Global spot gold prices climbed over 1% on Monday, reaching a historic peak of $3,728.43 per ounce as of 11:20 a.m. GMT.

The surge came amid mounting expectations that the U.S. Federal Reserve will continue to reduce interest rates in the coming months.

The Federal Reserve lowered its benchmark policy rate by 25 basis points last week, delivering its first cut since December. The decision came in response to weak U.S. economic activity, particularly sluggish job growth that has fueled rising recession fears.

Investors now expect two additional 25-basis-point reductions this year, in October and December, with probabilities of 92% and 81% respectively, according to the CME FedWatch tool.

Analysts noted that rising unemployment levels, combined with political pressure from U.S. President Donald Trump, have pushed the Fed toward a more accommodative stance.

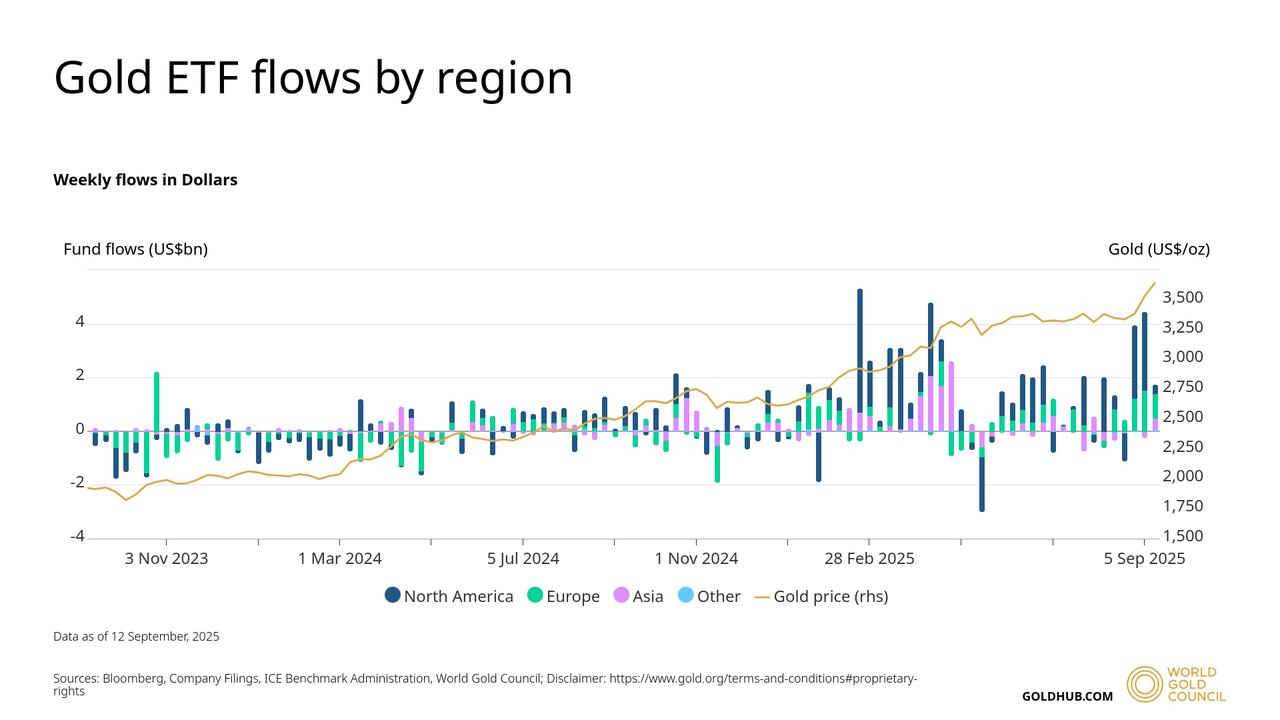

Over the past 12 months, gold prices have surged 40.7%, moving within a range of $2,536.91 to $3,728.43. So far in 2025, bullion has gained more than 42%, driven by global geopolitical tensions, heavy central bank purchases, and easing monetary policies.

Meanwhile, global gold ETF demand in the first two weeks of September has already outpaced the total inflows for August, reaching more than $6 billion, according to World Gold Council data.

Investors are now awaiting the release of the U.S. core personal consumption expenditure (PCE) price index later this week. The index is a key inflation gauge for the Fed, and its outcome could shape the pace of further rate cuts.

The rally extended beyond gold. Silver rose 1.6% to $43.76 per ounce, marking its highest level in more than 14 years.

Platinum increased 1.1% to $1,419.42, while palladium advanced 1.9% to $1,170.75.