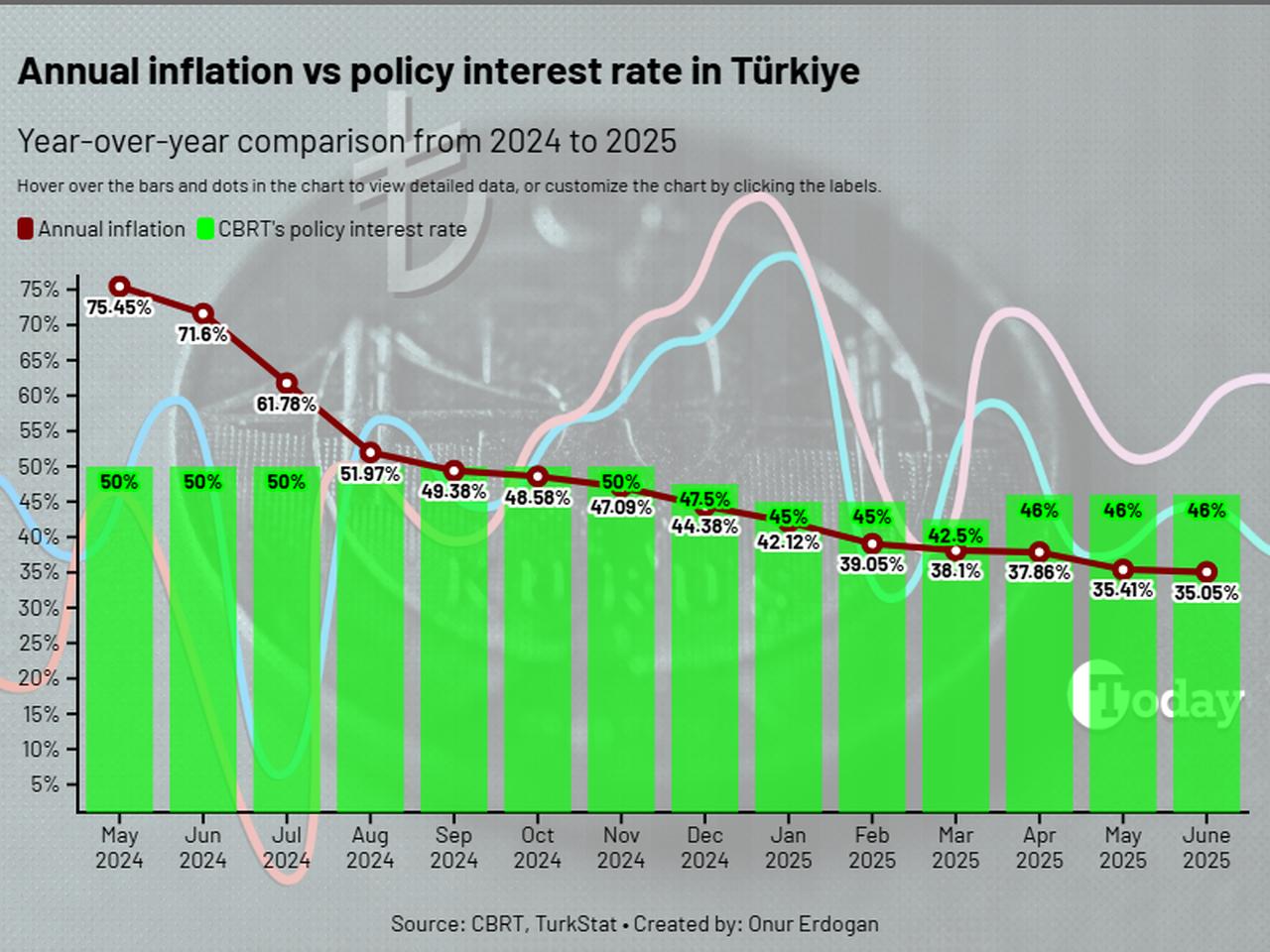

New York-based investment bank Morgan Stanley expects the Central Bank of the Turkish Republic (CBRT) to start cutting interest rates by July and projects the policy rate to drop to 36% by the end of 2025, according to a note released by the bank.

