Bank lending in Türkiye rose sharply to ₺15.55 trillion ($440.98 billion) in 2024, up 37.7% from ₺11.2 trillion ($380.5 billion) in 2023, despite persistently high interest rates that typically dampen credit demand.

The figures, published by the Banks Association of Türkiye, indicate sustained credit expansion in a tightening monetary environment, even as the policy rate remained at 50% for most of the year, starting in March.

According to the figures, Türkiye's banking sector has maintained consistent growth in loan volumes over the past five years.

The total value of outstanding loans stood at ₺3.4 trillion ($115.6 billion) in 2020, ₺4.7 trillion ($152.8 billion) in 2021, and ₺7.2 trillion ($384.2 billion) in 2022 before reaching ₺11.2 trillion ($380.5 billion) in 2023.

Loans are divided into two main categories: specialized and non-specialized. In 2024, specialized loans increased by 46% to ₺1.2 trillion ($34.57 billion), while non-specialized loans rose by 38.2% to ₺14.35 trillion ($406.41 billion).

Among specialized lending, agriculture accounted for the largest share in 2024, with ₺835.2 billion ($23.66 billion) in loans. Other sector-specific loans followed at ₺318.1 billion ($9.01 billion), real estate loans at ₺43.5 billion ($1.23 billion), and tourism loans at ₺19.9 billion ($0.56 billion).

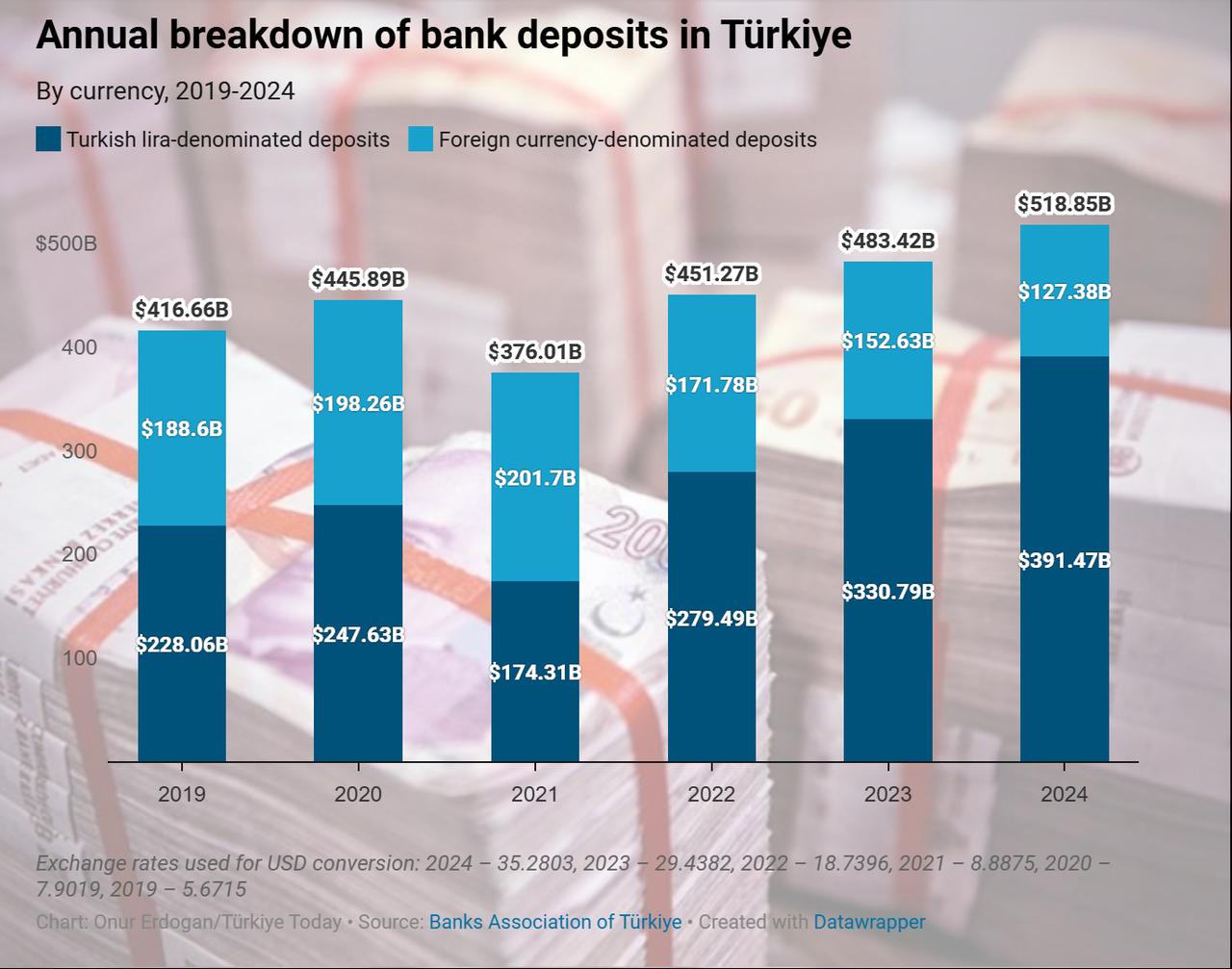

Total bank deposits also showed vigorous growth, reaching ₺18.30 trillion ($518.84 billion) in 2024, a 28.6% increase from ₺14.2 trillion ($482.1 billion) in 2023.

Deposits represent customer funds held in banks either without a maturity date or with predetermined conditions for withdrawal.

Ilbank, a public institution that provides financial and technical assistance to municipalities for infrastructure development, extended ₺75.8 billion ($2.15 billion) in loans in 2024, up from ₺65.1 billion ($2.21 billion) in 2023.

These credits include both specialized and non-specialized types. As the report did not include province-level breakdowns, the bank’s figures were listed as a separate entry.