Türkiye’s house sales rose by 26.6% in the first half of 2025, reaching 691,893 units, while average rent prices increased by 21.5% to $571 nationwide.

In line with this upward trend, 48% of Turkish investors identified real estate as the most attractive investment option.

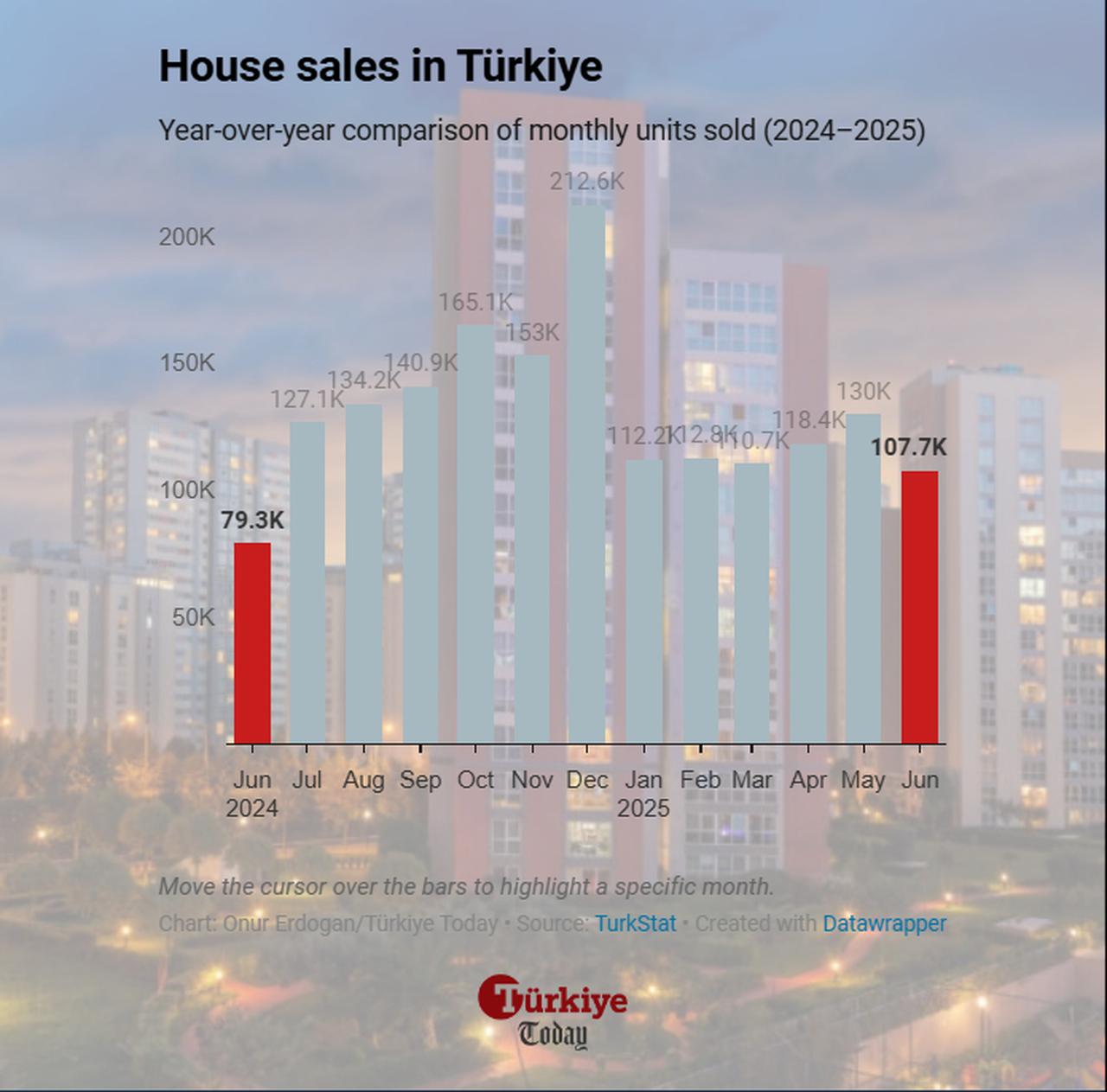

House sales in Türkiye increased by 35.8% year-on-year in June, the Turkish Statistical Institute (TurkStat) reported.

A total of 107,723 houses were sold during the month. Istanbul recorded 17,656 sales, followed by Ankara with 9,428 and Izmir with 5,987.

Sales to foreign buyers increased to 1,565 units, an 8.7% rise from the previous year. Russian, Ukrainian, and Iranian citizens purchased the most properties among foreign buyers.

New home sales rose by 32% year-on-year to 33,569 units. Second-hand sales increased by 37.6% to 74,154 units.

Mortgage-financed home sales rose by 112.6% in June compared to the same month of the previous year, reaching 14,484 units. These accounted for 13.4% of the total number of house sales.

