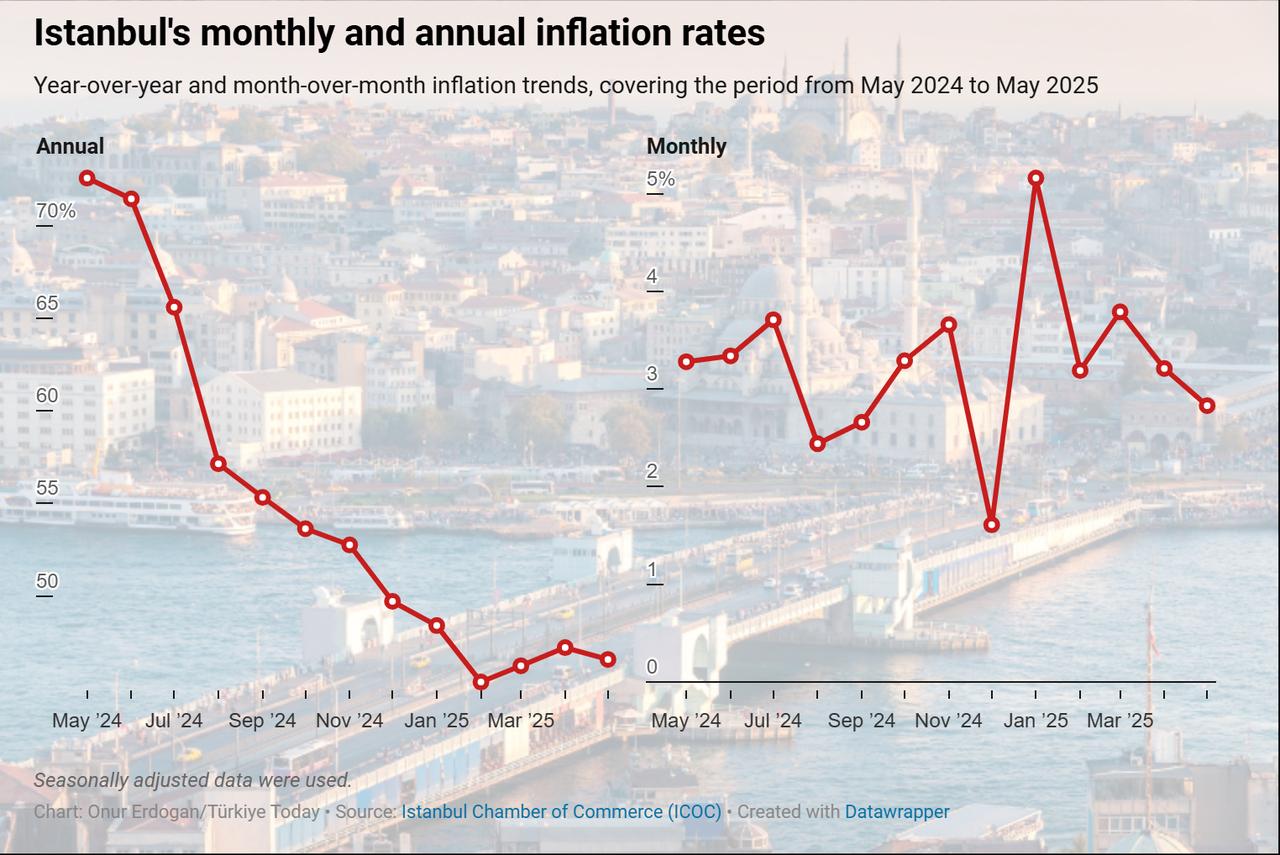

Inflation in Istanbul, Türkiye’s largest city and Europe’s most populous urban center, showed signs of moderation in May, according to data released Monday by the Istanbul Chamber of Commerce (ICOC).

The city's monthly consumer inflation rate eased to 2.83%, down from 3.21% in April. On an annual basis, consumer prices rose by 46.57%, slightly below the 47.21% rate recorded the previous month.

The data show that the food and non-alcoholic beverages category posted the steepest monthly increase at 3.24%, followed by housing costs, which rose by 3.10%.

Spending on recreation and culture increased by 2.52%, while miscellaneous goods and services climbed 2.06%. Home furnishings, restaurants and hotels, and transportation saw monthly increases of 1.79%, 1.7%, and 1.12%, respectively.

Communications costs edged up by 0.88%, healthcare by 0.72%, and clothing and footwear by just 0.15%.

Education was the only group to register a decline, falling by 0.01%, while alcoholic beverages and tobacco prices remained flat.

ICOC attributed the changes largely to seasonal shifts affecting food items, as well as market-driven adjustments in categories such as housing, cultural activities, home goods, and services.

The Wholesale Price Index, which tracks trends in producer and wholesale markets, rose 0.69% in May.

The most significant monthly increase occurred in construction materials, up 2.47%, followed by fuel and energy products at 1.85%. Price rises were also observed in minerals (0.49%), chemicals (0.22%), and food items (0.17%). Unprocessed materials declined by 0.16%, while textiles saw no change.

On an annual average basis, construction materials recorded the sharpest price increase at 81.37%, followed by textiles at 66.97%, chemicals at 40.55%, and food products at 37.55%.

Prices of unprocessed materials rose 32.38%, while fuel and energy products were up 29.85%, and minerals rose 23.29%.

Despite the monthly easing, the data suggest that structural price pressures remain particularly strong in categories sensitive to seasonal dynamics and global commodity trends.