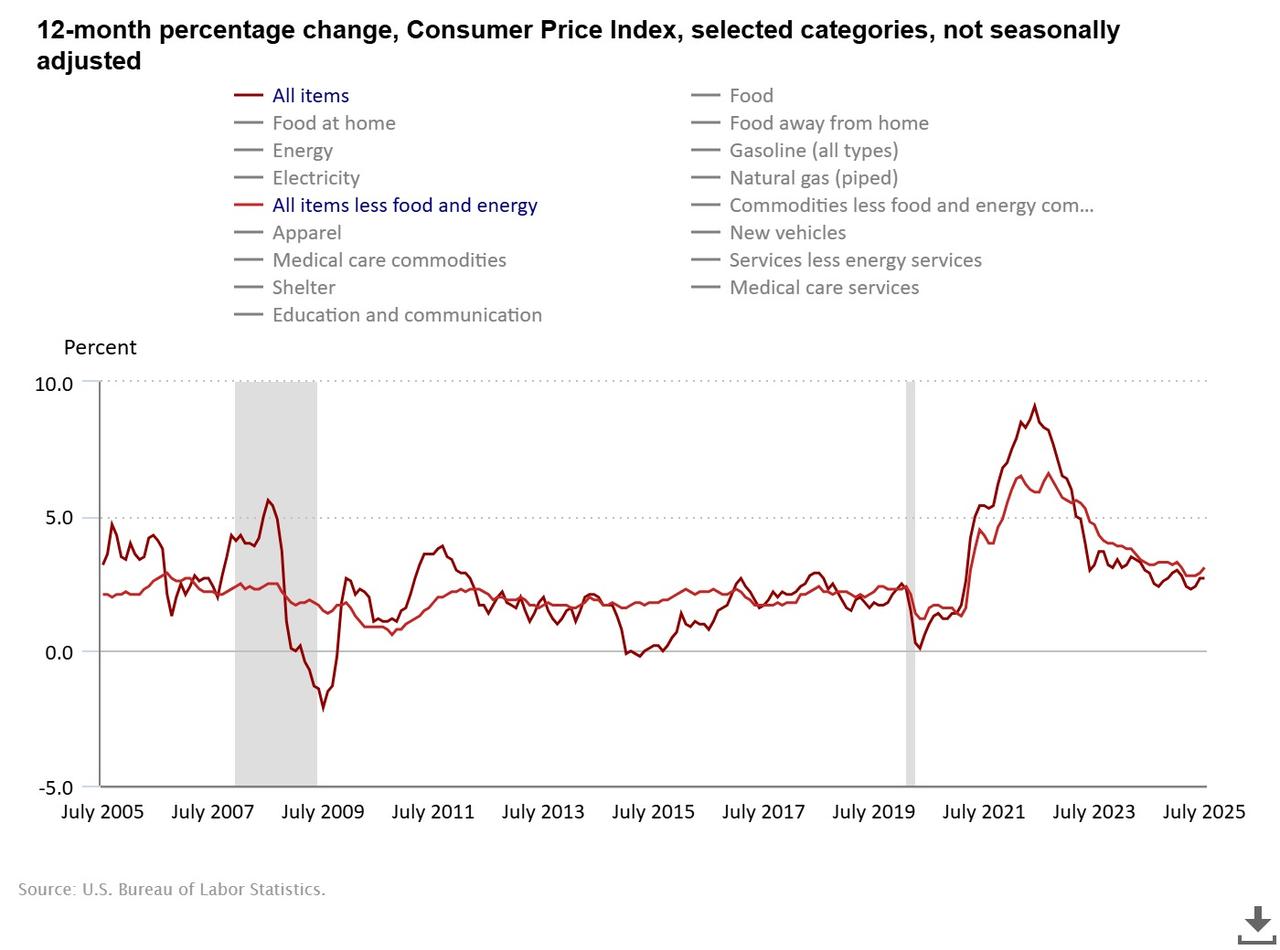

The Fed’s preferred inflation measure increased 2.6% in June from a year earlier, while the core index that strips out food and energy rose 2.8%. Both remain above the central bank’s long-term target of 2%.

In July, the U.S. annual inflation rate held steady at 2.7%, while core inflation rose by 0.3 points to 3.1%, fueling concerns over the impact of Trump’s tariffs, which took effect in early August at updated rates.

"With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance," Powell said, indicating that the Fed could be preparing to lower rates.

According to CME Group’s FedWatch Tool, markets now assign a 91% probability of a rate cut in September, up sharply following Powell’s remarks.

This was Powell’s final address at the Jackson Hole Economic Policy Symposium — an annual gathering of central bankers, economists, and policymakers in Wyoming — with his term as Fed chair set to end in May 2026.