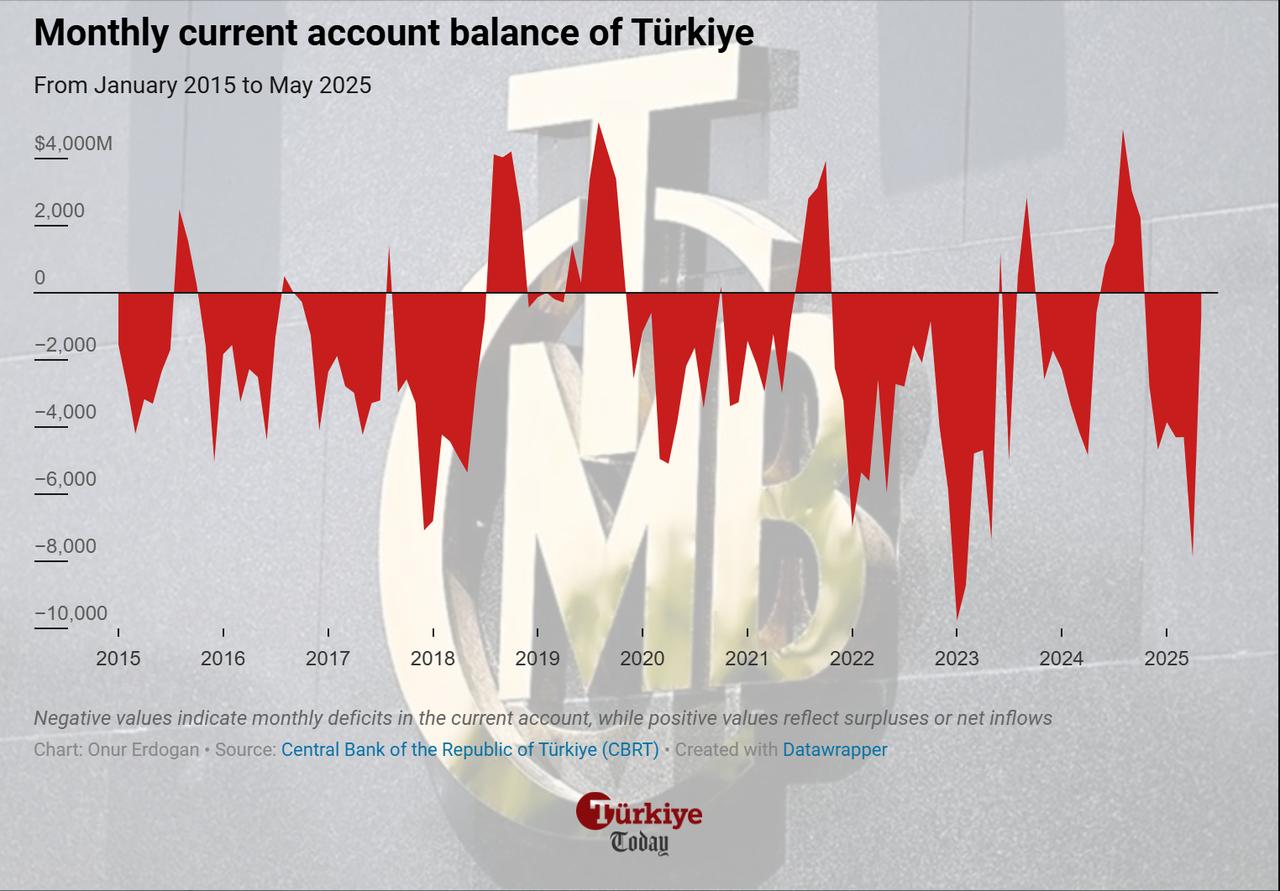

Türkiye's current account deficit dropped sharply to $684 million in May from $7.8 billion in April, driven primarily by a narrowing goods deficit and strong gains in the services sector, the Turkish central bank reported on Friday.

These figures beat Bloomberg's forecast of an $800 million shortfall, indicating a stronger-than-expected external balance performance.

On a 12-month rolling basis, the current account deficit stood at $16 billion in May.

When excluding gold and energy imports, the current account registered a $4.1 billion surplus in May. The goods account saw a deficit of $4.8 billion in May, nearly halving from $9.9 billion in April.

Meanwhile, Türkiye’s services sector continued to support the current account. Net revenues from services reached $5.6 billion, with $4.3 billion coming from travel and $1.9 billion from transportation. These inflows helped offset the goods trade gap and primary income outflows.

Over the same period, the goods balance posted a $61 billion deficit, while services maintained a surplus of $62.2 billion. The primary income account showed a $17.2 billion deficit, and the secondary income account a $68 million deficit.

Türkiye also recorded strong capital inflows in May, led by $2.5 billion in portfolio investments. Non-residents purchased $396 million in equities and $2.6 billion in government domestic debt securities. In international markets, they acquired $916 million in sovereign bonds and $161 million in real sector issuances, while banks saw net sales of $238 million.

Net direct investment inflows totaled $702 million, including $1.4 billion from non-residents, partially offset by a $675 million increase in residents’ external assets. Meanwhile, external borrowing reached $2.1 billion, with inflows from banks, the central government, and other sectors.

The country's official reserves rose by $13.5 billion in May, reversing the sharp $25 billion decline recorded in April.