Gold surpassed the $4,400-per-ounce level for the first time on Monday, supported by expectations of further interest rate cuts in the United States and a continued rise in safe-haven demand. Silver also continued its rapid ascent, reaching an all-time high near $70 per ounce.

After reaching an all-time high of $4,409.65, the yellow metal was trading around $4,404.46 as of 6:35 a.m. GMT with a 1.5% daily gain, while silver touched a new record of $69.43 before easing to $69.04 at the same time, reflecting a 2.8% increase on the day.

Other precious metals also advanced, with platinum rising 3.65% to $2,077.61 per ounce, its highest level in more than 17 years, while palladium climbed 4.73% to $1,844.39 per ounce, nearing a three-year high.

Thus, the yellow metal has risen 67% since the start of the year, breaking through the $3,000 and $4,000 milestones and heading toward its strongest annual performance since 1979. Silver, meanwhile, has continued its sharp rally, extending its record with a 138% year-to-date gain, supported by persistent investment inflows and tight supply conditions.

Softer U.S. inflation readings and weaker labor market signals have raised expectations that the Federal Reserve may proceed with two more rate cuts in 2026, despite its cautious tone in the latest Federal Open Market Committee (FOMC) statement.

Lower rates tend to support non-yielding assets such as gold by reducing the opportunity cost of holding them, while a weaker dollar has added further momentum by making bullion more affordable for international buyers.

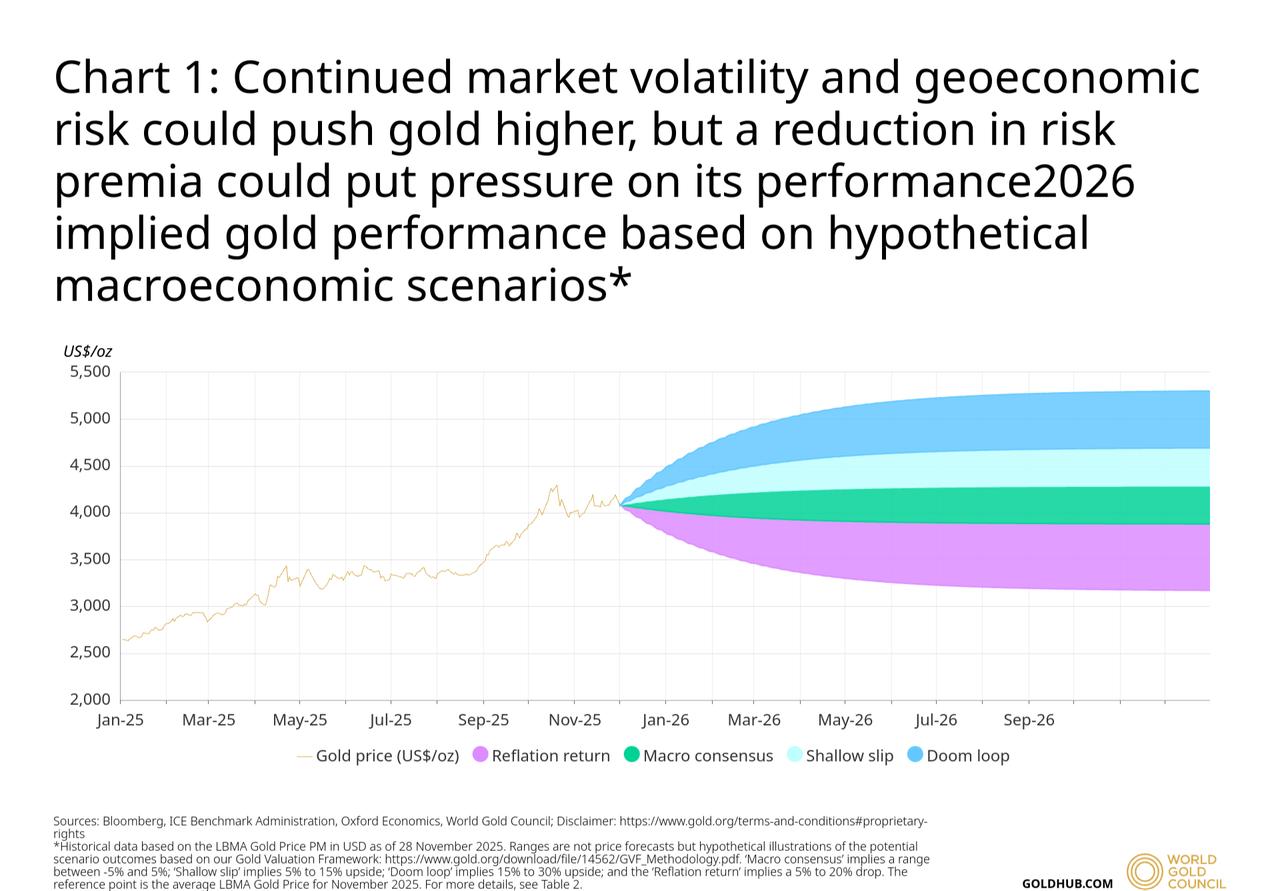

According to a report released by the World Gold Council in early December, gold prices could move in several directions in 2026 depending on macroeconomic conditions. Hypothetical scenarios show that gold prices could remain broadly stable within a minus-5% to plus-5% range under the "macro consensus," rise by 5% to 15% in a "shallow slip," climb by 15% to 30% in a "doom loop," or fall by 5% to 20% under a "reflation return" scenario.

"The combination of lower interest rates and a weaker dollar, paired with heightened risk aversion, would create a continued supportive environment for gold," the report noted, adding that prices could rise 5%–15% in 2026 depending on the depth of the slowdown and the scale of rate cuts.

Last week, U.S.-based JP Morgan also reiterated its bullish outlook, projecting gold to average $5,055 per ounce in the fourth quarter of 2026 and rise toward $5,400 per ounce by the end of 2027.