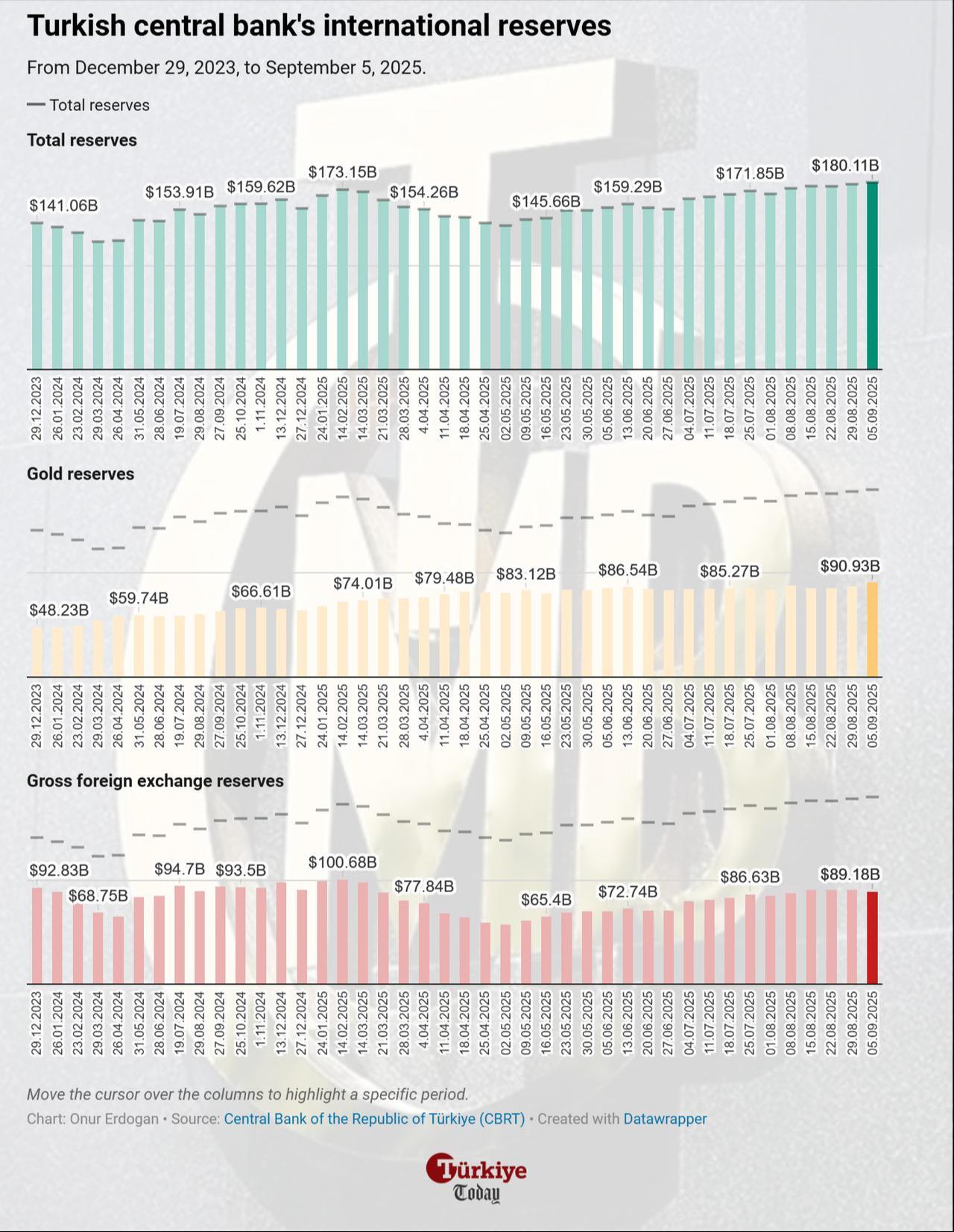

Türkiye’s central bank reserves climbed to a historic peak of $180.1 billion in the week ending September 5, supported by a surge in global gold prices.

Total reserves increased by $1.75 billion compared with the previous week, marking the highest level on record.

According to official data, the Central Bank of the Republic of Türkiye’s (CBRT) gross foreign exchange holdings fell by $1.85 billion, dropping to $89.2 billion. In contrast, the value of gold reserves rose by $3.6 billion during the same week, reaching $90.9 billion.

The sharp rise followed global bullion prices breaking above $3,600 per ounce for the first time in early September.

The CBRT’s net international reserves excluding foreign currency swaps stood at $54.4 billion, down from $56.9 billion the previous week.

Foreign investors sold $523.2 million in Turkish equities last week, widening the reversal of a $1.5 billion net inflow accumulated between June and August 22, after political tensions rose when a court annulled the main opposition Republican People’s Party’s (CHP) Istanbul Congress in 2023.

Non-residents also reduced holdings of government domestic debt securities by $1.02 billion, bringing the total to $14.5 billion.

Investments in other sectors outside general government dropped slightly to $835.4 million.

During the same period, lira-denominated deposits in banks fell by 1.6% to ₺13.81 trillion ($334.44 billion), while foreign currency deposits rose by 3.1% to ₺8.15 trillion. Adjusted for parity effects, domestic residents’ foreign currency deposits increased by $2.83 billion as of September 5.

In the banking sector, consumer loans held by domestic residents rose by 0.6% week-on-week, reaching ₺4.97 trillion.