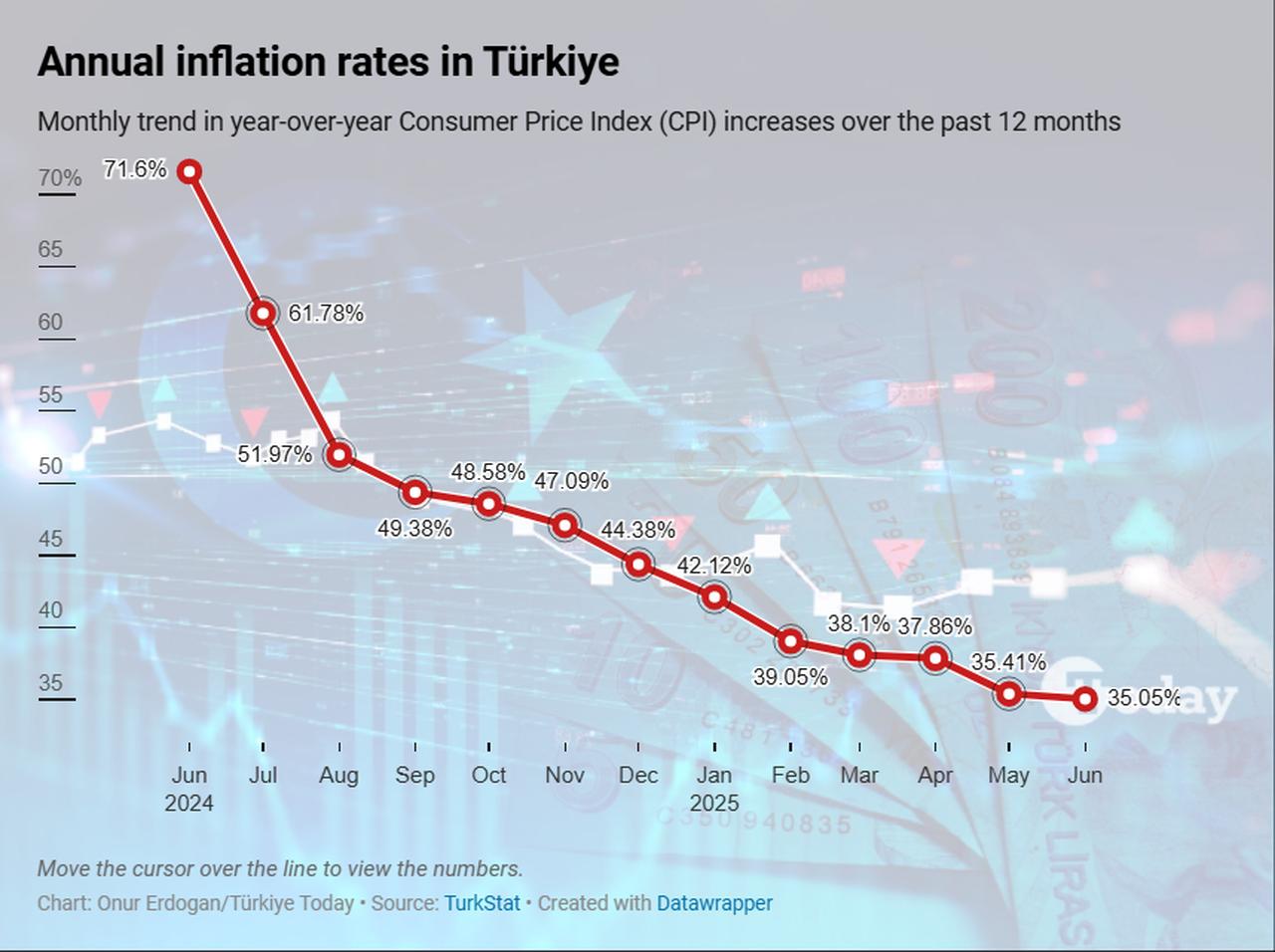

The bank’s latest analysis, authored by Hande Kucuk, follows the release of Türkiye’s June inflation figures, which extended the decline to 35.05%, and comes ahead of the Central Bank’s next policy meeting on July 24.

The report noted that headline inflation came in slightly lower than expected, though core inflation remained somewhat elevated.

The bank anticipates that the Turkish central bank will begin easing monetary policy in July with a 250 basis point cut. This would mark the first rate reduction since the bank raised its policy interest rate to 46% in April, from 42.5%, surprising markets at the time.

The CBRT held the policy rate steady in June, in line with market expectations. However, Morgan Stanley believes the conditions now support a cautious start to rate cuts.

Morgan Stanley’s projection outlines three additional 250 basis point cuts in September, October, and December, bringing the total expected reduction to 1,000 basis points. If realized, this would bring the policy rate down to 36% by the end of the year.

“We expect the disinflation trend to continue,” the report stated, “but considering relatively flat inflation in June and upcoming regulated price adjustments, we believe the CBRT will begin cutting rates cautiously in July.”

Morgan Stanley maintained its year-end inflation forecast at 29%, citing a slowdown in domestic demand, improving inflation expectations, and favorable base effects in July and August. The bank emphasized that risks remain balanced in both directions.