Gold prices surged past $4,200 per ounce on Wednesday, extending a powerful rally fueled by expectations of further Fed rate cuts and growing unease over escalating trade frictions between the U.S. and China.

The precious metal rose by over 1.7% to $4,218.27 at its highest, pushing its year-to-date gains to roughly 60%. Silver also climbed 2.54% to $52.70 per ounce, following last week’s record high of $53.20.

Other precious metals tracked gold’s upward trajectory, with both platinum and palladium gaining 2% to $1,678.15 and $1,596.48, respectively.

The rally came as Federal Reserve Chair Jerome Powell signaled on Tuesday that the central bank would continue to assess monetary policy on a "meeting-by-meeting" basis, balancing persistent inflation against a still-weak labor market. Powell acknowledged that the overall economy "may be on a somewhat firmer trajectory than expected," but noted that the job market remains under pressure.

Markets are now pricing in at least two additional 25-basis-point rate cuts by the Fed—one in October and another in December—as investors anticipate a looser policy stance to counter slowing growth following the first rate cut of the year in September, along with fiscal uncertainty linked to the ongoing government shutdown debate. Lower rates are expected to reduce dollar borrowing costs, weaken the currency, and further boost gold’s appeal.

At the same time, remarks from U.S. President Donald Trump deepened trade-related anxiety. Trump said the U.S. was considering severing certain commercial ties with China, including those involving cooking oil imports, after both nations imposed reciprocal port fees on each other earlier in the week.

Regarding the growing appetite for gold, JPMorgan Chase CEO Jamie Dimon said Tuesday that he sees "some logic" in owning the metal, describing its inclusion in a portfolio as "semi-rational."

“I’m not a gold buyer—it costs 4% to own it,” he said, adding that the recent surge is unsurprising and that further upward movement could still be likely. "It could easily go to $5,000, $10,000 in environments like this," Dimon argued.

However, recent forecasts from major global banks show a divided outlook for gold and silver, reflecting continued uncertainty through 2026.

Societe Generale expects gold to climb to $4,271 by end-2025 and $5,000 by 2026, while JPMorgan anticipates a brief pullback to $3,800 before a rebound to $4,390. Bank of America Merrill Lynch projects a slide below $4,000, with $3,750 by 2025 and $3,500 by 2026, whereas Goldman Sachs sees $4,030 this year and a recovery to $4,815 next. Morgan Stanley forecasts around $4,000 at the 2025 year-end.

For silver, JPMorgan foresees $42.20 in 2025 and $46.20 in 2026, while Bank of America expects $40 followed by a rebound toward $45. UBS and Citibank remain the most bullish, projecting prices above $50, with highs of $52 and $55, respectively.

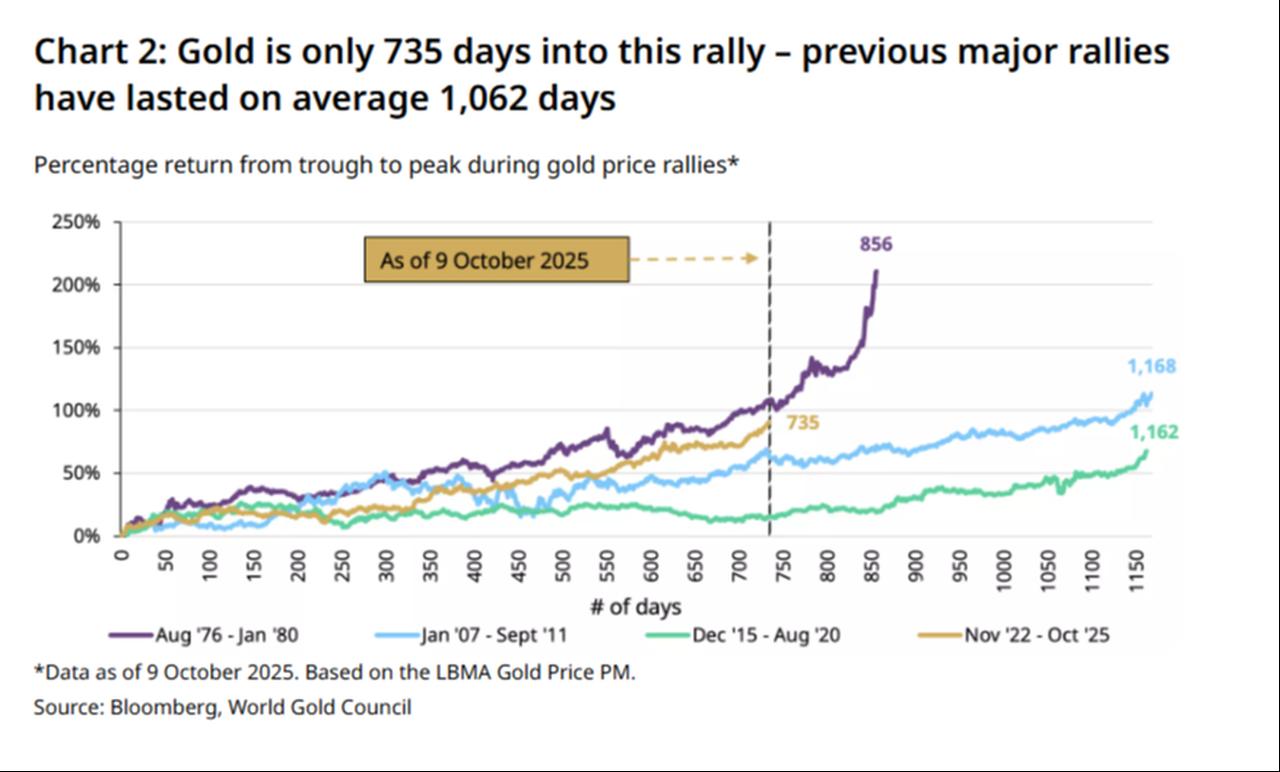

According to the World Gold Council, the current rally remains midway through its typical historical cycle. As of Oct. 9, gold has been rising for 735 days, whereas major past rallies have lasted an average of 1,062 days, suggesting further potential upside if historical patterns persist.