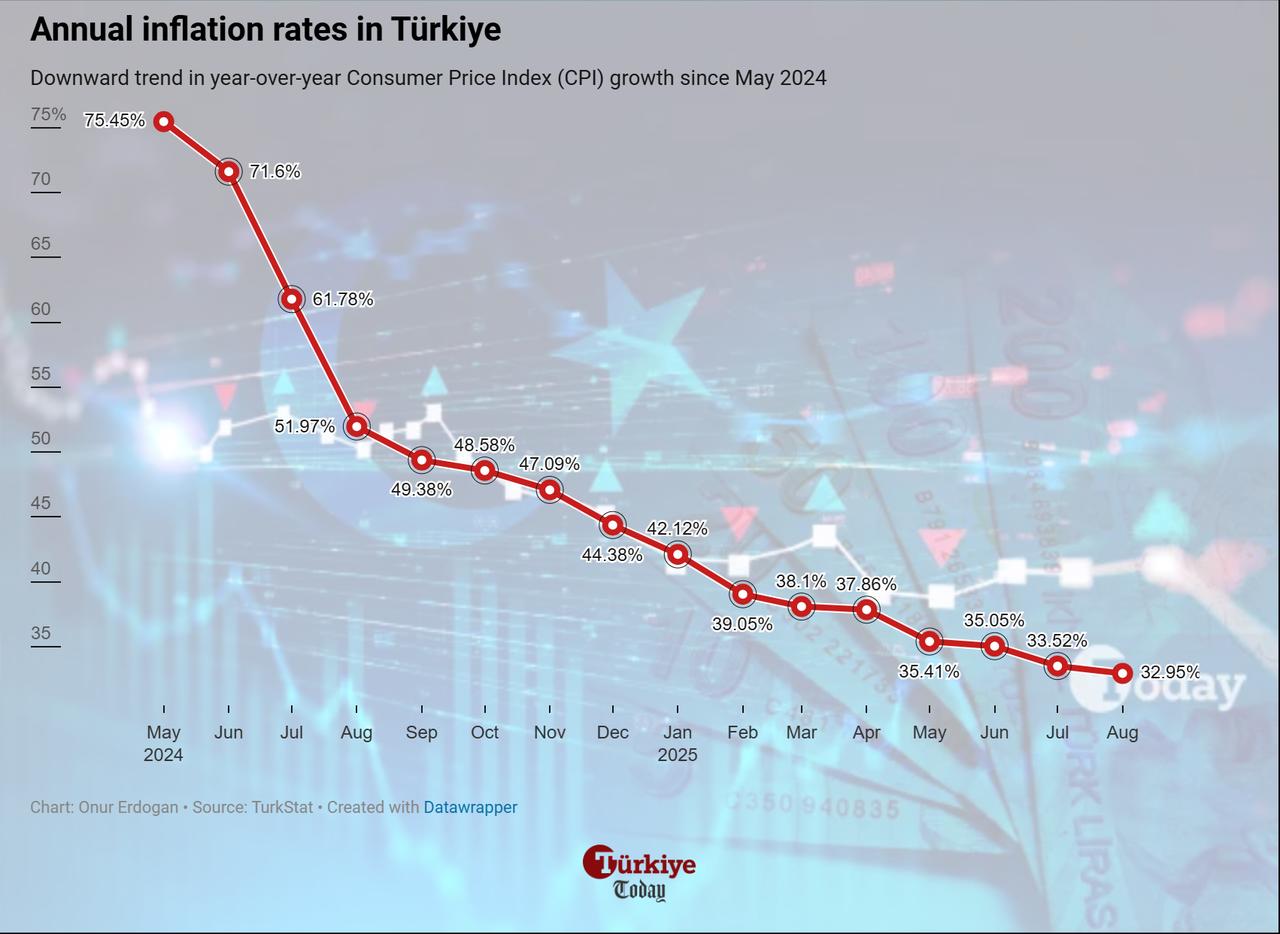

Annual consumer price increases in Türkiye extended their downward trend for the 15th consecutive month in August, retreating to 32.95% ahead of the Turkish central bank’s monetary policy meeting later this month, the Turkish Statistical Institute (TurkStat) reported on Wednesday.

Monthly inflation was recorded at 2.04%, driven mainly by increases in housing and transportation costs, according to the official data.

Core inflation, which excludes energy, food, non-alcoholic beverages, alcoholic beverages, tobacco, and gold, rose 1.74% every month and eased to 33.00% year-on-year.

The steepest annual price increases were recorded in education at 60.91%, housing at 52.37%, and hotels, cafes and restaurants at 33.96%. The lowest annual rises were seen in clothing and footwear at 9.49%, communications at 20.61%, and transport at 24.86%.

On a monthly basis, housing climbed 2.66%, transport 1.55%, and food and non-alcoholic beverages 3.02%. Out of 143 categories tracked by the index, prices fell in 20, remained unchanged in four, and rose in 119.

The data showed that housing and alcoholic beverages made the largest positive contributions to the consumer index, while clothing and footwear registered a 5.82% monthly decline that offset part of the rise.

Producer prices also accelerated in August, with the index rising 2.48% every month compared with 1.73% in July. The annual producer inflation rate increased to 25.16% from 24.19% in the previous month.

The Central Bank of the Republic of Türkiye (CBRT) will hold its next monetary policy meeting on Sept. 11 to decide whether the bank will pursue a rate cut cycle or keep its stance in a more hawkish tone.

According to the Survey of Market Participants conducted by CBRT, market representatives expect another 300-basis-point cut, bringing the policy rate down to 40%.

Türkiye’s better-than-expected second-quarter gross domestic product (GDP) results released this week also boosted expectations, giving the bank more maneuvering room in managing monetary policy.

However, a court decision that annulled the main opposition Republican People’s Party’s 38th Istanbul Congress reignited fears of potential turmoil similar to what happened in March, after then-Istanbul Mayor Ekrem Imamoglu’s arrest as part of a corruption probe.

Following the development, Türkiye’s stock exchange, Borsa Istanbul, closed Tuesday’s session down by 3.6%, with the lowest point at 10,616, marking nearly a 6% loss.

The stock exchange also opened Wednesday’s session in negative territory, with losses approaching 2% at its lowest level of 10,671.

Separately, during a business meeting on Tuesday, Central Bank Governor Fatih Karahan noted that the size of policy steps would be reviewed on a meeting-by-meeting basis with a cautious focus on the inflation outlook.

"In the event of a clear and permanent deterioration in inflation, all monetary policy instruments will be used effectively," he said.