In the January–June period of 2025, total house sales amounted to 691,893 units, a 26.9% increase compared to the same period of 2024.

According to a housing market report covering the January–June 2025 period by Endeksa, an artificial intelligence-supported real estate valuation platform, rental housing prices in Türkiye increased by 21.5% in nominal terms and by 4.4% in real terms during the first half of 2025.

The average rent reached ₺22,681 ($571), with an average square meter price of ₺220. The average size of rental properties was 103 square meters (1,108.68 square feet). For properties with similar features, the average amortization period—the time it takes for rental income to cover the purchase price—was at the 13-year level.

Compared to June 2024, rents increased by 32.6% on an annual basis. In real terms, however, there was a decrease of 1.9%.

For sale, residential property prices in Türkiye rose by 27.03% in June 2025 compared to the same month of the previous year. The average price for properties with similar specifications stood at $108,721, with an average property size of 129 square meters, and the average unit price per square meter was $843.

For these properties, the average amortization period also remained at the 13-year level.

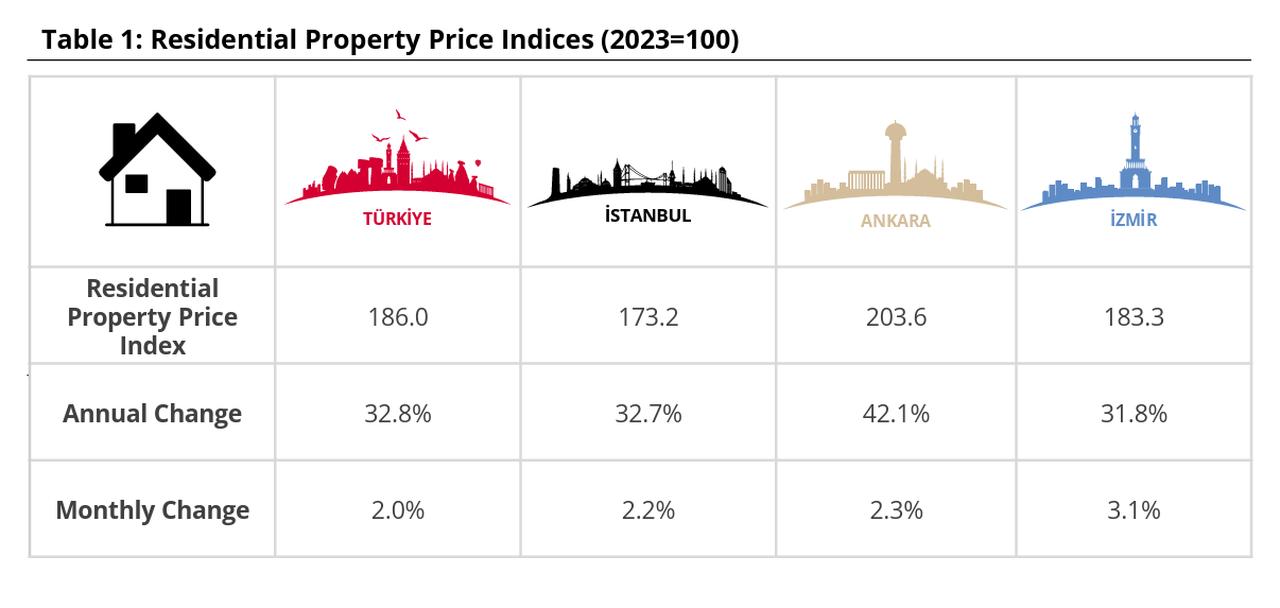

The Residential Property Price Index (RPPI) rose by 2% month-on-month and 32.8% year-on-year in June, the Central Bank of the Republic of Türkiye (CBRT) reported.

The index, calculated to track price changes of housing adjusted for quality (2023=100), increased by 2% from the previous month to 186.

On an annual basis, the index rose by 32.8%. During the same period, the real change showed a decrease of 1.7%.

In the three largest provinces, monthly index changes in June were 2.2% in Istanbul, 2.3% in Ankara, and 3.1% in Izmir.

Compared to June of the previous year, index values rose by 32.7% in Istanbul, 42.1% in Ankara, and 31.8% in Izmir.

On the other hand, reflecting the growing appeal of the Turkish housing market, real estate was preferred by 48% of survey participants as an investment option in a survey conducted by Emlakjet, a Türkiye-based online real estate platform.

A total of 35% preferred alternatives such as gold, foreign currency, and cryptocurrency, while 17% chose deposit interest.

According to the distribution of preferred property types, 35% of participants selected 3+1 apartments, 31% chose 2+1, 12% chose 1+1, and 6% were interested in 1+0 units. The share of those who preferred villas, summer houses, and similar property types was 16%.

The distribution showed that 27% of participants prioritized rental income in their investment decisions. This was followed by 24% who emphasized long-term security.

Another 22% considered the property's potential for future appreciation important. Location preference accounted for 21%, while tax and legal advantages were cited by 6% of participants.