Türkiye’s economic growth is expected to slow to 2.8% in 2025, down from an estimated 3.2% in the previous year, according to a Reuters poll of 34 economists conducted between July 18 and 23.

The growth projection stands significantly below the government’s target of 4% growth, as outlined in its three-year economic program released in September 2024, Reuters highlighted.

The International Monetary Fund (IMF) raised its 2025 growth forecast for Türkiye from 2.6% to 2.7% in its April World Economic Outlook. Similarly, the World Bank, in its June Global Economic Prospects report, upgraded its estimate by 0.5 percentage points to 3.1%.

Türkiye’s current account deficit is projected to shrink to 1.5% of gross domestic product (GDP) in 2025 and edge up slightly to 1.6% in 2026, according to median estimates in the poll.

It also suggested that the policy rate will fall to 41% by the end of September and to 36% by year-end. Economists expect further cuts through 2026, bringing the policy rate down to 23%.

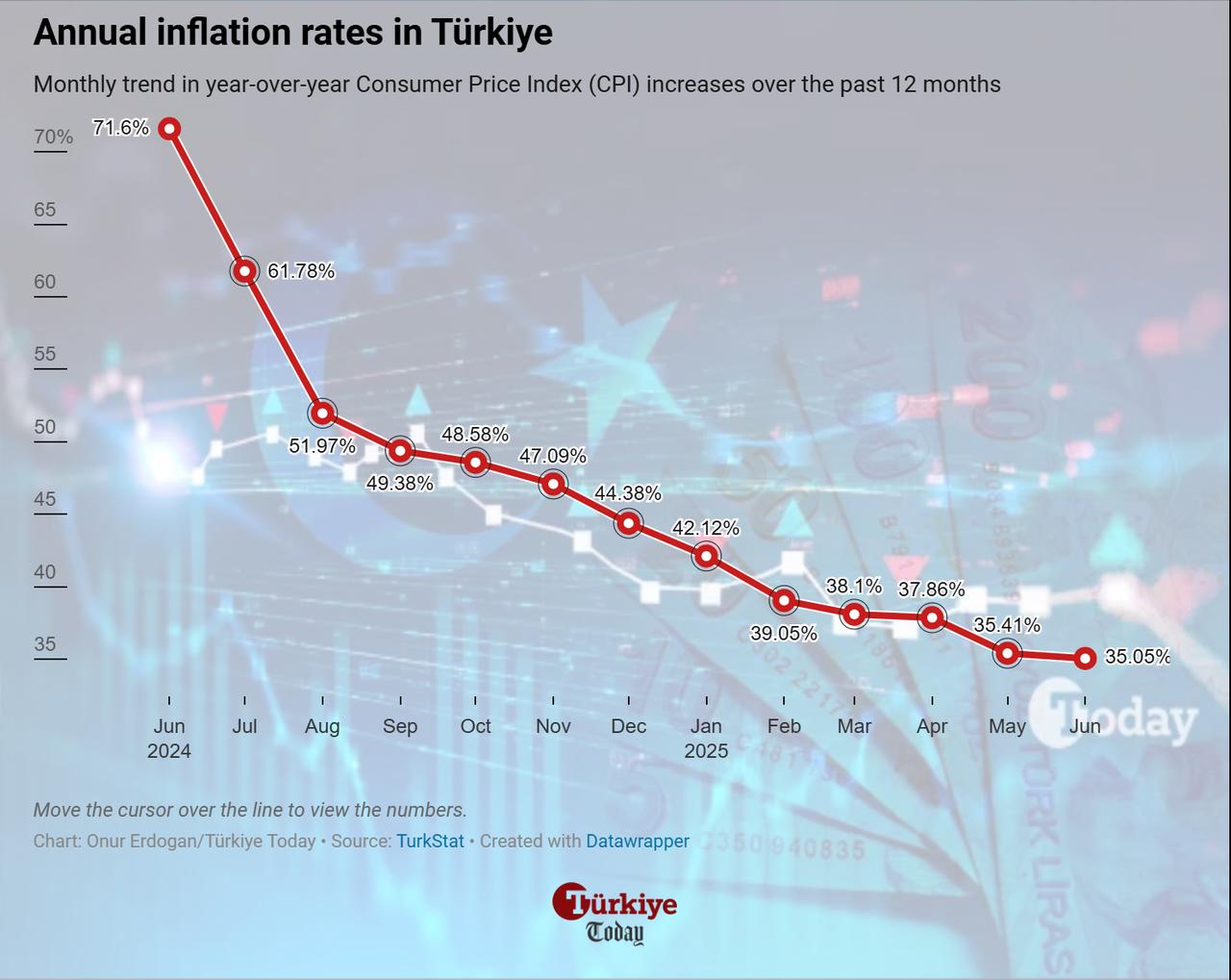

After surging to 75.45% in 2024, Türkiye’s inflation rate eased to 35.05% in June 2025, marking a 13th consecutive month of decline. Despite this decline, inflation is expected to remain well above the central bank’s targets. Median estimates from the Reuters poll indicate inflation will fall to 30% by the end of 2025 and to 21% in 2026.

The Central Bank of the Republic of Türkiye (CBRT) has forecast inflation at 24% for year-end, with an upper tolerance limit of 29%, signaling a more optimistic stance. The persistent gap between these projections underscores concerns about ongoing pricing pressures and the effectiveness of current policy measures.

In April, following market turbulence after the arrest of then-Istanbul mayor Ekrem Imamoglu over a corruption probe, the central bank sharply raised its policy rate by 350 basis points to 46%, reversing an easing cycle that had started in December 2024. The bank also deployed liquidity measures to push overnight funding rates above the policy rate, further tightening monetary conditions.

With inflation showing signs of moderation, economists now expect the central bank to resume monetary easing. A rate cut of at least 250 basis points is anticipated at the upcoming policy meeting on Thursday, based on the central bank’s latest survey of market participants.