Foreign investors expanded their positions in Türkiye’s financial markets during the week ending September 26, with net purchases totaling $574.5 million.

According to Central Bank of the Republic of Türkiye (CBRT) data, foreigners bought $415.7 million in government bonds, known locally as Government Debt Securities (GDSs), and $158.8 million in equities.

This followed the previous week’s inflow of $586 million, when non-residents acquired $407.6 million in equities and $178 million in bonds.

Despite foreign inflows, Türkiye’s benchmark BIST 100 index fell 1.27% on a weekly basis, closing at 11,366.82 points on September 26. Government bond yields also climbed, with the two-year yield rising to 36.43%, up 0.16 percentage points from the week before.

Istanbul-based brokerage Colendi noted that a total of $1.16 billion in foreign funds entered Türkiye during the second half of September. The firm suggested that inflows could accelerate if September’s inflation data, expected at 2.5% monthly, comes in softer than projected. It also pointed out that expectations for year-end inflation below 30% may further encourage foreign participation in both equities and bonds.

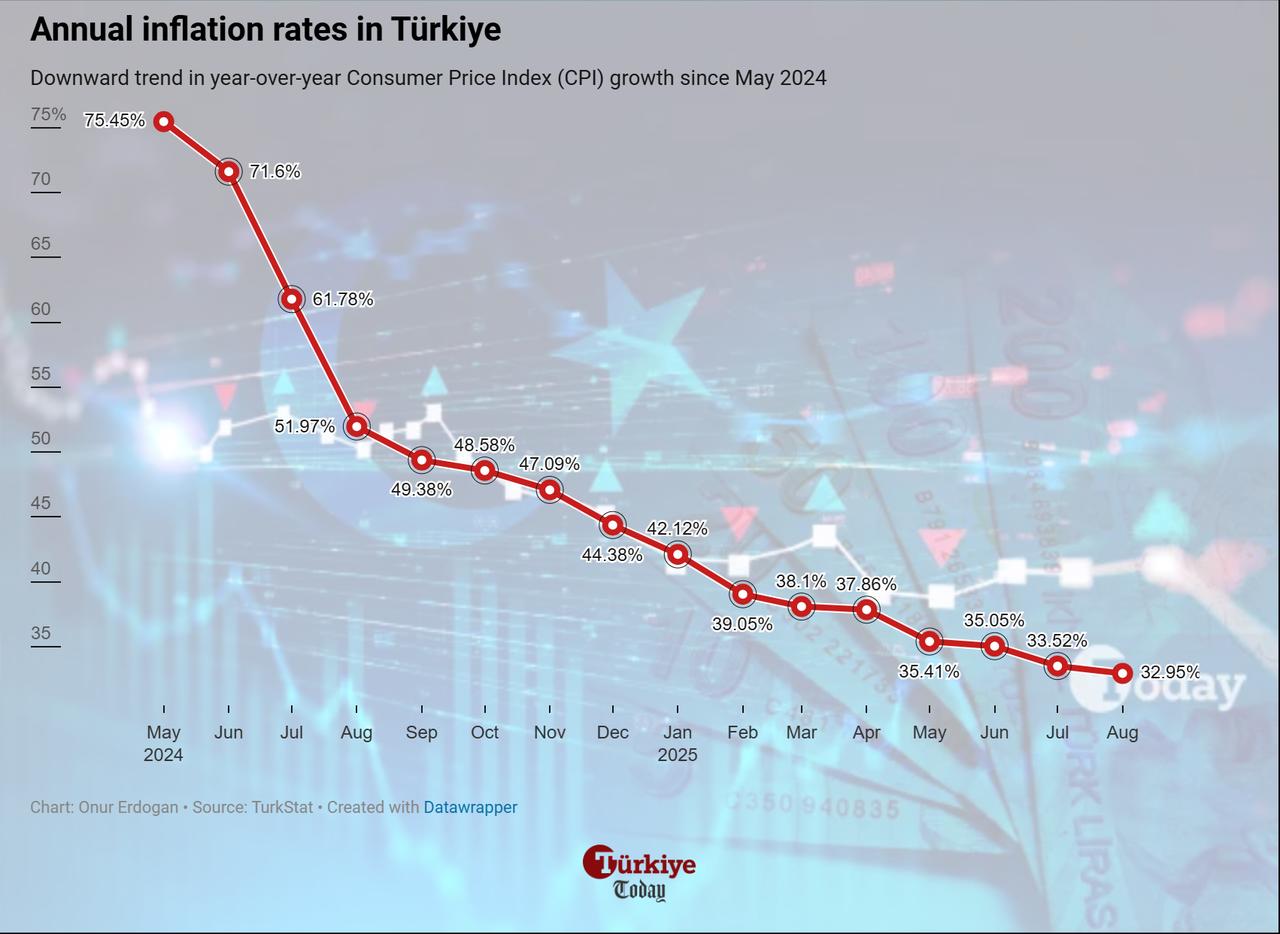

German lender Commerzbank forecast that consumer prices would rise 32.5% year-on-year in September, marking the 15th consecutive month of decline in annual inflation. It added that core inflation—excluding volatile items such as food and energy—was expected to remain elevated at 32.1% on an annual basis and 2.1% on a monthly basis.

The bank noted that the figures would represent a slight easing from August’s 32.9% rate but stressed that price pressures persist.

The Turkish Statistical Institute will release the national inflation figures on Friday, at 10.00 a.m. local time (GMT +3).

Ahead of the national inflation figures, the BIST 100 index closed Thursday at 11,082.63 points, down 1.23% on the day. Trading volume stood at ₺135.8 billion ($3.26 billion), while total market capitalization was ₺10.29 trillion ($247.9 billion). During the session, 27 sub-indexes rose and 73 declined, with financials falling 2.02%, industrials 1.14%, technology 0.76%, and services edging up 0.01%.

The yield on two-year government bonds increased by 0.36 percentage points to 36.13%.

On the currency side, the U.S. dollar traded at ₺41.62, while the euro was at ₺48.81.