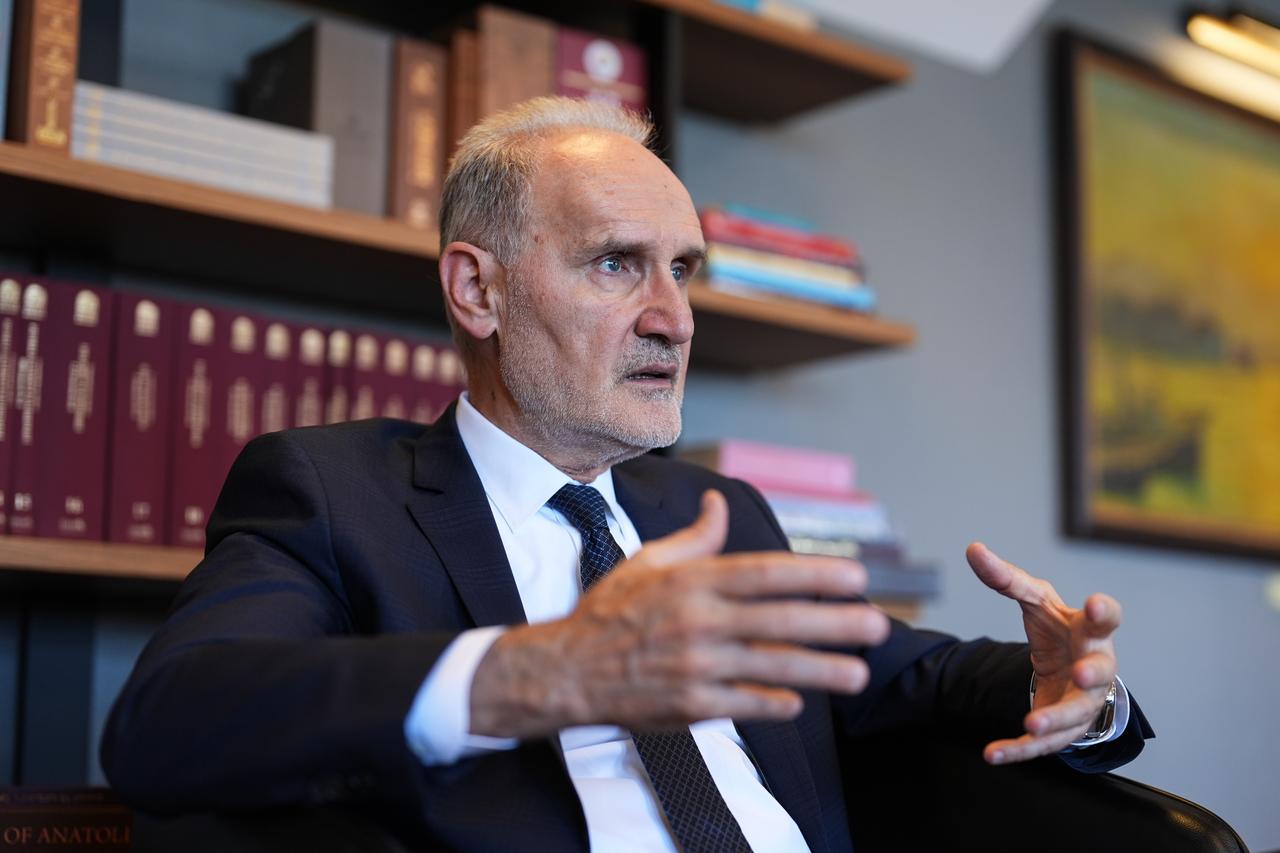

The long-term dominance of the U.S. dollar as the world’s primary reserve currency is being challenged by shifting geopolitical dynamics and growing interest in alternative financial systems, Istanbul Chamber of Commerce (ICOC) Chairman Sekib Avdagic said on Friday.

Speaking at the chamber’s July assembly meeting, Avdagic noted that even close allies of the United States are reevaluating their reliance on the dollar. He cited Saudi Arabia’s consideration of pricing oil exports in Chinese yuan through futures contracts as a notable example of the evolving global financial landscape.

“The dollar’s reserve currency status is increasingly being questioned,” Avdagic said, pointing to shifting geopolitical and geostrategic alignments that have prompted a wider discussion on diversification in global payments and reserves. He described this as an emerging trend among investors, corporations, and governments aiming to reduce their exposure to dollar-based systems.

According to Avdagic, this shift could open strategic opportunities for developing countries to expand the use of their own currencies or adopt regional alternatives. Doing so, he argued, may reduce dependence on U.S. monetary policy while improving access to financing and credit in emerging markets.

Market data appears to reinforce this view, as the U.S. dollar has significantly deteriorated year-to-date, weighed down by President Donald Trump’s protectionist trade policies, which have heightened global trade tensions and accelerated shifts toward alternative assets and currencies.

The U.S. Dollar Index fell more than 11% in the first half of the year, marking its worst first-half performance since 1973, driven in part by protectionist trade measures and rising global uncertainty. The dollar also declined by over 12% against the euro during the same period, sparking debate over whether the euro could emerge as a potential alternative to the dollar in international markets.

Meanwhile, the BRICS bloc—comprising Brazil, Russia, India, China, and South Africa—has ramped up efforts to conduct transactions in non-dollar currencies. Trump publicly criticized the initiative, accusing the bloc of attempting to undermine the U.S. dollar and threatening member states with 100% tariffs.

Addressing Türkiye’s domestic economic outlook, Avdagic expressed cautious optimism over the country’s inflation trajectory, forecasting that annual inflation could drop below 30% by the end of the year, within the range projected by the Central Bank of the Republic of Türkiye.

He added that easing inflation, which dropped to 35.05% in June, and a potential shift to lower interest rates could help alleviate financing challenges faced by businesses, particularly small and medium-sized enterprises (SMEs), and support renewed momentum in production, employment, and exports.

Avdagic emphasized that achieving lasting price stability would be key to restoring broader financial stability and consumer confidence.